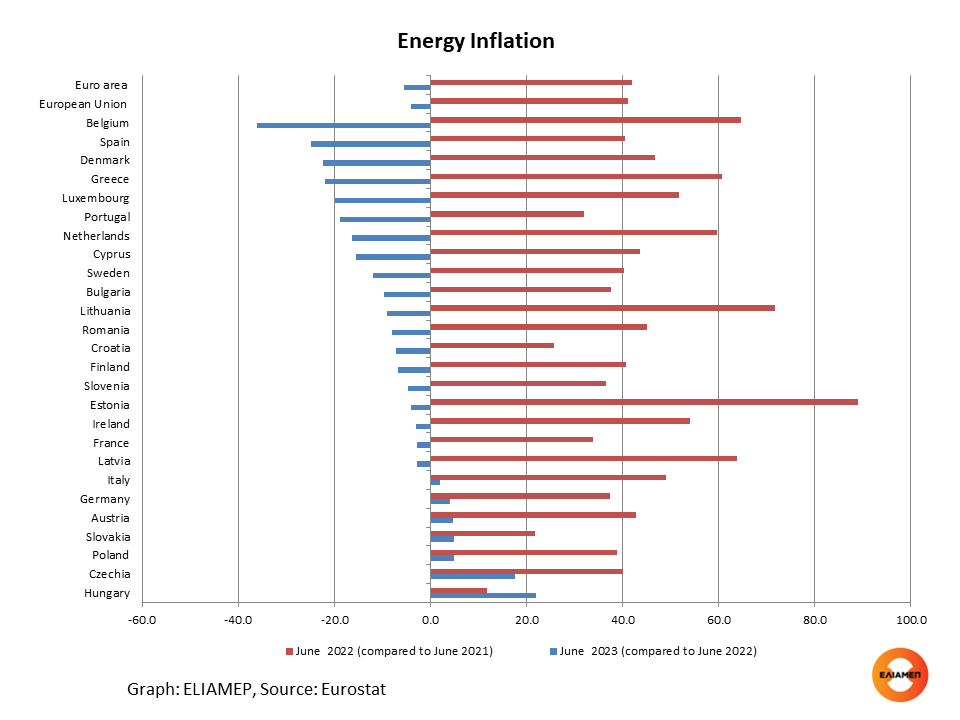

According to Eurostat data, energy inflation had increased dramatically in the EU after Russia’s invasion of Ukraine (+41.1% in June 2022 compared to June 2021). Due to a number of factors (reduced demand, price cap for natural gas, import diversification, refueling of LNG storage stations, and mild weather conditions), energy prices in the EU stabilized. In June 2023 energy inflation across the EU was 4.1% lower compared to the same month in 2022, according to new data.

In fact, energy prices fell in 19 member states. The largest decrease in energy prices was recorded in Belgium (36% in June 2023 compared to June 2022). Spain (25%) and Denmark (22%) followed. In Greece, the decline in energy prices in June 2023 reached 22% year-on-year, compared to an increase of 61% in the previous twelve months. A significant decrease in energy prices was also recorded in Luxembourg (20%), Portugal (19%), the Netherlands (16%), Cyprus (15%) and Sweden (12%).

On the other hand, in 7 Member States energy prices were still on the rise. The largest increases were recorded in Hungary (+22%) and the Czech Republic (+18%). In Slovakia, Austria, Germany and Italy energy prices increased slightly (below 5%).There are no available data for Malta.

While initially the rise in consumer price index reflected higher energy prices, this is no longer the case. In particular, in June the highest contribution to the annual euro area inflation rate (5,5%) came from food, alcohol and tobacco followed by services non-energy industrial goods. Conversely, the contribution of energy prices to inflation was negative

As electricity and gas prices have fallen, the European Commission is urging EU member states to cut horizontal subsidies that reduce incentives for consumers to save energy and increase public deficits. For Greece, the Commission in its interim spring report predicts that the phasing out of the measures that mitigated the economic and social impact of high energy prices is expected to be significant (from 2.5% of GDP in 2022 to 0.2% in 2023) and contributes to reduction of the general government deficit.

The question is whether the recent decline in energy prices is permanent or temporary. Fatih Birol, Executive Director of the International Energy Agency, in a recent interview with the BBC did not rule out another spike in energy prices. China’s economic recovery could significantly increase demand for natural gas. This development, combined with a harsh winter, would lead to a strong upward pressure on natural gas prices. Also, if Russian gas supplies are completely cut off the upward pressure on energy prices would be even more intense. At the same time, a prolonged drought during the summer can reduce the production of nuclear and hydroelectric energy, increasing energy prices further.

If some of these risks turn out to be true, pressure on household budgets will increase. In countries with a high dependence on natural gas and high wholesale prices, such as Greece, the adoption of the Commission’s recommendations for targeted support to vulnerable households is essential.

In the coming years, in order to fortify Europe against soaring energy prices, investments in renewable energy sources, LNG infrastructure, in green hydrogen production plants, etc., should increase significantly. Member states should carefully manage public spending while maintaining public investments. This is the next great challenge for fiscal policy.