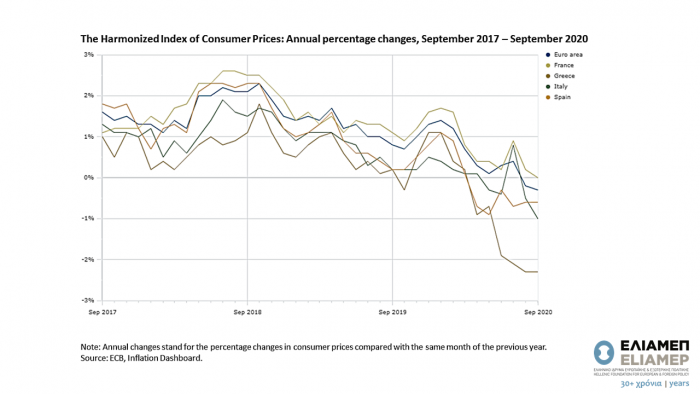

The COVID-19 pandemic has dramatically affected economic activity since early 2020. The economic turmoil could not have left the price level in Euro countries unaffected. As the chart shows, the economies of the Eurozone have not been able to stabilize at the price levels they had reached in mid-2017 and 2018. On the contrary, in the current quarter, the economies of the Eurozone have returned to a state of deflation for the first time after four years. Specifically, in September 2020, the HICP index for the Eurozone was at -0.3%, with Germany showing a decrease of 0.4%, and Greece recording a drop of 2.3%, compared to the previous year. In addition to the deflationary effect of falling oil prices and the rise of the Euro, pandemic developments are likely to have further slowed down the general price level, as constraining measures for public health purposes constitute a negative demand shock. Still, the effects of Covid-19 on the price level remain under discussion in the economic literature and the ECB appears reassuring in asserting that the disinflationary trends will be temporary. The main consequences of deflation to the economy are worth noting: First, deflation is a sign of economic weakening as expectations of falling prices reduce consumer spending and consequently, output and employment. Second, deflation burdens indebted households and businesses, as it increases the real value of their liabilities, making it difficult to service their debts.

In focus – Covid-19 and Deflation

▾