Across the EU, from 2010 to 2019, the share of income spent on housing (mortgage interest payments, rent payments, utilities, regular maintenance costs, service charges and housing taxes) decreased for property owners and rose for tenants.

In 2019, homeowners spent 16% of their income on housing (down from the 18% they spent in 2010). On the other hand, renters experienced an increase in housing costs from 28% to 31% of their income during the same time period. The rental market in Europe is nowadays particularly precarious. More specifically, 46% of tenants across Europe feel that they are at risk of having to leave their accommodation within the next three months because they will no longer be able to afford it.

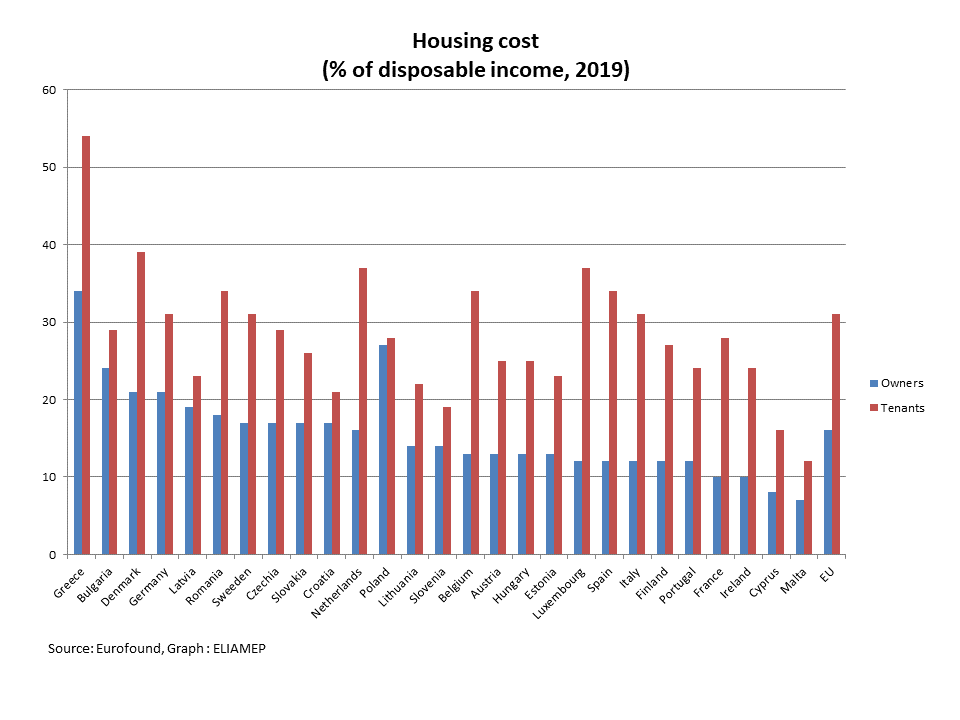

According to a recent analysis by the European Foundation for the Improvement of Working and Living Conditions, in all EU member states, tenants spend a higher proportion of their income on housing than owners. In fact, there are countries where this difference is significant. In Luxembourg and Spain, while property owners spend just 12% of their income on housing costs, tenants spend 37% and 34% respectively. In the Netherlands and Belgium, property owners spend 16% and 13% of their income on housing costs, while tenants spend 37% and 34% respectively.

On the contrary, there are countries where this difference is minor. For example, in Poland, 27% of the income of owners and 28% of the income of tenants goes to housing. In Malta and Cyprus the share spent on housing by owners and by tenants is particularly low (Malta 7% and 12% respectively, Cyprus 8% and 16%).

Our country “stands out” as a “champion” in terms of the share of income spent on housing both by owners (34%) and by tenants (54%). Part of this has to do with the massive decline of incomes after the economic crisis.

Thus, a tenant in Greece has to spend a much larger share of her income on housing compared to the European average (31%), but also compared to an owner in Greece. But how many are the tenants in Greece and in the EU? Based on 2020 data, 7 out of 10 people in the EU live in a home they own and just 3 out of 10 rent. In all Member States, home ownership is more common than renting (except Germany where 50.4% rent). Also, homeownership is more common among people aged above 40 than among people aged 18–40. Also, between 2010 and 2019, renting became more common for young adults under 40.

There are differences in the rate of homeownership, not only between countries but also within countries. For example, in Greece, 26% of the population rents, but in Athens and some islands this figure increases to 40%.In many of these areas the growth of short-term rentals has greatly increased prices. In Greece’s Attica region, rental prices increased by over 50% between 2017 and 2020, and they have gone up by 30–40% in other Greek cities (Thessaloniki, Patras, Volos).

Designing appropriate policy interventions to address high housing costs is not an easy task. Many of the traditional policy tools have unintended distributional consequences. Policies aiming to increase housing affordability often benefit higher-income citizens more than those with lower income, while rent subsidies can drive up rents.

In Greece, “Coverage” program refers to the provision of free housing (the rent is paid by the state) to vulnerable young people (25-39 years old who do not have a primary residence and are beneficiaries of the minimum guaranteed income). Also, with “My Home” program low-interest or interest-free housing loans are granting to young people (25-39) for the purchase of their first home.

However, as the Greek market lacks housing stock, a potential increase in demand could drive up prices. New tools and measures that simultaneously increase the supply of quality housing, such as the investments in public housing like the ones that have already started in Spain and Portugal and the program “koinonikh antiparochi” in Greece, are necessary for the design of comprehensive housing strategies.