This policy brief explores the evolution and goals of industrial policy in the EU, aiming to identify the ways in which these recent developments can provide significant opportunities for Greece. In this context, we outline some of the key features of the fragmented landscape of Greek industrial strategies and suggest future directions through which the country can leverage the current momentum of industrial policy in the EU to pursue the restructuring of its productive base along the lines of sustainability, the twin (green and digital) transition, and European strategic autonomy.

- Since the Great Recession of 2008, the EU has openly supported coordinated and complementary policies in an effort to tackle structural deficiencies that render its productive systems vulnerable.

- The pandemic crisis, the Ukrainian war, and the general call for action against climate change have highlighted the need for the further reconfiguration of industrial development across the world along the lines of inclusion, sustainability, and resilience.

- The EU New Industrial Strategy and its update in the aftermath of the pandemic provide blends of horizontal and vertical actions that target resilience in the Single Market, EU strategic autonomy, and the acceleration of the green and digital (twin) transitions.

- In response to the energy crisis, the EU Green Deal Industrial Plan for the Net-Zero Age has been promoted to ensure that sustainable competitiveness goals are on track with the recent geopolitical developments.

- Greece has already aligned its strategic planning to the EU’s industrial policy objectives through a dedicated National Industrial Strategy and other strategic documents that target innovation, the green transition and sustainable development, and digitalization across key industrial ecosystems and value chains.

- Key initiatives, such as industrial alliances and Important Projects of Common European Interest (IPCEIs), major reforms through dedicated Acts, and an unprecedented wealth of financing and regulatory instruments outline significant opportunities of transformative potential Greece’s productive model.

- The country must meet the challenges of implementing its ambitious action plans, while simultaneously monitoring, evaluating, and updating its strategic orientation against the backdrop of a volatile global market environment.

- Different strategies should be integrated into a unified system of policies that creates a clear connection between, and path dependence for, different objectives, diverse market reforms and policy interventions.

Read here in pdf the policy brief by Aggelos Tsakanikas, Associate Professor, National Technical University of Athens (NTUA); Director of the Laboratory of Industrial and Energy Economics (LIEE), NTUA; Head of NTUA Tech-Transfer Office and Petros Dimas, Postdoctoral Research Fellow, Laboratory of Industrial and Energy Economics (LIEE), National Technical University of Athens (NTUA); Adjunct Lecturer, Department of Financial and Management Engineering, University of the Aegean.

Introduction

Industrial policy since the Great Recession of 2008, the European Commission (EC) and the US have openly supported coordinated and complementary policies as an effort to tackle structural deficiencies that make their productive systems vulnerable.

It was not really anticipated or expected, but touching as it does on the core of European competitiveness, the deepening of the European Single Market, and the overall orientation of European Union, industrial policy may well be the most relevant, substantial, and meaningful policy discussion of them all, especially post-pandemic. Of course, this is nothing new. After the trend rejecting active and interventional industrial policy practices in favor of free markets and the perceived benefits of the so-called Washington Consensus that dominated academic and policy debates in Europe and the United States (US) in the 1990s, the dawn of the 21st century was met with a renewed interest in industrial strategy paradigms that could meet the demands of significant emerging challenges (Warwick, 2013). Traditional concerns regarding the extent to which governments must or should intervene in steering market mechanisms, favoring “winning” sectors over others, are still at the heart of the debate. But since the Great Recession of 2008, the European Commission (EC) and the US have both openly supported coordinated and complementary policies as an effort to tackle structural deficiencies that render their productive systems vulnerable (Veugelers, 2013).[1]

Still, it was not just the economic crisis. Several factors have contributed to this shift over to more active and systemic approaches to industrial strategies and policy instruments. One group of factors relate to the traditional orientation of industrial policy: namely, supporting industrial development for long-term growth and competitiveness. They range from the prominent failure of neo-liberal policies to facilitate economic growth to the rapid development relating to globalization and the rise of global value chains (GVCs), technological change and digitalization, and the overall de-industrialization of western economies, which called into question the traditional role of manufacturing as an engine of growth (Andreoni and Chang, 2019). In the case of the EU in particular, and especially since China’s accession to the World Trade Organization (WTO) in 2001, there has been a profound re-allocation of manufacturing activities outside Europe, leading to a significant structural shift featuring hazardous impacts on employment and growth, and an early call for a “manufacturing imperative” at the EU level (Stöllinger et al., 2013).[2] These concerns have now given rise to one of the EU’s main industrial strategy goals: its strategic autonomy, without major external dependencies in terms of production and (mainly digital) technology (EC, 2021).[3]

These “megatrends” have altered the EU’s industrial strategy and highlighted the need for a further reconfiguration of industrial development across the world along the lines of inclusion, sustainability, and resilience.

A second group of factors is environmental and social in nature. Since 2015 and the communication of the United Nation’s sustainable development goals (SDGs), it became clear that industrial systems would have to be reconfigured to become green and sustainable and that industrial strategies would have to be reoriented towards sustainable development (Aiginger and Rodrik, 2020). The EU was a pioneer in this area through its flagship European Green Deal program and its New Industrial Strategy (EC, 2019; 2020).[4] However, the pandemic crisis, the Ukrainian war, and the general call for action against climate change have brought certain profound socio-economic implications into the spotlight. These “megatrends” have altered the EU’s industrial strategy and highlighted the need for a further reconfiguration of industrial development across the world along the lines of inclusion, sustainability, and resilience (Kastelli et al., 2023).

In what follows, we will explore the evolution and goals of industrial policy in the EU by focusing on the recent developments and industrial strategies that target the green and digital transition of European industry. In this context, we aim to identify the ways in which these recent developments can provide significant opportunities for Greece. The country has recently exited a decade of severe financial crisis (2008–2018) in which waves of foreclosures, huge unemployment rates and investment stagnation significantly altered its economy and production structure. The ramifications of the crisis were also particularly evident in the domestic energy market and in the nation’s technological capabilities[5], making the quest for a new productive model a necessity for Greece’s future.[6] In this vein, and against the new set of challenges in the aftermath of the pandemic related to , the energy crisis and the climate change adaptation, we will also review some of the key features of the fragmented landscape of Greek industrial strategies and suggest future directions the country can take to leverage the current industrial policy momentum in the EU to outline and embark on the restructuring of its productive base.

Setting the scene: The evolution of industrial policy in the EU

Defining industrial policy

Industrial policy can be understood as government interventions selected to alter the production structure towards sectors the government considers to be strategic or to have high growth potential.

How does the EU define and exercise industrial policy? Is industrial policy strictly related to manufacturing? Industrial policy can be understood as selected government interventions to alter the production structure towards sectors that the government considers to be strategic or to have high growth potential (Pack and Saggi, 2006). This definition can be further expanded to account for interventions that improve the overall business environment and focus not only on sectors per se, but also on technologies or tasks which apart from growth, also offer great potential for societal welfare and sustainable development (UNIDO, 2021). Still, although industrial policy can be related to any economic activity, manufacturing remains the main focal point. In the EU, industrial policy is directed towards improving industrial competitiveness across its member-states, with a view to sustainable growth and employment. It is closely linked to many other significant policy areas (trade, competition, research and innovation, employment, digitalization) and sets a specific set of objectives: i) increasing the speed at which EU industry adjusts to structural changes, ii) encouraging a favorable business environment across the EU, with a focus on small-medium enterprises (SMEs)[7], ii) encouraging a business and regulatory environment that is favorable to business cooperation in both domestic markets and across the EU, and iv) fostering better industrial exploitation of policies of innovation, research and technological development (Article 173 TFEU).

