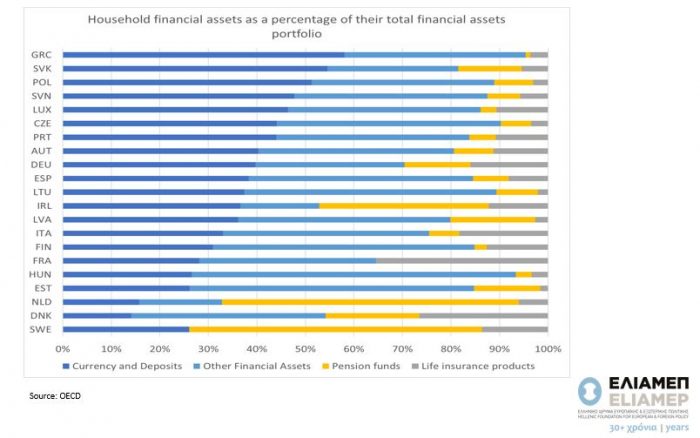

During the pandemic, declining employment and shrinking incomes render the savings and assets of the households critical for their financial well-being. The chart shows the distribution of household financial assets in 21 European countries. Specifically, the latest available asset data are presented, excluding real estate wealth, as available from the OECD for 2018. The distinct categories are currency and deposits, financial assets including stocks, bonds, mutual funds, and other financial assets, pension funds, and life insurance products.

We observe that households in economies such as Greece, Slovenia, and Poland hold more than 50% of their wealth in currency and deposits, while northern European countries such as Sweden, Denmark and the Netherlands have more diversified balance sheets, with deposits not exceeding 30% of the total wealth. By contrast, the share of pension funds exceeds 20% in Sweden and Denmark, while in the Netherlands, it exceeds 60%. The share of insurance products is the smallest of all categories in most of the countries presented, with the exception of France (35%).

This heterogeneous distribution of household wealth has important implications for their prospects and the breadth of their choices. Households in countries with a larger share of deposits enjoy greater liquidity, as they can easily draw on their wealth to meet unexpected needs. However, this liquidity involves an opportunity cost. The preference for liquidity over other financial assets means that households forgo the possibility of a higher income from investments in products with higher risk but also a higher return. The fact that households in some countries exhibit this readiness to forgo this additional income, in addition to the intensity of risk aversion, which is determined to some extent by cultural characteristics but also by the level of financial literacy, may also reflect the insecurity of households in relation to the capacity of public structures (e.g. the welfare state) to protect them against unforeseen risks. Furthermore, the share of wealth channeled into pension funds reflects the level of development of the financial sector but also the existence of a strong contributions-based ‘insurance’ pillar in the pension system. Investing part of the household portfolio in retirement plans, whether private or public, provides households with additional protection against the risk of old age, and fosters the expectation of higher prosperity in the future, regardless of the amount provided by basic public pensions.