In 2021, Russia was the 15th largest importer in the world. Ιn 2020, the EU was Russia’s first trade partner and 36.5% of Russia’s imports of goods came from the EU. Russia was the EU’s fifth largest trade partner for EU exports of goods (4.1 % of the EU’s total exports). Exports of services to Russia amounted t €20.5 billion (2.0% of total EU services exports).

The EU-Russia trade relationship was highly impacted by the annexation of Crimea, the pandemic, and of course the invasion of Ukraine. While the pandemic led to a temporary contraction in bilateral EU-Russia trade, EU’s sanctions against Russia in 2014 and especially in 2022 are expected to have long lasting effects on EU-Russia trade relations.

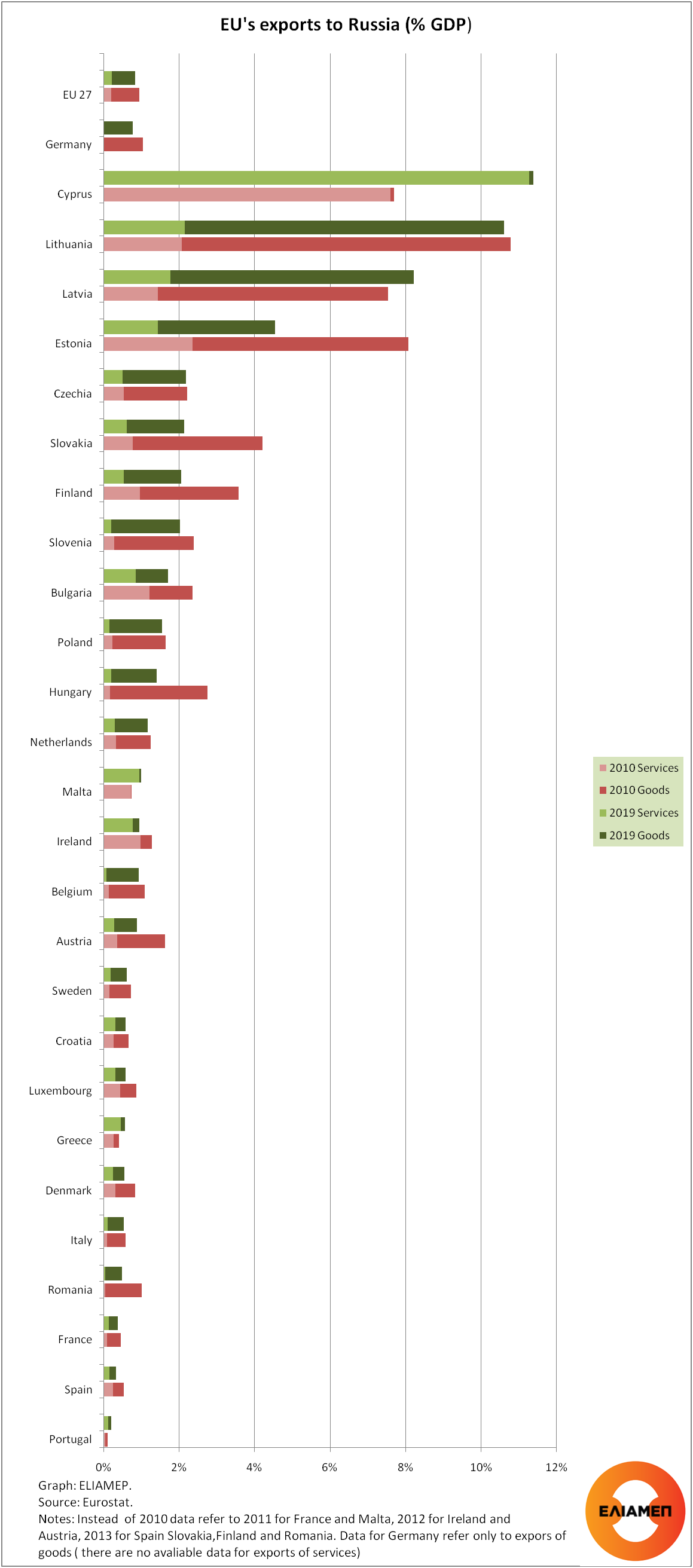

EU’s exports of goods to Russia decreased in 2020 to recover again in 2021 surpassing the 2019 level by 2%.European exports of services followed the same trend, with the difference that in 2021 they remained 13% below the 2019 level. It is worth noting that from 2010 to 2019 EU’s exports of goods to Russia increased in value (from €82.7 to €87.7 billion, but fell as a share of EU’s GDP (from 0.75% to 0.63%). EU’s exports of goods to Russia decreased in absolute terms in 13 out of 27 Member States (including Greece), while the share of exports as a percentage of GDP fell in all Member States except Cyprus, Latvia, Malta and Portugal. (In Greece this share decreased from 0.14% in 2010 to 0.11% of GDP in 2019.) In 2019, the Baltic countries, reported significant dependence on Russian imports of goods: Lithuania (8.4% of GDP), Latvia (6.4 %), and Estonia (3.1%). Among EU member states, the largest exporter of goods to Russia is Germany (26.7 billion euro in 2021). Poland (€8 billion) and the Netherlands (€7.9 billion) were second and third. The EU exported a wide range of products to Russia in 2021. In value terms, the largest product groups exported to Russia in 2021 were machinery (21.8% of the total value of its exports to Russia) vehicles (10.0 %), pharmaceuticals (9.0 %) and electrical machinery (8.5 %)

The largest destinations for exports of services from the EU in 2020 were the United Kingdom, the United States, Switzerland, China, Japan and Singapore. Russia was in 7th place. The three largest exporters to Russia before the pandemic were France (€3.2 billion in 2019), Ireland (€2.7 billion) and Cyprus (€2.6 billion). (There are mo data available for Germany.) From 2010 to 2019, European exports of services to Russia increased both in absolute terms (from €20.1 to €28.2 billion) and as a share of the European GDP (from 0.18% to 0.20%). Exports of services to Russia increased in value for 20 of the 26 Member States for which data are available. As a percentage of GDP, exports to Russia increased only in 11 of the 26 member states, despite the fact that exports of services are increasing their share in international trade. Cyprus is highly dependent on exporting services to Russia: in 2019, exports of services to Russia accounted for 11.3% of GDP. The three Baltic countries followed: Lithuania (2.1% of GDP), Latvia (1.8%), and Estonia (1.4%). The share of Greek exports of services to Russia increased from 0.26% of GDP in 2010 to 0.44% in 2019.

The war in Ukraine has highly impacted EU-Russia bilateral trade. On December 16, 2022, European leaders agreed on a new (ninth) package of sanctions, which will inevitably adversely affect trade relations between the two countries. The future of EU-Russia bilateral trade relations will depend on when and how the war ends.