Early efforts at industrial policy in the EU

Europe’s approach to industrial policy has evolved over time. After interventionist, sector-specific policies (aka vertical policies) with strong national flavors from the 50s through to the mid-1970s[8], the 1980s and the 1990s were met with market-enabling policies aimed at putting in place the right business and regulatory frameworks for business activities across the continent (aka horizontal policies), while avoiding the extreme interventions and “winner” picking policies of the past. During this latter period, the EU’s institutions laid the foundations for the establishment of the European Single Market[9], with proper competition policy and guidelines for state aid packages.

This shift towards holistic, horizontal policies with an emphasis on regulation, R&D stimulation, and innovation[10] cumulated in the 2000 Lisbon Strategy, which sought to transform the EU into “the most competitive and dynamic knowledge-based economy in the world” (EC, 2000). Implementing the so-called Lisbon Strategy produced the EU’s first ever fully integrated industrial policy framework, with cross-sectoral and market enabling actions and initiatives.[11]

EU industrial policy after the Great Recession of 2008

The undertaking of soft, horizontal initiatives came to an end in the aftermath of the Great Recession of 2008, which marked an era of industrial policy revival across Europe.

The undertaking of soft, horizontal initiatives came to an end in the aftermath of the Great Recession of 2008, which marked an era of industrial policy revival across Europe (Tagliapietra and Veugelers, 2023). The Lisbon Strategy was replaced by Europe 2020 in 2010 (COM(2010)2020), which contained flagship initiatives that aimed to rejuvenate the competitiveness of European industry by enhancing workforce skills (COM(2008)0868), stimulating innovation (COM(2010)0546) and enabling digitalization (COM(2010)0245). Seeking to address emerging pressures from changes in the structure of international trade, such as China’s manufacturing dominance and the US’s technological leadership, the EU presented two interrelated communications: ‘An Integrated Industrial Policy for the Globalization Era’ (COM(2010)0614) and ‘Industrial Policy: Reinforcing competitiveness’ (COM(2011)0642). Both outlined deep structural reforms and coherent policies across member states in an effort to achieve sustained resilience against market distortions along with improved competitiveness in international markets, with special considerations for SMEs.[12]

Adding to its efforts to counterbalance the effects of the Crisis and increasing globalization pressures, the EC expanded its 2010 strategy in 2012[13] and aimed at raising the GDP share of industry from 16% to 20% by 2020. The EC’s vision included a mobilization of several tools across all policy areas relating to industrial competitiveness. The key pillar was the support of investments in innovation and R&D policies, while the strategy identified six priority areas: clean production through advanced manufacturing technologies (green innovation), KETs, bio-based products, raw materials and a sustainable construction policy, clean vehicles, and smart grids.[14]

The current state of play

The European Green Deal and EU’s New Industrial Strategy

…it was the European Green Deal that revamped the Union’s growth strategy. As its new flagship program, it introduced three main objectives: i) zero greenhouse gas emissions (net-zero) by 2050, ii) sustainable economic growth decoupled from resource usage, and iii) a just twin transition where no person or region is left behind.

2019 can be deemed a pivotal year with EU policy changing direction significantly. Until then, the EU’s industrial policy was mainly focused on horizontal actions aimed at growth and competitiveness, with an early 2017 communication entitled ‘Investing in a smart, innovative and sustainable industry’ (COM(2017)0476) paving the way for new sustainable industrial development goals.[15] However, it was the European Green Deal that revamped the Union’s growth strategy. As its new flagship program, it introduced three main objectives: i) zero greenhouse gas emissions (net-zero) by 2050, ii) sustainable economic growth decoupled from resource usage, and iii) a just twin transition where no person or region is left behind. The program made the continent’s joint green and digital—or twin—transition its priority and outlined a strategy towards a clean and circular European economy that continues to define EU initiatives today (EC, 2019).[16]

Following the Green Deal’s trajectory, in 2020 the EC presented a New Industrial Strategy for the twin transition, which focused on EU industry and contained a set of specific policy priorities, including maintaining global competitiveness, achieving climate neutrality by 2050, and shaping Europe’s digital future (EC, 2020). The paradigm shift was outlined on the basis of solidifying the EU’s perceived competitive advantage in clean technologies and green innovation, and of addressing the lag in its digitalization compared to other major global players. The strategy included key drivers and blends of horizontal and vertical actions targeting resilience in the Single Market, EU strategic autonomy, and the acceleration of the green and digital transitions.

The 2020 industrial strategy identified key industrial ecosystems, going beyond the traditional sector/technology focus and targeting actors at every stage of critical value chains, from input suppliers to after-sales service providers. These ecosystems comprise diverse actors including start-ups, SMEs, large firms, and academic and research institutions, as well as public authorities. The EC sought to map market-enabling and fiscal-support needs across borders and ecosystems, as well as analyzing strategic dependencies to devise tailor-made policy toolboxes to address them. One of the main initiatives taken in this direction has been the launch of industrial alliances in the identified ecosystems, which have now solidified into being significant delivery vehicles for the EU’s industrial strategies.[17]

The pandemic shakedown, the energy crisis, and the EU Green Deal Industrial Plan

The day after the 2020 New Industrial Strategy was presented, the World Health Organization announced the COVID-19 pandemic. The events that followed had immense ramifications for the European economy, including a 6.3% GDP contraction and severe employment and turnover implications for European SMEs.[18] The impact was evident across different ecosystems and provided some valuable lessons. These were outlined in a substantial update to the industrial strategy, which was published in May 2021 and reaffirmed the importance of the twin transition, placing the EU’s “open strategic autonomy” center-stage (EC, 2021). The EC proposed a diverse set of actions along the major three axes already defined in the 2020 strategy:

- Strengthening the resilience of the Single Market—initiatives here included an emergency policy instrument, specific support for SMEs and the establishment of the annual monitoring of the Single Market through the Annual Single Market Report.

- The strengthening of the EU’s strategic autonomy, which included a proposal for diversified international partnerships that secure openness to trade and foreign direct investment inflows, the establishment of industrial alliances on key industrial ecosystems aiming at attracting private investments and creating high-value jobs, and the continuous monitoring of strategic dependencies in key products from sensitive industrial ecosystems.

- Accelerating the twin transition—initiatives here included the co-creation of transition pathways in key industrial ecosystems with the relevant stakeholders, the adoption of multi-country joint projects, the facilitation of Horizon Europe partnerships, and measures to accelerate investments and access to decarbonized energy.

