Industrial production in the EU and internationally has recently been hit by two major shocks.

The first was the financial crisis (2008-2012). In particular, in 2009 industrial production in the EU reported a significant decline, before returning to positive rates of change in the following year in all countries with the exception of Greece, Croatia and Cyprus. However, in 2012 industrial production for the EU as a whole decreased again, while after 2015 it returned to continuous positive growth in most EU countries. This upward trend was reversed by the outbreak of the pandemic and the containment measures that restricted economic activity. This was the second shock for the industrial production. As a result of the COVID-19 crisis, EU countries with the exception of Ireland, displayed negative rates of change in industrial production in 2020, only to recover again thereafter.

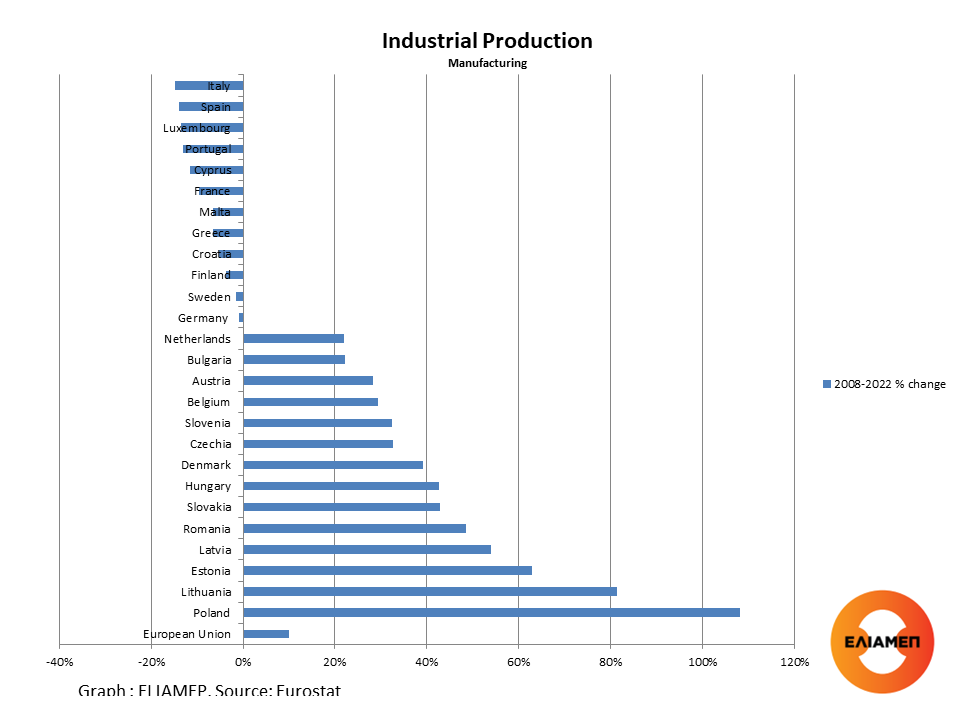

The effects of the two crises were not the same for all Member States. In fourteen Member States industrial production was higher in 2022 than in 2008. The largest increases were recorded in Poland (+108%) and the Baltic countries: Lithuania (+81%), Estonia (+63%), Latvia (+54%). Industrial production also increased in other member states of Central and Eastern Europe. The spectacular rise in the index of industrial production in these countries is related to the phenomenon of the relocation of European industry: value chains that start mainly in Germany have been expanded in these economies. In the EU as a whole industrial production was higher in 2022 compared to 2008 (+10%).

On the other hand, in the same period in some of the traditional industrial champions of the EU, industrial production declined. In particular, Italy, that records the second highest value of industrial production in the EU, shows the largest decrease in industrial production in the Union (-15%). But also in France, the third largest industrial power of the EU, the decline was significant (-10%). In Spain, which records the fourth largest industrial production in the EU, in 2022 the index of industrial production was reduced by 14% compared to 2008. Finally, even in Germany, the engine of the European economy, industrial production shows a marginal decrease (-1%) compared to pre-financial crisis levels.

However, although industrial production in the last 15 years has increased in the newest member states and decreased in the older ones, in 2021 only six EU Member States generated 72 % of the EU’s value of sold industrial production : Germany recorded the highest value of sold production, equivalent to 27 % of the EU total, followed by Italy (16 %), France (11 %), Spain (8 %), Poland (6 %) and the Netherlands (4 %).

In our country, the index of industrial production recorded a continuous decrease in the period 2008-2015. In recent years, the post-pandemic recovery of industrial production has been strong (+13% in 2022 compared to 2018), although the industrial production remains at lower levels compared to 2008 (-6%).

It could be argued that as a whole the EU’s industrial production has shown resilience in a hyper-globalized environment, but the risk of Europe’s de-industrialization remains high. Europe now faces “idiosyncratic” pressures on its industry, with a huge package of US industrial subsidies increasing competition on the other side of the Atlantic. In conditions of high energy costs, maintaining the production base of industries in Europe will become increasingly difficult. The problem is that this applies mainly to Member States with limited fiscal space that cannot finance generous state aid to their industry. Without substantial European solutions, the gap in the industrial production between member states with and without “deep pockets” risks widening further (see relevant ELIAMEP study).