The historically low interest rates of the previous decade have led housing prices to record levels in many EU countries. In July 2022 – when the ECB first started raising interest rates to fight inflation – housing prices in the EU was 33.6 percentage points higher than five years earlier.

With central banks raising interest rates to contain inflation, prices started falling in many countries, while in others the pace of the increase has slowed down. The impact of rising interest rates on property prices was evident also in the EU. For the first time since the beginning of 2015, house prices fell in the fourth quarter of 2022 (-1.5% compared to the third quarter of 2022).

Several analysts believe that rising interest rates could lead to another housing crisis similar to the one of 2007. If interest rates remain high, the housing market will no longer be as attractive as it was to investors, housing finance will become less affordable for households, while at the same time mortgagors with variable interest rates face higher loan repayments, which increases the risk of defaulting on their obligations.

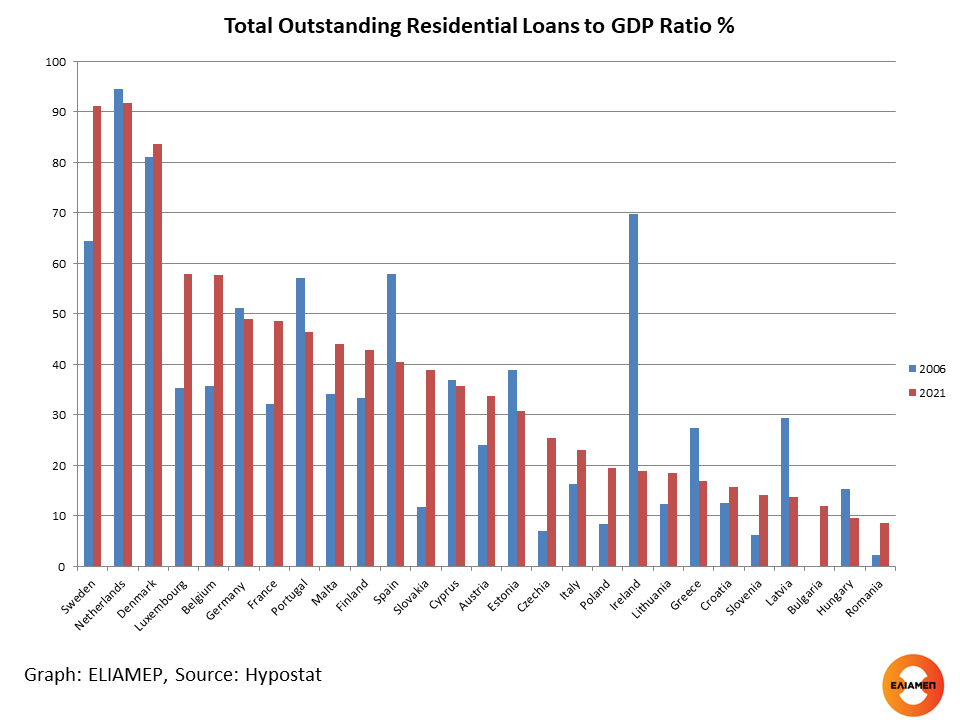

One of the factors increasing the risk of a housing slump is the high ratio of residential loans to GDP. According to the graph, in 2021 the Netherlands (91.7%), Sweden (91.2%) and Denmark (83.7%) reported the highest total outstanding residential loans as a % of GDP in the EU. In contrast, total outstanding residential loans as a % of GDP was the lowest in Romania (8.5%), Hungary (9.5%) and Bulgaria (11.9%).

In the EU as a whole, total outstanding residential loans as a % of GDP today compared to 2006- before the collapse of the housing market- has decreased marginally (from 48.2% in 2006 to 45% in 2021). In fact, in 16 out of the 26 Member States for which data are available, housing debt as a percentage of GDP has increased. The largest increases took place in Slovakia (27.1 percentage points), Sweden (26.7 percentage points), and Luxembourg (22.5 percentage points).

On the other hand, in ten member states total outstanding residential loans as a percentage of GDP are lower today compared to 2006. This decrease was particularly significant in member states in which the real estate bubbles of the previous period had serious economic repercussions. In fact, in Ireland and Spain report the highest decrease in total outstanding residential loans as % of GDP in the EU (-50.9 percentage points and -17.6 percentage points respectively). A significant decrease – of 10 percentage points – in total outstanding residential loans as a % of GDP is also reported in Greece (from 27.4% in 2006 to 16.9% in 2021).

Despite the fact that the ratio of housing debt to GDP is as high in some EU countries as it was in 2006, there are lower possibilities of a housing slump lower today. The first reason for this is that banks are now better capitalized compared to 2006. Tighter mortgage regulations after the crisis have shut out less creditworthy mortgagors. Most households with a mortgage have a different profile than in 2006 as they finance an important part of the value of the property they buy with their own recourses.

Secondly, according to a recent article by the Economist, mortgagors are better equipped today to deal with the rise in interest rates. Those with a fixed rate loan are safer from interest rate fluctuations (at least for a period of time). In the EU as a whole, the share of total mortgages with a variable interest rate was 15% in 2020 although it varied significantly between member states (see previous In focus). Additionally, in 2020-21, many households drastically reduced consumption and increased their savings. These savings can act as a safety net for higher interest rates (borrowers can repay part of the debt).

Thirdly, after the pandemic people seem to attach greater value to more spacious properties that allow them to work from home. Thus, despite the increase in interest rates the demand for detached houses further away from the city center may remain high. Moreover, buying a property in an inflationary environment is considered to be a safe option.

Although the situation appears to be different from 2006, there are no grounds for complacency. Learning from the experience of the previous crisis, it is evident that the housing market is very important for economic growth and financial stability. Recent developments in the housing markets require close monitoring, particularly in EU member states with high levels of residential loans and a large share of mortgages issued at floating rates.