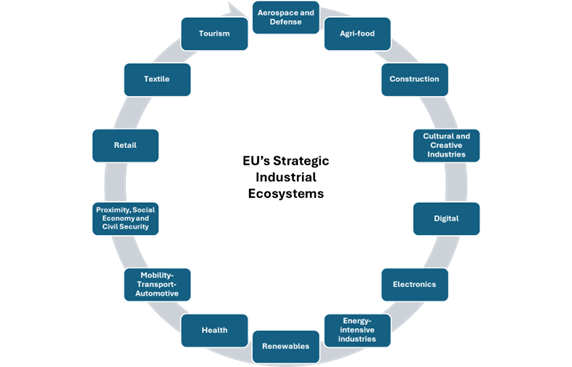

The updated industrial strategy outlined 14 key industrial ecosystems, that account for approximately 80% of the EU’s business economy.

The updated industrial strategy, which was accompanied by the 2021 Annual Single Market Competitiveness Report18, outlined 14 key industrial ecosystems that account for approximately 80% of the EU’s business economy (Fig. 1). For each ecosystem, a specific policy toolbox was developed, which includes funding sources, regulations, and corresponding industrial alliances.[19]

Figure 1: The EU’s strategic industrial ecosystems. Source: Authors’ elaboration on SWD(2021)0351

In addition, the update offered insights into strategic dependencies on foreign suppliers in key areas across ecosystems and their supply chains, including raw materials, active pharmaceutical ingredients, batteries, hydrogen, semiconductors, cloud and edge computing (SWD(2021)0352).[20] In a 2022 follow-up, additional areas were added to the list including rare earths, magnesium, photovoltaic (PV) solar panels, a number of chemicals, and key digital technologies related to cybersecurity and IT software (SWD(2022)041). A key insight that emerged is that the EU is mainly dependent on China in these areas; this triggered an active engagement towards addressing this dependency through various measures including regulation, new international partnerships (especially in raw materials), and investment pipelines through industrial alliances.

…the EC further upgraded the role of Important Projects of Common European Interest (IPCEIs) as tools for reversing strategic dependencies.

In the same context, the EC further upgraded the role of Important Projects of Common European Interest (IPCEIs) as tools for reversing strategic dependencies. IPCEIs are a provision of EU state aid that allows member states to jointly design and implement national investments in key technology with significant growth, employment, and breakthrough innovation potential. These transnational projects are critical in developing technology and production capabilities for the Single Market that could not be otherwise achieved, as they bring together knowledge, resources, and expertise from various economic actors across the Union.[21] Since the 2021 update, the EC has approved 8 IPCEIs on microelectronics (2 projects), cloud and edge computing infrastructure (1 project), batteries (2 projects), and clean hydrogen (3 projects) with the participation of 22 member states and an overall budget of approximately €80 billion (including private R&D investments).[22]

Flagship funding programs are aimed at achieving EU industrial goals and include – among others – InvestEU, NextGenerationEU and its Recovery and Resilience Facility (RRF) instrument, the Multiannual Financial Framework (MFF) 2021–2027, and Horizon Europe.

To date, the updated 2021 industrial strategy has served as the main industrial policy document that directs all the policy tools and actions adopted by the EC. Flagship funding programs are aimed at achieving EU industrial goals and include – among others – InvestEU, NextGenerationEU and its Recovery and Resilience Facility (RRF) instrument, the Multiannual Financial Framework (MFF) 2021–2027, and Horizon Europe.[23]

However, the escalation of the Russo-Ukrainian war produced one of the largest energy crises the continent has ever faced, challenging the EU to navigate its independence on Russian gas, sky-high energy prices, the need to secure affordable energy supplies, and ultimately deliver on its ambitious net-zero twin transition targets. The EU’s response came in the form of REPowerEU[24] and the ‘Green Deal Industrial Plan for the Net-Zero Age’, which seek to ensure that the Green Deal’s ambitious goals remain on track with the recent geopolitical developments (COM(2023)062). The new industrial plan builds on the guidelines of, and the progress made by, the EU’s industrial strategy and aims to speed up Europe’s progress to climate neutrality. The EU is expected to foster the development of a simplified and predictable regulatory framework, enable faster access to funds, support up-skilling and re-skilling initiatives, and actions that enhance the resilience of the EU’s supply chains through open trade. In this context, the EC adopted two key proposals:

The Net-Zero Industry Act

The Net-Zero Industry Act (NZIA) (approved February 2024) aims to substantially strengthen the EU’s capacity to manufacture strategic net-zero technology products.

The Net-Zero Industry Act (NZIA)[25] (approved February 2024) aims to substantially strengthen the EU’s capacity to manufacture strategic net-zero technology products. Through this Act, the EU aims to boost its industrial competitiveness, create high quality jobs, and lower its strategic dependencies on net-zero techs, while accelerating its progress towards Green Deal targets for 2030.

The NZIA’s objectives also include the creation of regulatory frameworks that can enable the roll-out of key technologies and relevant disruptive innovations, and an ambitious goal of strengthening the EU’s strategic autonomy by covering 40% of the EU’s needs in strategic tech products domestically (intra-EU).[26] To achieve this, the NZIA targets the facilitation of green investments by:

- Simplifying permit-granting processes for projects and legislation related to net-zero industries.

- Creating regulatory sandboxes for the introduction of innovative products into markets, facilitating business case conditions for start-ups and SMEs.

- Contributing to the identification of strategic projects in clean tech supply chains, including multinational (e.g., IPCEIs) projects.

- Stimulating consumer demand for net-zero products and defining rules for public incentives.

- Developing a coordination mechanism for knowledge and best practice exchange on clean techs.

- Enhancing workforce skills through academies.

The Critical Raw Materials Act

Critical Raw Materials (CRMs) are of strategic importance for the EU. […]to address both existing dependencies and upcoming (demand) challenges, the EU adopted a CRM Act (CRMA)

Critical Raw Materials (CRMs) are of strategic importance for the EU. Their supply chains present a significant risk of disruption, given that the EU is highly dependent on foreign suppliers—predominantly China—for their sourcing.[27] On top of this, demand for CRMs is expected to sky-rocket in the coming decades, as they are essential in almost all the EU’s strategic industrial ecosystems, but most significantly in renewables, mobility, ICTs and microelectronics, aerospace, and defense. They are also indispensable for the development of clean tech products. In March 2024, to address both existing dependencies and upcoming (demand) challenges, the EU adopted a CRM Act (CRMA)[28] to:

- Strengthen every stage in European CRM value chains by significantly diversifying the EU’s imports to reduce strategic dependencies on single countries.[29]

- Improve the EU’s efficiency at monitoring demand requirements and mitigating risks of supply disruptions in CRMs.[30]

- Improve circularity and sustainability.

- Support R&I on resource efficiency and the development of substitute materials and technologies.

In line with the scope of the NZIA and the Green Deal targets, the CRMA has set measurable—and, most importantly, realistic—targets for 2030 relating to:

- CRM extraction—the target is for at least 10% of the CRMs consumed annually in the EU to have been extracted from within its member-states.

- CRM processing—the target is for at least 40% of the CRMs consumed annually in the EU to have been processed by its member-states.

- CRM recycling—the target is for at least 25% of the CRMs consumed annual in the EU to originate from member states’ domestic recycling.

- CRM dependency reduction—the target is for no more than 65% of the EU’s annual consumption of key CRMs to originate from a single non-EU country, irrespective of the stage in the supply chain.

…the new industrial plan also delivered a much-needed reform of the EU’s electricity market in the face of increased energy costs.

