During the pandemic, many governments took initiatives to support business activity. The temporary suspension of operations, the sharp decline in revenues, fixed costs and the constant uncertainty about the evolution of the pandemic created significant operational problems and led to a lack of liquidity. In response, governments around the world have focused on providing loans with state guarantees, direct financing of sectors that are significantly affected, temporary freezing of debts, covering part of labor costs and insurance contributions, etc.

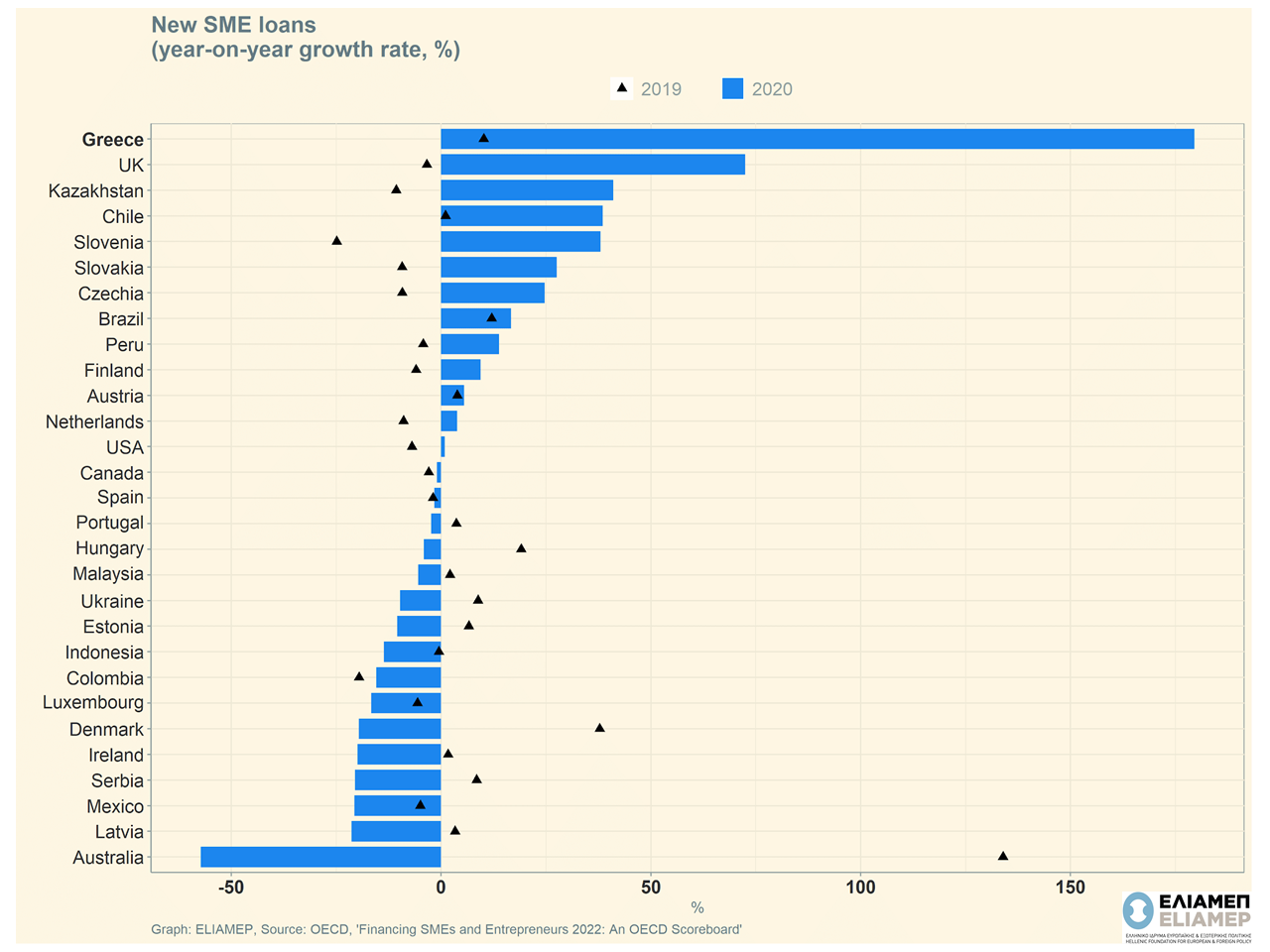

These fiscal support measures as well as the monetary policy of low interest rates have substantially affected the financing of small and medium-sized enterprises through bank lending, however, the trend observed worldwide is not homogeneous. In a recent report, the OECD notes that in some cases (e.g. Greece, United Kingdom, Slovenia, Slovakia) there has been an increase in new bank loans aimed towards small and medium-sized enterprises. In contrast, in countries such as Australia, Latvia, Ireland and Denmark, small and medium-sized enterprises either benefited from different non-banking support measures or kept a wait-and-see position, resulting in a decrease in bank lending rates in 2020.

Greece in 2020 exhibited the largest increase in new lending to small and medium-sized enterprises by the banking sector, among the OECD countries. Compared to 2019, new loans to small and medium-sized enterprises increased by almost 180%. This extremely large growth rate is partly due to the very low starting point: bank lending to small and medium-sized enterprises in Greece from 2008 to 2019 was in constant decline. Indicatively, the 3.5 billion euros of new lending to small and medium enterprises in 2020 (from 1.25 billion euros in 2019) pale in front of the 12.5 billion euros in 2008.

Small and medium-sized enterprises in Greece still face major problems in accessing bank financing. The pandemic period put an end to a long period of declining debt, but did not reach the level fifteen years ago. This observation is confirmed by data from a recent ECB survey in which 18% of Greek small and medium-sized enterprises cite financing as the most important problem they face (the European average is only 9%), while 22% report difficulties in accessing bank lending in particular.

But there are also signs of improvement. Non-performing loans to small and medium-sized enterprises have decreased (from 36.1% of total lending in 2019 to 28.5% in 2020). At the same time, the rate of rejection of loan applications from small and medium-sized enterprises has also decreased (from 20.7% in 2018 to 18.4% in 2020).

The circumstances are not in favour. The global economic environment is affected by rising prices due to the war in Ukraine, causing rising operating costs for businesses. Monetary policy is expected to become tighter, rendering bank lending even more difficult. Greece is therefore called upon to strengthen the backbone of its business activity, small and medium enterprises, starting from a very low base, and under adverse conditions.