The financial crisis of the previous decade had a major impact on the housing market. The end of the rapid credit expansion of the first Euro period (2001-2007) led to decrease in house prices. Construction industry also suffered a big drop in activity. The construction slowdown had repercussions for employment in the sector. Many households found themselves over-indebted with non-performing loans, especially in the countries at the epicenter of the crisis.

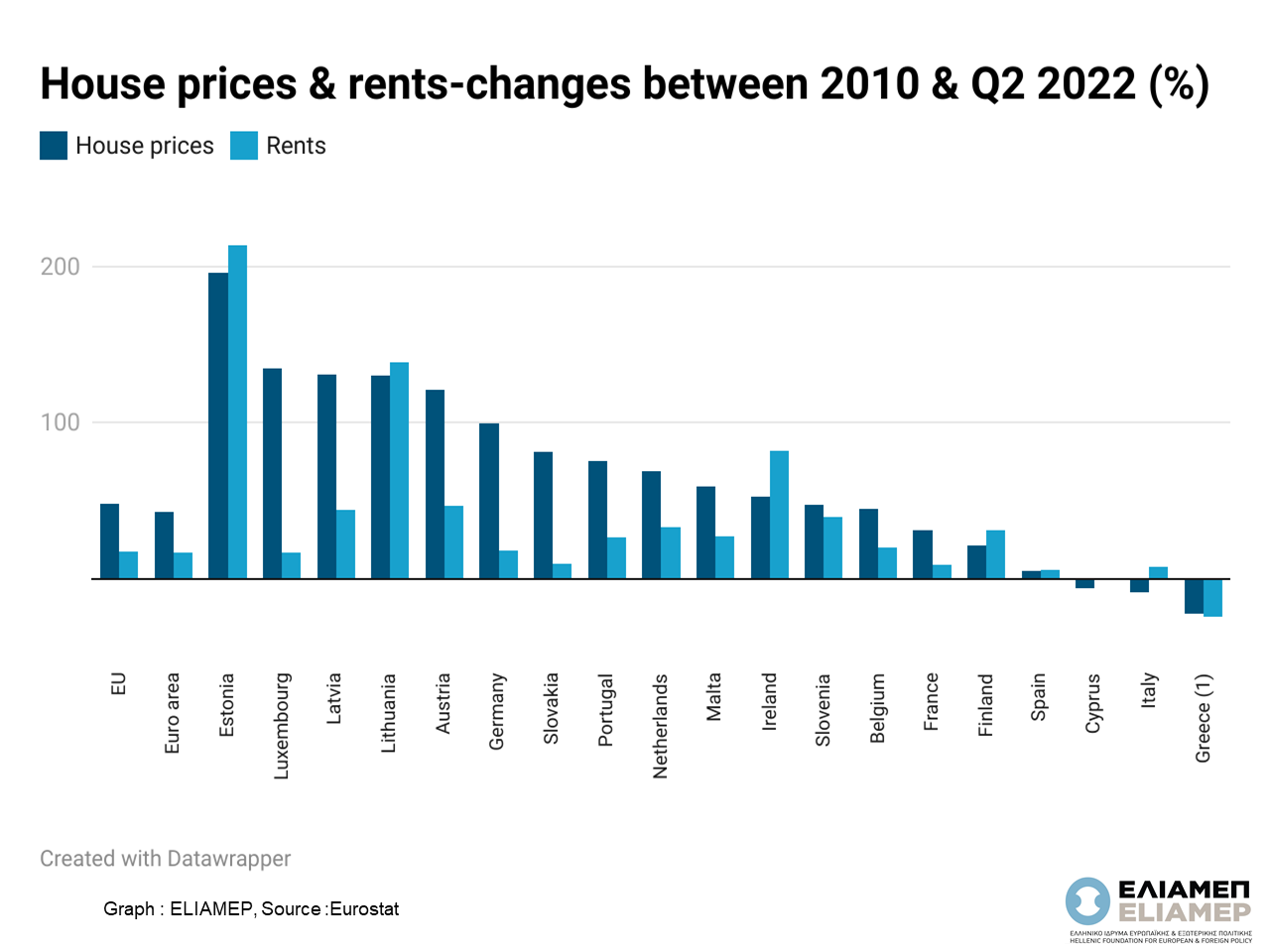

According to Eurostat data, after a decline between the second quarter of 2011 and the first quarter of 2013, house prices in Europe remained more or less stable between 2013 and 2014. The improvement of the macroeconomic environment, the recovery of the European economy, and a prolonged period of low interest rates contributed pushed up house prices after 2015. The COVID-19 pandemic has increased demand for larger homes located away from city centers, accelerating house price growth. When comparing the second quarter of 2022 with 2010, house prices in the EU increased more than rents (48% compared to 18%)

According to Eurostat data for the second quarter of 2022, house prices more than doubled in several countries (Estonia, Hungary, Luxembourg, Latvia, Lithuania, and Austria) compared to 2010. In most EU countries, the increase was lower. Decreases were only observed in Greece (-23%), Italy (-8%) and Cyprus (-6%) (In Greece the data are for 2021). When comparing the second quarter of 2022 with 2010 for rents, the highest rises were recorded in Estonia (+214%), Lithuania (+139%) and Ireland (+82%). Decreases were recorded only in Greece (-24%) and Cyprus (-0.2%).

As we reported in a previous In focus, the increase in housing costs has significantly burdened household budgets. In our country, rents and house prices have not yet reached the levels of 2010. Nonetheless, the stability of wages and salaries, explains why a large percentage of the population still struggles to pay increasing housing costs.

The political economy of housing will not be easy in Greece. Short-term rentals and foreign investment are pushing up house prices and rents. At the same time given the fact that wages and salaries are growing slowly, a lot of people -especially the young- will be impacted by the lack of affordable housing. The state’s traditional (almost total) lack of involvement in housing policy makes things very difficult. The measures announced at The Thessaloniki International Fair can be an opportunity for a new beginning. But much remains to be done.