In addition to the two critical acts, the new industrial plan also delivered a much-needed reform of the EU’s electricity market in the face of increased energy costs.[31] This reform provides a long-term shield against the ramifications of the 2022 energy crisis and aims to control volatility in the price of electricity in the long term by reducing its dependency on fossil fuel prices, protecting consumers from price spikes and facilitating the deployment of renewable energy sources (RES).

Why do we care about industrial policy in Greece?

The aftermath of a prolonged crisis and a new growth strategy

By 2018, most of the EU economies that faced significant challenges amidst the financial turmoil were already bouncing back, with the EU economy on a steady growing course. However, Greece was among the notable exceptions.

The problems that led to high public-private debt and large fiscal and balance-of-payments deficits in Greece during and after the recession are still present, rooted in the lack of structural reform implemented in the country.[32] Indeed, the country’s pervasive underperformance in terms of competitiveness in the European Single Market, despite the financial support it receives from the EU, can largely be traced to several structural deficiencies tied to the country’s productive model. These deficiencies were reflected to the country’s productive and technological capabilities[33] and problematic business environment[34], and triggered a discussion in the early 2010s centered on the need for a coherent Greek industrial strategy for productive transformation.

In 2020, the Greek government delivered a strategic document detailing a new growth model for Greece. The document provided a structural analysis of the Greek economy, a set of objectives for 2030, and accommodating policy tools to achieve them.

In 2020, the Greek government delivered a strategic document detailing a new growth model for Greece (Pissarides et al., 2020). The document provided a structural analysis of the Greek economy, a set of objectives for 2030, and accommodating policy tools to achieve them. Two broad areas of progress were established: participation in the labor market and enhancement of labor productivity. These were considered as pillars of growth and competitiveness and four sets of — albeit overly broad – policy measures were proposed:

- Policies that improve the business environment by reducing regulatory and administrative burdens and restoring transparency to the country’s institutions.

- Policies that strengthen social cohesion by upgrading the domestic labor market, educational system, and health services.

- Policies that improve infrastructure, one of Greece’s core deficiencies by facilitating the twin transition, enhancing the country’s trade openness, and attracting greenfield foreign direct investments (FDIs).

- Policies that target individual sectors, with a focus on lowering production costs for the domestic manufacturing sector and enhancing university-business collaboration in applied research.

Despite the horizontal nature of the first three sets of policy measures, the explicit identification of sectoral needs provided a vertical direction, which had already been in place since 2010, when key industrial ecosystems were identified during the developing process of the National Smart Specialization Strategy 2014–2020.[35]

The Greek Industrial Strategy

In 2022, a strategic document entitled ‘National Industrial Strategy and Action Plan’ was presented, setting the stage for the future of Greek industry. The document outlines 43 interventions across seven key strategic areas.

In 2022, a strategic document entitled ‘National Industrial Strategy and Action Plan’[36] was presented, setting the stage for the future of Greek industry. The strategy’s vision is that the Greek industry can act as the transformative factor of the economy through innovation, international cooperation, and human capital development, and thus empower the country’s sustainable development. The document outlines 43 interventions across seven key strategic areas:

- Industrial competitiveness. The Strategy aims to support the scaling-up and international trade activities of industrial firms (particularly SMEs). Key objectives include developing strategic partnerships, identifying niche markets (mostly abroad) for high value-added products, and attracting investment.

- Innovation. The Strategy aims to support industrial research, university-industry collaboration, R&D investments and seeks to enhance domestic start-up and entrepreneurial ecosystems.

- Digital transformation. The Strategy aims to promote the digitalization of industrial firms, the adoption of cutting-edge digital techs, and the upgrading of digital infrastructure.

- Green transformation. The Strategy seeks to enhance the deployment of RES, increase energy efficiency, adopt and apply circular economy production models, and develop sustainable products.

- Human resources and skills. The Strategy seeks to upskill and reskill the Greek workforce by developing digital and sustainable STEM skills to address labor market needs and reducing the gap between education and labor markets.

- Business environment. The Strategy aims to facilitate a well-functioning market by alleviating heavy bureaucratic obligations, simplifying procedures, and developing updated production and IP standards for the uptake of innovation.

- Industrial resilience. The Strategy seeks to manage soaring energy costs, to strengthen the country’s strategic autonomy in key resources, and to adapt the economy to climate change.

The Greek industrial strategy also identified five key domestic industrial ecosystems, adopting the EU’s approach of focusing on all the actors engaged in the value chain rather than specific sectors. These key ecosystems are agri-foods, structural materials, health, digital technologies and applications, and green technologies/circular economy. The ecosystems are tied to niche markets for high value-added products in which Greece is either already actively engaged and needs to secure and upgrade its position (value-for-money food, shipbuilding) or has the potential to gain a competitive advantage should it achieves its industrial strategy objectives (next-gen materials, health technologies, robotics, electromobility, defense industry).

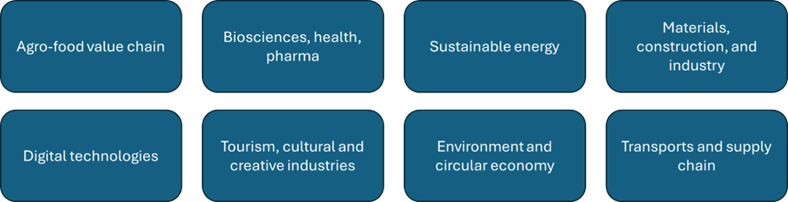

Greece’s innovation strategy is outlined in the National Smart Specialization (NSS) Strategy 2021–2027 published in 2022, which sets the direction, objectives and framework for the country’s research, technology and innovation (RTI) policy.

It should be noted that most of the key strategic areas outlined in the Greek industrial strategy are also identified in other dedicated strategic documents. For instance, Greece’s innovation strategy is outlined in the National Smart Specialization (NSS) Strategy 2021–2027 published in 2022, which sets the direction, objectives and framework for the country’s research, technology and innovation (RTI) policy. [37] This strategic document is directed at addressing challenges faced by national and regional research and innovation systems. It focuses on eight priority areas identified in the previous version of the Strategy for the 2014–2020 period (Fig.2) and further promotes the entrepreneurial discovery process as a refined dialogue process with local entrepreneurial ecosystems aimed at identifying potential priority areas and sectors of interest.

Figure 2: Key priority areas identified in Greece’s National Smart Specialization Strategy. Source: GSRI

In terms of the digital transformation of the Greek industry, which is a pressing issue given the deficiencies in the country’s digital infrastructure and workforce skills, the industrial strategy’s action plan and objectives are aligned with the National Strategy for the Digital Transformation of the Greek Industry. In addition, the National Energy and Climate Plan (NECP), (revised October 2023) lists objectives and initiatives for the green transition.

