Russia’s invasion of Ukraine in February 2022 has triggered a series of sanctions imposed by the European Union, the United States and other countries. Sanctions aimed among other things Russia’s banking sector, the National Central Bank of Russia (it is estimated that more than half of Russian reserves are frozen), transportation, oil and coal and other raw materials.

Although the economic sanctions have been unprecedented, their aim –to impose severe consequences on Russia for its actions and to effectively thwart Russian abilities to continue the aggression– has not yet been achieved. According to an article by Bruegel, Russia’s current account has improved dramatically in 2022. The surplus for January-September was almost at $200 billion, roughly $120 billion higher compared to the same period in 2021. Two main developments explain this: lower imports since the beginning of the war, and high energy prices.

According to a recent article in Politico, November was the first month when the value of EU imports from Russia was lower than in the same month of 2021. For eight months, the EU spent more on Russian imports than before the war. More recent data are not yet available, but it is likely that the downward trend in spending on imports coming from Russia will continue: sanctions on crude oil came into effect in December 2022, and on refined petroleum products in February 2023 (see previous In Focus).

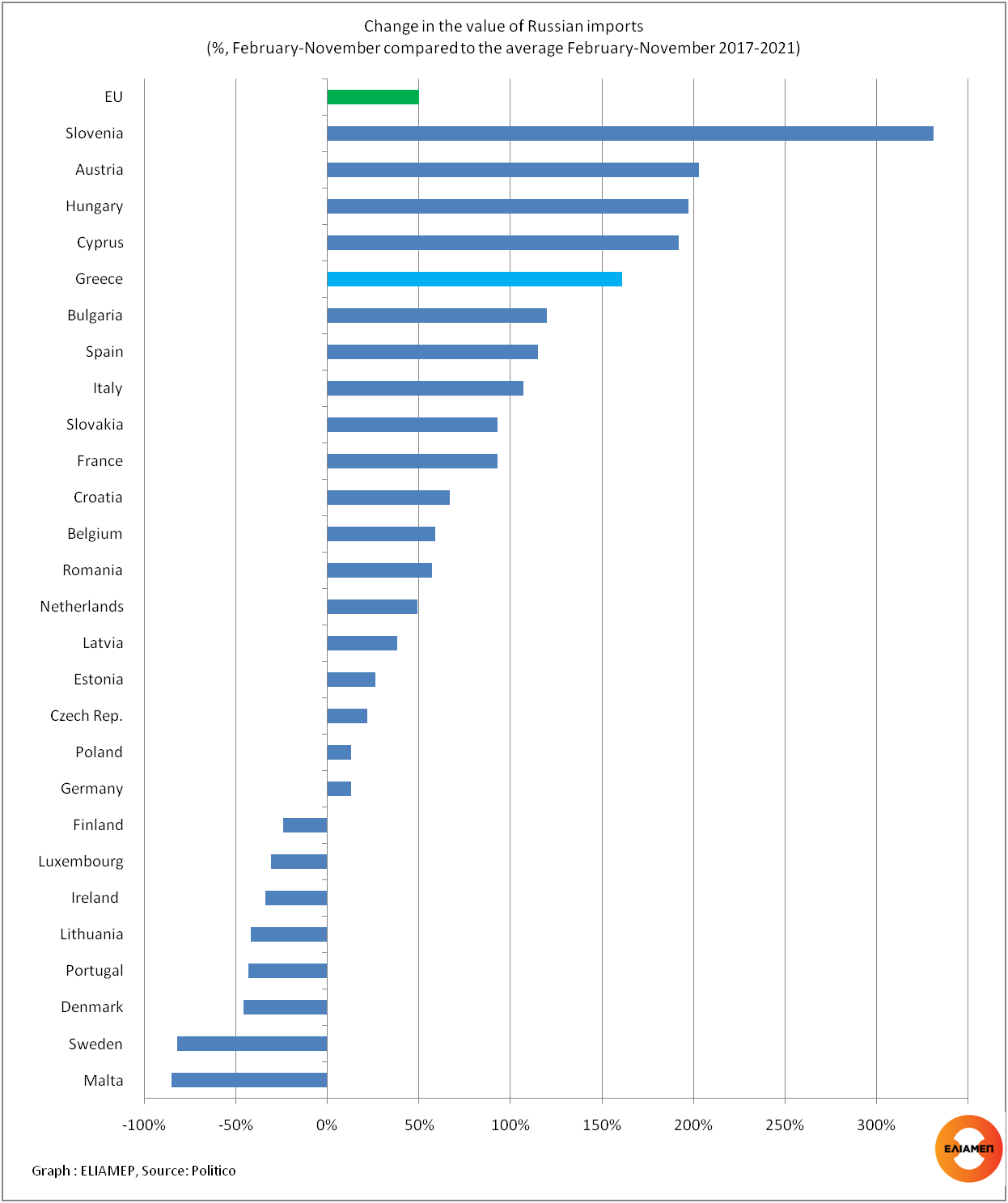

Although volumes of Russian oil and gas exported to the EU have fallen significantly, prices have soared, increasing revenues for Russia (see previous In Focus). According to the Politico article, only in few countries the monetary value of imports started decreasing just a few weeks after the invasion. For the EU as a whole, the total value of imports from Russia from February to November 2022 was 50% higher compared to average imports over the same period in 2017–2021.

According to the graph, in 19 member states the value of imports from Russia was higher during the war compared with their average imports during February-November 2017-21. The largest increase in the value of imports from Russia was observed in Slovenia (+331%), followed by Austria (+203%), Hungary (+197%), Cyprus (+192%) and Greece (+161%). From the major Eurozone economies, Russia also received more revenue: Spain +115%, Italy +107%, France +93% and Germany +13%. Of particular interest is that in 12 countries, including Greece, the value of imports of goods from Russia was higher in November 2022 than their average for that month during 2017-21.

The optimistic version is that the effects of sanctions on the Russian economy will become soon obvious. The EU’s energy strategy : first meeting its own energy needs and afterwards imposing sanctions- played a role and revenue streams continued to Moscow.The EU embargo on Russian oil and refined petroleum products, the price cap on natural gas, and the resulting drop in energy prices are expected to significantly limit the flow of revenue to Russia.

On the other hand, as long as no actual sanctions are imposed on Russian liquefied natural gas (LNG) shipments to Europe, which were higher in 2022 than in 2021 (see previous In Focus), and as long as all member states do not show the same determination for reducing energy dependence from Russia, the risk of unintentionally financing the invasion of Ukraine with EU funds remains threatening.