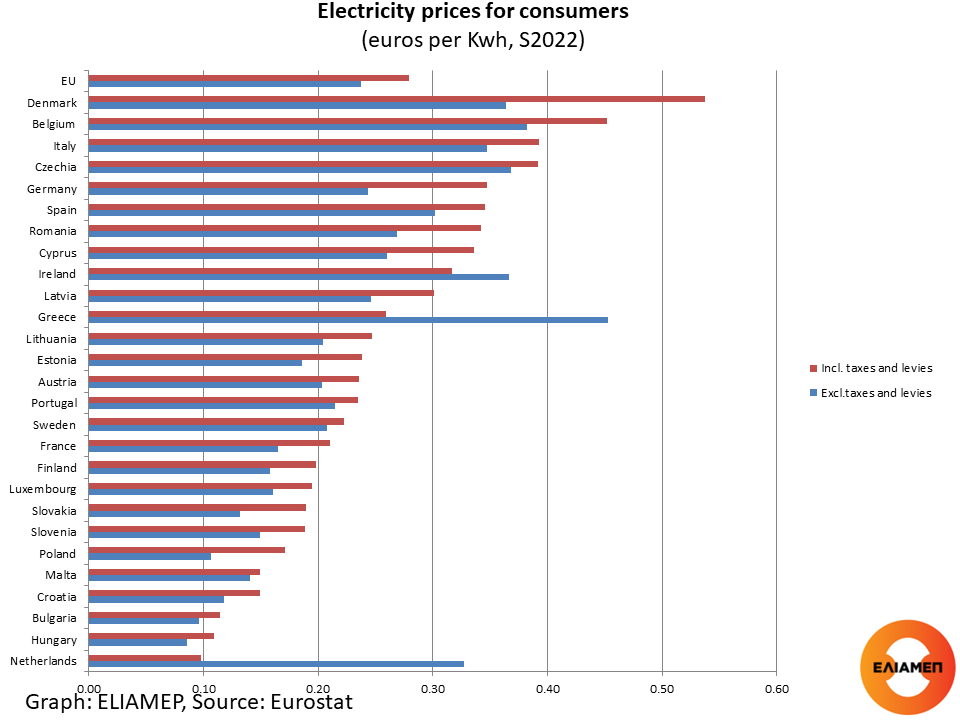

As it is well known and as we analyzed in a previous In focus, after the Russian invasion of Ukraine the cost of energy in Europe increased significantly, fueling the inflationary crisis. For example, according to Eurostat data, in the second half of 2022 household electricity prices in Greece were on average 24% higher than in second semester of 2021. In other countries, electricity prices increased even more: in neighboring Italy, by 54%. On the other hand, in Germany and Austria the increase in the price of electricity for households was only 4%. It is noteworthy that in the Netherlands household electricity price was actually 7% cheaper at the end of 2022 than a year earlier. According to the Eurostat Press Release this reflects the impact of generous price subsidies and allowances. Due to state subsidies, the average price of electricity for domestic use in the Netherlands was the lowest in Europe (consumer price €0.10 per kilowatt-hour), while the producer price was higher than the EU average (0.33 against 0 .24 euros per kilowatt hour).

In general, in most Member States elceticity prices (after taxes and levies) for consumers are higher than the price charged by producers. In other words, taxes increase the price of electricity more than government subsidies alleviate it. For example, in Denmark the producer price is 0.36 euros, while the consumer price is 0.54 euros per kilowatt hour. In the EU as a whole, taxes and levies set the consumer price at 0.28 euros per kilowatt hour (from a producer price of 0.24 euros).

Only in three Member States consumer electricity prices are lower than producer prices: the Netherlands, Ireland and Greece. In our country, government subsidies reduce the price of electricity more than taxes increase it, forming a consumer price of 0.26 euros per kilowatt hour (from a producer price of 0.45 euros). In Greece, the producer price is the highest in the EU, almost twice the EU average (0.24 euros per kilowatt hour).

The large scale of the Greek government’s fiscal effort to address the high energy prices is widely known. According to an OECD analysis, in Greece public expenditure on energy support measures in 2022 (4.87% of GDP) was higher than in the other 40 member states of the organization. Most of this expenditure (4.13% of GDP) was for “non-targeted measures”. As it was analyzed in last year’s In focus, horizontal price subsidies have the advantage of speed and efficiency, but they also have significant disadvantages: they are expensive for the state, they benefit more affluent and wasteful consumers, while at the same time they remove incentives for energy efficiency investments.

Despite the huge spending on subsidies, recent research by the Dublin-based European Foundation for the Improvement of Living and Working Conditions demonstrates that Greece has the highest proportion of households in the EU who report being behind with their utility bills (50%) , with vulnerable households being disproportionately affected.

Why is electricity so expensive in our country? In general, the price of electricity depends on a number of factors: market conditions, geopolitical situation, national energy mix, import diversification, environmental protection costs, taxation, etc. For example, in our country the structure of the electricity production market is oligopolistic: according to Eurostat data, 95% of all electricity is produced by only 3 companies. For example, the number of companies that produce 95% of all electricity is 450 in the Netherlands, 860 in Italy, and 1030 in Denmark. Furthermore, according to the International Energy Agency, the Greek supply code allows retail suppliers to unilaterally switch consumers from a fixed-rate contract to a variable rate contract after sending a notification, while there are still barriers that limit market access for new and small market participants. Finally, in the context of the complex mechanism applied throughout Europe, the price of electricity in our country is mainly determined by natural gas, the cost of which increased spectacularly in 2022.

However, the electricity mix share is changing. According to an analysis by GreenTank, 2022 was the first year in history that electricity from renewables with large hydro exceeded that from fossil gas and lignite combined. In particular, RES together with large hydroelectric plants covered 46.7% of the total electricity demand. Fossil gas share in electricity production was 35.4% and lignite 11%. Despite the positive progress, the International Energy Organization recommends the elimination of barriers in the timely processing of licenses and permit for new RES projects, while calling for the reassessment of planned investments in fossil fuels.