In terms of the digital transformation of the Greek industry, which is a pressing issue given the deficiencies in the country’s digital infrastructure and workforce skills, the industrial strategy’s action plan and objectives are aligned with the National Strategy for the Digital Transformation of the Greek Industry, which was published in 2021.[38] In addition, the National Energy and Climate Plan (NECP), (revised October 2023) lists objectives and initiatives for the green transition. These are related, but not restricted, to the country’s industrial sector and include decarbonization, energy efficiency and supply, RES integration, green fuels (including green hydrogen), critical and strategic raw materials, climate change mitigation, and clean tech development (green innovation).[39]

Outlining a Greek Industrial Policy: Opportunities and challenges

Together, the extensive body of strategic directions, action plans, initiatives, reforms and objectives identified across these four major documents form Greece’s rather fragmented industrial policy landscape. The documents were prepared in response to recent developments at the EU level and the significant challenges facing Greek and EU industrial competitiveness. These challenges can be grouped into four key areas: i) digital transformation and technological catch-up, ii) green transition, circular economy, and climate change, iii) strategic autonomy, and iv) funding for capacity.

The timing of these documents, and especially the development of a national industrial strategy, was critical. On the one hand, extreme global challenges are already putting the structurally deficient Greek productive model under immense pressure and demand an immediate strategic response. On the other hand, the EU’s shift towards active engagement and, most importantly, the direct financial stimulation of industrial competitiveness presents an unprecedented opportunity for restructuring the Greek productive model. The strategic areas and objectives they outline have the potential to address the country’s key structural deficiencies; the underlying causes of its consistent underperformance in terms of competitiveness and fragility in the face of external shocks, whether these be finance-, energy-, or global supply chain-related.

Despite the significant challenges it faced during and after the recession, the Greek industrial sector[40] is set on a path to recovery. In 2022, its contribution to national GDP was 1.2 p.p. higher than in 2010[41], its labor productivity was at an historic high, and since 2014 approximately 25% of the country’s labor force has been employed in industrial activities or activities related to industry (SEV, 2023). In addition, the share of industrial exports in GDP has almost tripled since 2010, with R&D investments almost doubling. But there is still much to be done for Greek industry to enhance its competitiveness in both the Single Market and global markets.

…the new strategic status quo that emerged in the EU and has been quickly transmitted to Greece presents transformative potential for the country’s productive model.

Drawing on recent developments in the EU’s industrial policy and the pillars put in place by the different strategic documents discussed earlier, we present a set of recommendations on the opportunities and risks presented by the revival of industrial policy in the current decade. We argue that the new strategic status quo that emerged in the EU and has been quickly transmitted to Greece presents transformative potential for the country’s productive model. In this vein, we discuss a set of key opportunities the country should leverage (what we should do), some pitfalls that must avoided (what we shouldn’t do), and some concerns that should be borne in mind (what we should be aware of) when strategizing for the Greek industry in the years ahead.

What Greece should do

One of the key features in the EU’s updated industrial strategy is that it doubles down on the promotion of significant intra-EU industrial alliances in key ecosystems of strategic importance. The key here is the intra-EU character of these partnerships, which emanates from the strategic autonomy goals outlined by the EU.[42] In this context, the industrial alliances initiative presents a significant opportunity for Greek industrial enterprises—and knowledge-intensive industrial SMEs, in particular—to formulate production linkages with major suppliers and clients in the EU and participate in key value-chains of high-value added products. The potential here is twofold. On the one hand, industrial alliances can facilitate access to new markets, stimulating the potentially limited domestic demand for niche products related to key high-tech supply chains, such as batteries, advanced materials, clean techs, and microelectronics.[43] On the other hand, such alliances can act as pipelines for knowledge and innovation transmission, which can be quite beneficial not only for the firms that participate in them, but also for the rest of the local economy through knowledge spillovers. Hence, they can enhance both industrial and innovation capacity in critical high-value-added activities through strategic intra-EU partnerships and strengthen the country’s competitiveness in the Single Market.

To exploit the potential of industrial alliances, a vertical approach should be adopted that fosters innovation and entrepreneurship in critical ecosystems (as outlined in the NSS Strategy).

To exploit the potential of industrial alliances, a vertical approach should be adopted that fosters innovation and entrepreneurship in critical ecosystems (as outlined in the NSS Strategy), going beyond agro-food and tourism to target materials[44], sustainable energy, digital technologies, environment, and the circular economy. To achieve this, policy interventions must focus on two broad fronts: regulation and financing.

On the regulation front, we need to continue our efforts to push through major reforms that can upgrade the Greek business environment by simplifying market regulations, speeding up the granting of permits through efficient mechanisms, providing tax incentives for investments in key technology areas, and further easing bureaucratic procedures. It is critical to build on the contents of NZIA and CRMA by successfully developing and exploiting regulatory sandboxes for disruptive clean-tech and composite materials innovations, as well as for the extraction and processing of CRMs, that can facilitate the introduction of new Greek products in EU markets and substantially enhance business case conditions for innovative start-ups and industrial SMEs.

On the financing front, updated regulation and a business-friendly market environment can help attract greenfield FDIs in strategic ecosystems which are crucial for the development of industrial capacity and the upscaling of Greek industrial SMEs.[45] However, the main challenge is to successfully utilize an unprecedented wealth of EU and state financing tools—including the RRF, the MFF 2021–2027, Horizon Europe, the new development law (Law 4887/2022), and additional funds made available by the various Commission Acts. To this end, proper mechanisms should be developed for the efficient and just allocation of available resources towards research and innovation activities related to key strategic ecosystems and their supply chains, prioritizing the creation of skills and infrastructure that will enable them to develop industrial capacity.

An additional funding source in the same spirit as industrial alliances is the IPCEI instrument. Greece is very active in this field and is already engaged in 4 IPCEIs related to batteries, clean hydrogen (2 projects), and microelectronics. These projects rely on intra-EU partnerships between both firms and states and provide a combination of EU, state, and private financing support for R&D and industrial deployment in key technologies that matches the funds of the Horizon Europe program. Participation in such projects should become a key pillar in the country’s strategic planning, as they provide access to scale-up funds, innovation and technology pipelines and niche markets, as well as helping to formulate strategic partnerships with diverse actors (from multinational enterprises to universities and research institutes across the EU) that can significantly stimulate its industrial competitiveness.

What Greece should not do

…we should avoid making the oldest and most persistent mistake in the history of active industrial policy; pick “winners” and, by extent, create “losers”.

In utilizing the emerging opportunities in the EU industrial policy landscape, we should avoid making the oldest and most persistent mistake in the history of active industrial policy; pick “winners” and, by extent, create “losers”. While targeting specific ecosystems and technologies where advanced capabilities are desirable, two priorities should emerge: i) to not create “national champions”, i.e., specific firms that are considered strategic assets and are favored against others, and ii) to not leave other sectors and ecosystems behind in the race for industrial competitiveness. In this vein, regulation and finance should again receive the spotlight of policy attention, but this time as horizontal instruments for market-wide initiatives.

Reforms that target the simplification of market procedures and upgrade the business environment can have a horizontal effect on the Greek economy, stimulating business and entrepreneurial activity across multiple sectors, and at the same time facilitate the conditions for private investments (domestic and foreign). However, reforms and regulation interventions must be combined with an efficient and transparent competition policy that will not undermine the dynamic nature of the markets in favor of specific incumbent or emerging leading firms in the various ecosystems. Furthermore, as Greece embarks on this long-awaited transformative journey, it should not stop at the regulatory and administrative reforms that are already designed or are effectively in use. Strategic planning should remain a continuous process that includes constant screening for new regulatory needs or for improvements in already established frameworks; only in this way can the mistakes of the past which could hamper the economy in the future by creating significant deficiencies be avoided.[46]

It is also critical that the pool of financial resources is allocated efficiently and transparently in the Greek economy.

