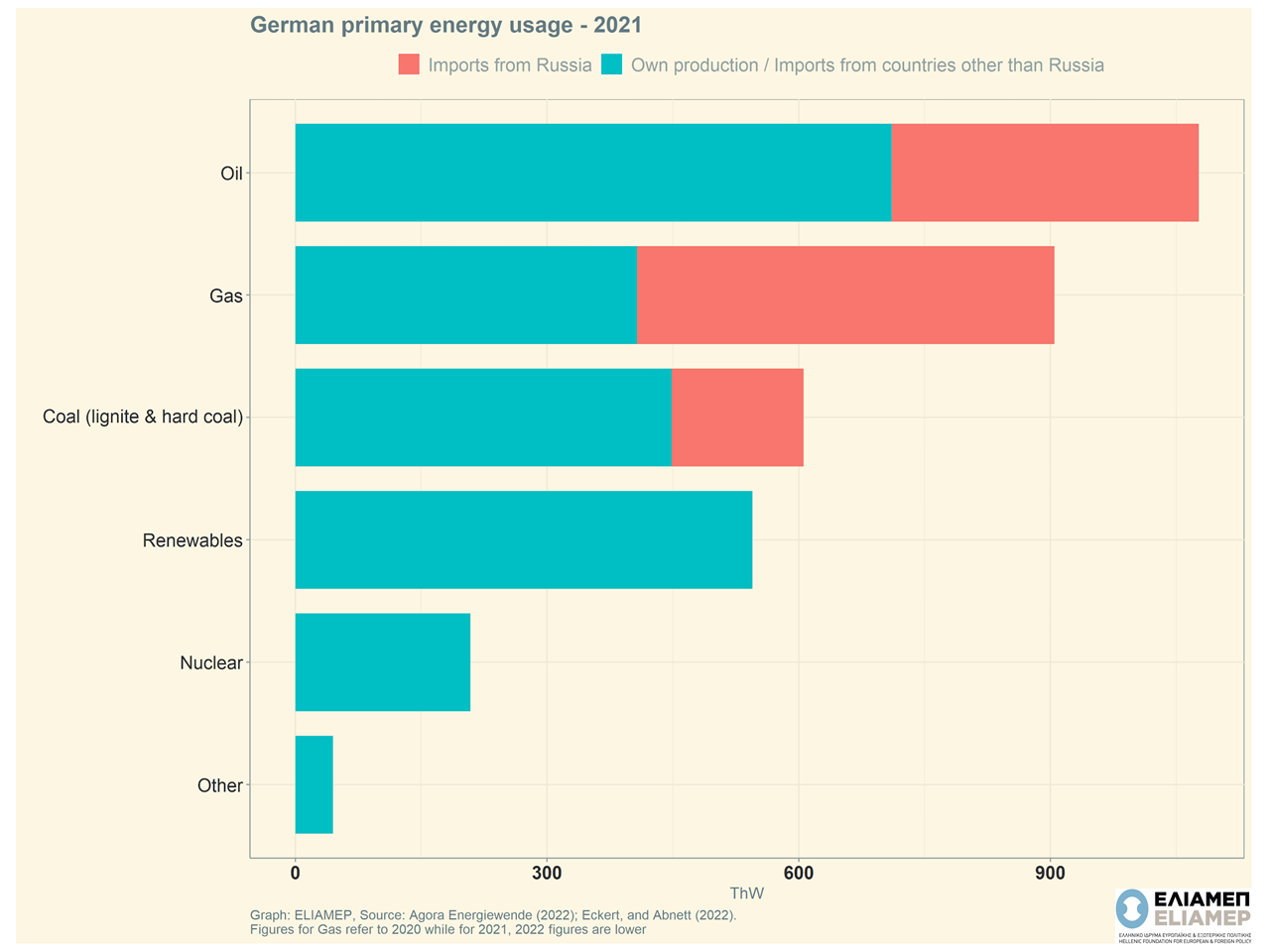

Germany is among the most energy-dependent countries on Russian energy exports across Europe. According to the graph, Germany imports 34% of its oil, 55% of its natural gas and 26% of its coal from Russia. In total, 30% of Germany’s energy needs are met through imports from Russia.

Germany’s dependence on Russian energy exports is crucial for Europe in both the short term and the long term. In the short term, this dependence could create rifts on the Western Front regarding the West’s coordinated response to the Russian invasion of Ukraine and the subsequent imposition of sanctions. It is noteworthy that while the United States announced an embargo on Russian oil, Chancellor Olaf Soltz explicitly states that an immediate stop of Russian imports is very difficult in the case of Germany at the moment. In the long run, Germany’s degree of dependence on Russian imports will be critical for the broader European energy policy as well as for the successful transition to renewable energy sources.

A recent study by a group of economists and energy experts examines the economic impact of a possible cessation of energy imports from Russia on the German economy. The main conclusion is that in such a case the cost for Germany will be significant but manageable, with the analysis predicting a fall in GDP of 0.5% – 3% under different scenarios. It is indicative that during the pandemic the German economy was hit by 4.5% of GDP. Substituting Russian oil and coal imports is not the main problem, as there are alternative export countries but also capacity to fill the gap. The main challenge is the replacement of natural gas, for which the available alternatives are limited as we showed in a previous note. According to the study, the projected increases in the price of gas will mainly affect low-income households and the industry, but targeted aid packages without distorting incentives to curb energy consumption can correct this economic burden. Therefore, turning Germany away from Russian energy imports will hurt its economy, but with the right policies the country will manage.

Undoubtedly, Europe’s energy diversification away from Russian energy will come at a cost. The forecast for Germany is indicative of what is expected at the European level, although it constitutes an upper bound as Germany is one of the most dependent countries in Europe and currently does not have liquefied natural gas terminal stations. Countries that have developed alternative energy sources such as renewables, liquefied natural gas terminals, nuclear power plants and operational lignite power plants have viable alternatives to replacing Russian gas in the short term. However, in the long run, turning to green energy and shifting imports away from Russia will come at a significant cost.

The current crisis increased further an already surging energy cost but at the same time highlighted the need for a more coordinated, bolder EU shift to energy autonomy, with significant strategic and environmental benefits. Decision-making is already expected at European level to speed up adoption of renewable energy sources, as well as to reduce gas emissions long before 2030, which was the original goal.