In a recent report, the Organization for Economic Co-operation and Development (OECD) highlights inheritance, gift and estate taxes as an important instrument that can increase tax revenues as well as mitigate wealth inequality.

As a primary argument in favour of increasing tax rates on inheritance gifts and estate, OECD refers to the growing wealth inequality and its persistent concentration over the recent decades. Projections of increasing asset prices, population ageing and longer life expectancy point to a greater role for inheritance taxation in the tax mix. In addition to that, the economic shock caused by the pandemic and the subsequent need for relief spending put high pressure on governments to find and exploit new sources of tax revenue.

Certain characteristics of inheritance, gift and estate taxes render them less distortionary compared to alternative forms of taxation. In particular, employment and entrepreneurship are distorted less by inheritance taxes than they are by company taxes, personal income taxes, and social contributions. Furthermore, inheritance taxes have limited effects on savings, protecting the incentives for potential heirs to work and produce. At the same time, inheritance taxes can reduce the misallocation of capital, of assets and of real estate intergenerationally. Lastly, inheritance taxes can act as an impediment to the persistent concentration of wealth within families, promoting a wider allocation of assets.

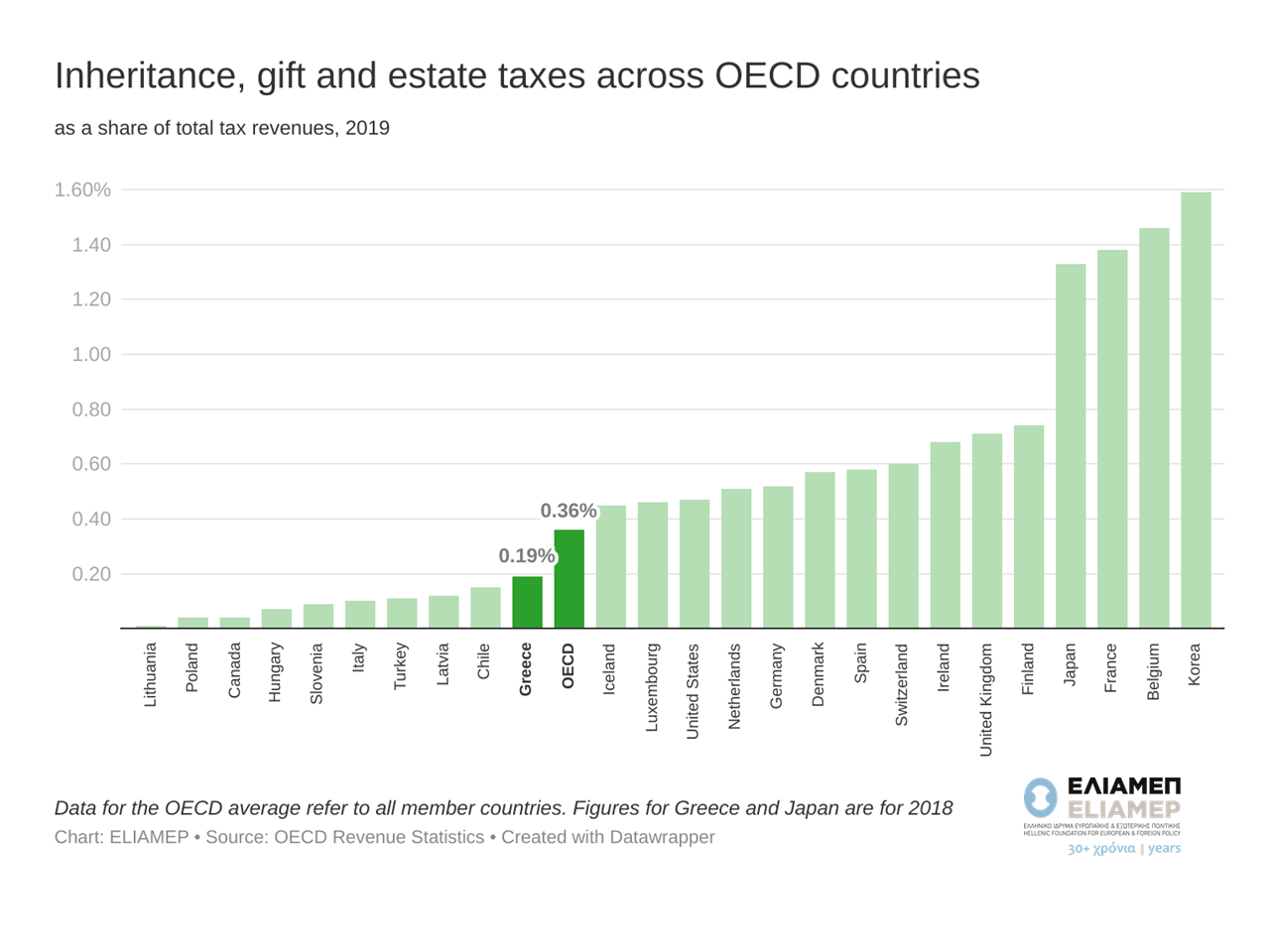

Although most OECD countries operate inheritance, gift and estate taxes, their contribution to total tax revenues is low, leaving great scope for relying more on such taxes. As shown in the figure, inheritance, gift and estate taxes account for 0.36% of all tax receipts in the OECD area on average, while in the top four countries (Japan, France, Belgium and Korea) this share rises to between 1.33% to 1.59%. Greece is below average, collecting no more than 0.19% of all tax revenues from inheritance, gift and estate taxes (in 2018). These figures have induced OECD and other international organisations (such as the IMF) to call for greater reliance on inheritance, gift and estate taxes, shifting the tax burden away from labour and business taxation towards wealth and inheritance taxes.

Clearly, inheritance, gift and estate taxes are not a panacea. Designing the tax schedule should take into consideration the joint distribution of income and wealth. In Greece, where home ownership is widespread (75.4% according to the latest data), inherited wealth contributes significantly to the net wealth of asset-poor households (25% of all net wealth in the first quintile of the wealth distribution is inherited, according to the OECD report cited above). Balancing the objectives of preventing excessive concentration of wealth and of minimising perverse incentives requires judicious tax policy design.