It is also critical that the pool of financial resources is allocated efficiently and transparently in the Greek economy. For instance, the funds made available by the RRF and the MFF 2021–2027—targeting the digital and green transitions, the re-skilling and upskilling of the Greek labor force, and the development of proper infrastructure across multiple sectors—provide significant transformative potential and can create a horizontal boost for economic and industrial activity. These tools must be put to “good use”, meaning they should seek to benefit everyone and not just selected ecosystems or sectors. High value-added and tech-intensive ecosystems can benefit from access to tailor-made funding sources, such as the new development law, funds from NZIA and CRMA and new EU Acts on key ecosystems and technologies that may be forthcoming, Horizon Europe, and participation in IPCEIs, which are innovation-oriented and thus better suited to accommodating the need for applied research and industrial capacity. In this setting, the role of the Greek state should lie in the efficient and effective governance of the various emerging and incumbent industrial ecosystem to create strategic direction and develop proper mechanisms for the effective and just allocation of available funds to them. It should be noted, however, that entrepreneurship should not be undermined by this process. Concrete and tangible strategic targets and requirements can be set through a top-down approach, but at the same time they must be broad enough to allow creativity as to how they are achieved (Mazzucato, 2018).

While the extensive pool of EU and state-oriented financial resources is a significant arrow in the quiver of the current Greek industrial and growth strategy, their potential benefits must be taken with a grain of salt to avoid an overreliance on public funds. The strategic allocation and exploitation of these resources should aim to foster industrial firms fit for capacity, and not provide a continuous funding lifeline. In other words, Greece is challenged to exploit the available financial resources to create a well-functioning industrial sector where private investments could potentially thrive in the long-term. In this regard, apart from significant regulatory and market reforms that seek to attract FDIs, it is crucial that macroeconomic policies also aim to achieve a significant reduction in the cost of borrowing to stimulate bank financing in the Greek industry.

What Greece should be aware of

…the country must engage in a complete mapping of its GVC activities to identify foreign suppliers of key inputs, but also users of Greek products that can act as strategic partners in future alliances.

Something that is notably absent from the current Greek industrial policy landscape is an in-depth analysis of Greece’s strategic dependencies of the sort that the EU has conducted. Identifying imports for key products and technologies could help the country pin down structural break points in its supply chains that can lead to significant deficiencies, while their constant screening can provide early warnings of potential disruption. One characteristic example is the country’s critical import dependence on energy products, which leads to energy costs that industrial enterprises find extremely difficult to address (FEIR/IOBE, 2023).[47] To monitor such dependencies, the country must engage in a complete mapping of its GVC activities to identify foreign suppliers of key inputs, but also users of Greek products that can act as strategic partners in future alliances. Through this process, new areas of strategic interest can emerge, creating a future-orientation within the national industrial strategy that can guide interventions, funding, R&D and innovation as well as the overall entrepreneurial activity in the economy.

Another point of awareness is intra-EU competition. The EU’s industrial strategy creates an opportunity for Greece to participate in critical value chains and specialize in high value-added activities. It also provides fertile ground for leading economies to expand their strengths and specialization patterns and secure multiple competitiveness gains based on their advanced technological capabilities. Participation and active engagement in industrial alliances and IPCEIs in key ecosystems and technologies is up for grabs among EU members, planting the seeds for a potential subsidy race among them. This is a serious problem that could undermine the performance of the EU Single Market.

…another major focal point is the emerging pattern of loosening state aid provisions among EU members.

In the same context, another major focal point is the emerging pattern of loosening state aid provisions among EU members. This process began in 2020, in the aftermath of the pandemic, when the EC’s communication of the State Aid Temporary Framework (2020/C 91 I/01) led to a wave of significant national fiscal stimulus packages being injected into EU domestic markets to enhance economic resilience. Even though all members benefited from the framework (including Greece), leading players (predominantly Germany and France) were able to make use of their stronger fiscal positions to inject larger funds into their markets.[48] The temporary framework came to an end in 2022, but it had already sparked the flame of loosening state aid provisions towards pursuing national industrial strategy goals, a pattern that could be further enhanced indirectly by the recent Acts and all the funding tools that the EU has promoted through its updated industrial strategy and the Green Deal Industrial Plan. A significant risk emerges here for Greece, but also for the whole EU economy: the potential for a beggar-thy-neighbor subsidy war in the Single Market, in which dominant players crowd out smaller economies by leveraging their fiscal position to direct excessive national funds into key technologies and segments of critical value chains.[49] Such policies could have significant ramifications for societal welfare and competition in the EU Single Market, which in turn could significantly augment territorial disparities (Terzi et al., 2023).

Against this backdrop, another major challenge emerges for Greece: that of swift action in the form of dynamic strategic planning with tangible goals and objectives which reflect the country’s strengths, weaknesses and potential opportunities and threats in terms of industrial competitiveness in the EU Single Market. While the country has made significant progress in this direction through its various strategic documents and goals, it still needs to double down on both their implementation and the constant screening for new needs that may emerge.

Last but not least, another point of consideration is extra-EU competition and the Union’s overall trade openness to markets outside Europe. The promotion of the Inflation Reduction Act (IRA) by the US[50] in 2022 indicates that industrial strategies for climate change, the green transition and strategic autonomy are at the forefront of policy agendas across the world. The EU’s strategic autonomy aspirations could create an EU-only orientation in trade activities and thus set the stage for a wave of protectionism across the continent. Greece must navigate these uncharted waters with caution, leveraging potential new alliances with EU members but also maintaining current strategic partnerships outside the EU (e.g., Egypt, Israel, and the US), as well as exploring new ones, to secure important FDIs and potential markets for high value-added Greek products.

Conclusions

The EU has already transitioned into a decade of industrial policy revival. The objective of sustainable industrial competitiveness through the twin transition and strategic autonomy in view of the challenges posed by climate change and the energy crisis is now at the top of the policy agenda. Key initiatives such as industrial alliances and IPCEIs, major reforms and funding stimulus through dedicated Acts, plus an unprecedented wealth of financing and regulatory instruments pave the way for a reconfiguration of the European industry towards a green and digital re-industrialization paradigm in the years ahead.

…the new strategic status quo in the EU can help shield the economy’s structural deficiencies and provide the proper platform for a green and digital transformation of the country’s productive model.

These developments provide significant potential for structural transformation across all member states, including Greece. In the aftermath of a prolonged crisis, the Greek economy faces a new set of challenges posed by energy markets and climate change. However, at the same time, the new strategic status quo in the EU can help shield the economy’s structural deficiencies and provide the proper platform for a green and digital transformation of the country’s productive model. Greece has already aligned its strategic planning to the EU’s industrial policy objectives through a dedicated National Industrial Strategy and several other strategic documents that target innovation, the green transition and sustainable development, as well as digitalization across key industrial ecosystems and value chains. These documents outline a Greek policy roadmap towards 2030 with the potential to integrate and leverage new developments and opportunities emerging from the EU policy landscape, as discussed in this policy brief.

But strategic planning is not enough for Greece to leverage the current EU industrial policy momentum towards structural transformation. Mistakes will be made; no strategy is omnipotent in the face of changing market conditions. The country must meet the challenge of implementing its ambitious action plans while constantly monitoring, evaluating and updating (if necessary) its strategic orientation against the volatility of the current global market environment. In this context, the need emerges for a holistic industrial policy in the years ahead, in which different strategies and documents relating to competitiveness, research and innovation, the twin transition, and climate change adaptation are integrated into a unified system of policies. This systemic approach can create a clear connection and path dependence for different strategic objectives, diverse market reforms and policy interventions and, by extension, provide the solid foundations for the pursuit of sustainable growth and competitiveness by the Greek industry in the long term.

[1] Macro-economic measures in the Washington Consensus tradition (such as labour market interventions) were shown to be particularly inefficient at addressing the recession effects in the Greek economy.

[2] Stöllinger et al. (2013) argued that industrial policy is imperative ahead of the challenges the EU’s manufacturing sector is facing and suggested a broad set of measures that were largely incorporated into subsequent industrial strategies, such as funding aid to member states, providing public support for R&D, and training and upskilling the EU’s labor force.

[3] Notably, China has transitioned from being a key trade partner into a “systemic rival”.

[4] The European Green Deal sets the ambitious goal of the EU becoming climate-neutral by 2050, with the EC identifying the program as the Union’s “new growth strategy”.

[5] Greece was in last place (28th) on the Digital Economy and Society Index (DESI) for 2018, coming in behind every other EU members (plus the UK) in terms of digital readiness. Since 2019, Greece has made significant progress in all four pillars of the DESI, including digital skills, digital infrastructure, digital transformation of businesses and, above all, the digitalization of public services during the pandemic (see here). The country has also devised one of its very first concrete strategy documents, the Bible of the Digital Transformation 2020-2025 (see here), and pledged significant funds from its Recovery and Resilience Fund (RRF) to its digital transition and to achieving the EU’s ambitious Digital Decade targets.

[6] https://www.kathimerini.gr/politics/1041592/tasos-giannitsis-i-krisimi-dekaetia-2020-2030/

[7] SMEs account for approximately 99% of all businesses In Europe (in Greece, it is 99.9%) and contribute more than half of its GDP (Di Bella et al., 2023).

[8] Owen (2012) considers this era to be the heyday of industrial policy in Europe. Apart from strong national policies aimed at “winning” sectors, it was during this era that the European Coal and Steel Community (ECSC) was formed (1952), the first Europe-level industrial policy, which paved the way for the later formation of the European Economic Community (EEC) (1957) and contributed significantly to European economic integration towards a Single Market (Tagliapietra and Veugelers, 2023).

[9] The EU Single Market is considered the main pillar of the EU’s industrial policy. In 2023, the EU celebrated the Single Market’s 30th anniversary with an informative infographic on its accomplishments (see here). To date, its completion and safeguarding remains one of the EU’s key policy priorities.

[10] Science, technology, and innovation policy were integrated into the EU’s industrial strategies through the EC’s Framework Programs (FPs), which provided directions and funding. These programs were later replaced by Horizon 2020 and the current Horizon Europe (2021-2027).

[12] The characteristic shift was explicitly outlined as a “fresh approach” which brought together “a horizontal basis and sectoral application” and considered the whole value chain to develop “globalization reflexes”.

[13] ‘A Stronger European Industry for Growth and Economic Recovery – Industrial Policy Communication Update’ (COM(2012)0582).

[14] The communication was followed by proactive sector-specific action plans including additional sectors such as creative industries, space, healthcare technologies, medical devices, and tourism (Veugelers, 2013).

[15] The key feature of this communication was the development of the Strategic Forum for Important Projects of Common European Interest, which gained significant momentum in the later New Industrial Strategy.

[16] For more information on the various dimensions and environmental importance of the Green Deal, see Koundouri et al. (2023).

[17] The first successful cases were the European Battery Alliance (2017) and the Circular Plastics Alliance (2019), which boosted the creation of an EU market for recycled plastics. Recent advancements include the Clean Hydrogen Alliance, the Raw Materials Alliance, the Alliance for Zero-Emission Aviation, and others (see here).

[19] A dedicated action plan is also available for each ecosystem (see here).

[20] These six areas contained 137 products identified as dependencies, with 34 (equating to approximately 0.6% of extra-EU import value) designated as even more vulnerable given their low potential for intra-EU production substitution.

[21] https://www.europarl.europa.eu/thinktank/en/document/EPRS_BRI%282022%29729402

[22] https://competition-policy.ec.europa.eu/state-aid/ipcei/approved-ipceis_en

[23] Horizon Europe allocates €53.5 billion of its overall €95.5 billion in this direction, signaling an active engagement with innovation policy aimed at achieving industrial targets (see also here).

[24]https://commission.europa.eu/strategy-and-policy/priorities-2019-2024/european-green-deal/repowereu-affordable-secure-and-sustainable-energy-europe_en

[25] https://www.consilium.europa.eu/en/infographics/net-zero-industry-act/

[26] Such as solar PVs and thermal energy onshore wind and offshore renewables, batteries, and clean hydrogen.

[27] China supplies the EU with all its heavy rare earth elements (100%).

[28] https://www.consilium.europa.eu/en/infographics/critical-raw-materials/

[29] The EU is also dependent on Turkey for supplies of boron (98%) and on South Africa for platinum (71%).

[30] The EU maintains a dynamic list of 34 CRMs.

[31] https://www.consilium.europa.eu/en/press/press-releases/2023/12/14/reform-of-electricity-market-design-council-and-parliament-reach-deal/

[32] https://cepr.org/voxeu/columns/growth-plan-greece

[33] Including, inter alia, the lag in the country’s export specialization in high value-added/high-tech products, the underdevelopment of human capital, problems in the exploitation of new knowledge and innovation (also reflected in below-EU-average R&D investments), and the inefficient linkages between the various actors in the national innovation system (Caloghirou et al., 2021).

[34] Including stringent regulation, unstable corporate tax schemes, and laborious bureaucratic procedures.

[35] https://gsri.gov.gr/trechousa-ekdosi-tis-ethnikis-stratigikis-exypnis-exeidikefsis-2014-2020/

[36] https://www.mindev.gov.gr/wp-content/uploads/2022/09/2.-Εθνική-Στρατηγική-Βιομηχανίας-και-Σχέδιο-Δράσης-National-Industrial-Strategy-and-Action-Plan.pdf

[37] https://gsri.gov.gr/ethniki-stratigiki-exypnis-exeidikefsis-2021-2027/

[38] https://www.ggb.gr/el/node/1820

[39] https://commission.europa.eu/publications/greece-draft-updated-necp-2021-2030_en

[40] Including manufacturing, mining and quarrying, energy supply, water supply and waste management.

[41] 1.4 p.p. for manufacturing activities only (SEV, 2023).

[42] A €38 billion surplus of trade-in-goods in the EU is already reported for 2023 in contrast to the €436 billion deficit of 2022. This was achieved by reducing extra-EU imports of energy products and materials (see the news report here).

[43] All of which already have established alliances.

[44] Greece’s geological environment is favorable for the extraction of several identified CRMs, thus leading to opportunities for entry into related EU supply chains (FEIR/IOBE, 2023).

[45] Industrial alliances perfectly align with the SME-dominated landscape of industrial enterprises in the Greek economy.

[46] A relevant example is the need for significant reforms in national intellectual property (IP) regulation to align it with emerging EU standards.

[47] It is estimated that a 10% reduction in energy costs in Greece’s energy-intensive industries would stimulate the country’s GDP by approximately €600 million and create 12,000 additional jobs (FEIR/IOBE, 2021). Targeted efforts to upgrade the country’s capacity and deployment of RES and efficient leveraging of the new reforms in the EU electricity market could be pivotal in reducing the volatility of electricity prices and thus create a new steady state in industrial energy costs.

[48] For more information on EU state aid cases and budgets, see here.

[49] For example, as part of its National Industry Strategy 2030, Germany promoted the “Hermes scheme” to support the export performance of its SMEs through credit guarantees. The program’s budget for 2020 was €29.8 billion (Terzi et al., 2023). To provide a disturbing comparison, Greece’s flagship “Competitiveness Program” in the context of its national MFF 2021-2027 provides approximately €3.9 billion to enhance the country’s export performance (with a special focus on SMEs) and implement its NSS strategy (for more information, see here).

[50] https://www.whitehouse.gov/cleanenergy/inflation-reduction-act-guidebook/

References

Aiginger, K., Rodrik, D. (2020). Rebirth of Industrial Policy and an Agenda for the Twenty-First Century. Journal of Industry, Competition and Trade. Available at: https://doi.org/10.1007/s10842–019–00322–3

Andreoni, A., Chang, H-J. (2019) The Political Economy of Industrial Policy: Structural Interdependencies, Policy Alignment, and Conflict Management. Structural Change and Economic Dynamics. Available at: https://doi.org/10.1016/j.strueco.2018.10.007

Caloghirou, Y., Tsakanikas, Α., Protogerou, Α., Panagiotopulos P., Siokas, Ε., Siokas, G, Stamopoulos D. (2021). An Integrated Systemic Strategy with a Focus on Innovation and Knowledge and a Framework for its Implementation: Why it is necessary, what it includes, how it is implemented, with whom it will be promoted. Final report of a research project funded by the Research and Analysis Organization “diaNEOsis” (in Greek).

Di Bella, L., Katsinis, A., Lagüera-González, J., Odenthal, L., Hell, M., Lozar, B (2023). Annual Report on European SMEs 2022/2023. Publications Office of the European Union. Available at: https://publications.jrc.ec.europa.eu/repository/handle/JRC134336

EC (2000). Presidency Conclusions, Lisbon European Council, 23 and 24 March 2000. Available at: https://www.europarl.europa.eu/summits/lis1_en.htm

EC (2019). The European Green Deal. European Commission, COM/2019/640 final. Available at: https://eur-lex.europa.eu/legal-content/EN/TXT/HTML/?uri=CELEX:52019DC0640

EC (2020). A New Industrial Strategy for Europe. European Commission, COM/2020/102 final. Available at: https://eur-lex.europa.eu/legal-content/EN/TXT/HTML/?uri=CELEX:52020DC0102

EC (2021). Updating the 2020 New Industrial Strategy: Building a Stronger Single Market for Europe’s Recovery. European Commission, COM/2021/350 final. Available at: https://eur-lex.europa.eu/legal-content/EN/TXT/HTML/?uri=CELEX:52021DC0350

FEIR/IOBE (2021). The Greek Energy Sector: Patterns, Opportunities and Challenges. Foundation for Economic and Industrial Research Reports. Available at: https://iobe.gr/research_dtl.asp?RID=225 (in Greek)

FEIR/IOBE (2023). The Greek Manufacturing Sector: New Challenges and Potential for Sustainable Development in an Evolving European and Global Environment. Foundation for Economic and Industrial Research Reports. Available at: https://iobe.gr/research_dtl.asp?RID=305 (in Greek)

Kastelli, I., Mamica, L. and Lee, K. (2023). New perspectives and issues in industrial policy for sustainable development: from developmental and entrepreneurial to environmental state. Review of the Evolutionary Political Economy. Available at: https://doi.org/10.1007/s43253–023–00100–2

Koundouri, P., Dellis, K., and Plataniotis, A. (2023). The Green Transformation of Europe: Challenges, opportunities, and the way forward. Greek & European Economy Observatory Policy Brief Series, Hellenic Foundation for European & Foreign Policy (ELIAMEP). Available at: https://www.eliamep.gr/wp-content/uploads/2023/12/Policy-briefs-special-edition-Leventis-1-EN-final.pdf

Mazzucato, M. (2018). Mission-oriented innovation policies: challenges and opportunities. Industrial and Corporate Change. Available at: https://doi.org/10.1093/icc/dty034

Owen, G. (2012). Industrial Policy in Europe since the Second World War: What Has Been Learnt? ECIPE Occasional Paper 1/2012, European Centre for International Political Economy. Available at: https://www.econstor.eu/handle/10419/174716

Pack, H., and Saggi K. (2006). Is There a Case for Industrial Policy? A Critical Survey. The World Bank Research Observer. https://doi.org/10.1093/wbro/lkl001

Pissarides, C. A., Meghir, C., Vayanos, D., and Vettas, N. (2020). A Growth Strategy for the Greek Economy. Available at: https://www.government.gov.gr/schedio-anaptixis-gia-tin-elliniki-ikonomia/ (in Greek)

SEV (2023). The Greek Industry Today and in the Future: Plan and Actions for an Industry Fit for our Capabilities. Hellenic Federation of Enterprises Special Reports. Available at: https://www.sev.org.gr/ekdoseis/schedio-kai-tomes-gia-ti-viomichania-ton-dynatotiton-mas/ (in Greek)

Stöllinger, R., Foster-McGregor, N., Holzner, M., et al. (2013). A “Manufacturing Imperative” in the EU—Europe’s Position in Global Manufacturing and the Role of Industrial Policy. European Competitiveness Report, Wiiw Research Report 391

Tagliapetra, S., and Veugelers, R. (eds) (2023). Sparking Europe’s new industrial revolution: A policy for net zero, growth and resilience. Bruegel Blueprint Series Volume XXXIII Available at : https://www.bruegel.org/book/sparking-europes-new-industrial-revolution-policy-net-zero-growth-and-resilience

Terzi, A., Sherwood, M., and Singh, A. (2023). European Industrial Policy for the Green and Digital Revolution. Science and Public Policy. Available at: https://doi.org/10.1093/scipol/scad018

UNIDO (2021). The Future of Industrialization in a Post-Pandemic World: Industrial Development Report 2022. Available at: https://www.unido.org/news/future-industrialization-post-pandemic-world-industrial-development-report-2022

Veugelers, R. (ed) (2013). Manufacturing Europe’s future. Bruegel Blueprint Series Volume XXI. Available at: https://www.bruegel.org/book/manufacturing-europes-future

Warwick, K. (2013). Beyond Industrial Policy: Emerging Issues and New Trends. OECD Science, Technology, and Industry Policy Papers. Available at: https://doi.org/10.1787/5k4869clw0xp-en