According to ECB data, the euro area bank interest rate on loans for house purchase has moved steadily downwards from 3.9% in August 2011 to 1.3% in August 2021. The low interest rates have enabled more borrowers to take larger loans but also contributed to house price growth. Nowadays, key interest rates increased, in an attempt to fight inflation and get price growth under control. When interest rates are on the rise financing costs of mortgages also increase.

However, loans tied to variable rates allow changes in official interest rates to be transmitted directly to households’ loan obligations. Households face higher interest payments and therefore a decrease in their disposable income. In contrast, contracts tied to fixed rates over a certain period of time serve as insurance against potential future increases in official interest rates. The protection provided by the fixed interest rates is not complete: even fixed rate borrowers will face soaring mortgage costs soon. In addition, the increase in interest rates leads banks to readjust the fixed interest rates of the loans that will be issued from now on.

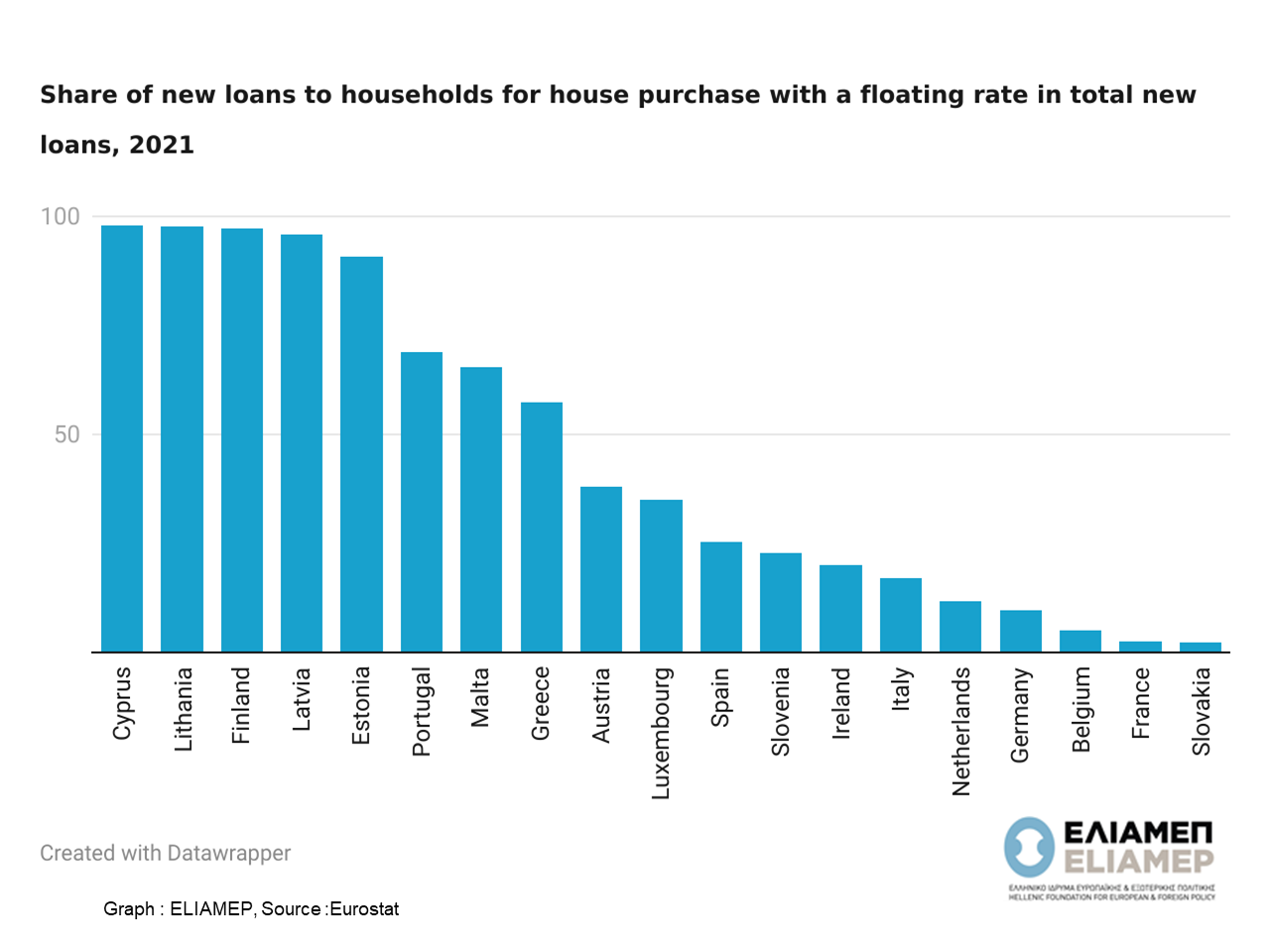

The share of housing loans tied to variable rates in total loans granted is a meaningful indicator of how changes in interest rate levels may affect households budgets. In the euro area in 2021, the share of housing loans with variable rates was over 95% in Cyprus, Latvia, Lithuania, and Finland. By contrast, in France and Slovakia, contracts with variable interest rates were less than 3% of new mortgages. In Greece, in 2021 the share of new mortgages with a floating interest rate was 57%.

In other words, the effects of the ECB’s monetary policy will not be the same for all Eurozone countries. The effects of rising interest rates will also vary within each country. Some households with variable rate loans will suffer more than others. In order to reduce the impact of future fluctuations in the interest rates, and to keep the monthly installment of the loan constant, the repayment of the housing loans is designed so that in the beginning mortgages repayments are made up from more interest than capital. Over time the debt shrinks and the interest accruing on it falls. As a result, recent borrowers (who tend to be younger) are especially vulnerable to interest rate increases compared to established (and older) borrowers.

Rising prices and energy costs will make the financial situation for households even more difficult. All this means that with the rise in interest rates, households will struggle to make higher mortgage repayments and more households will be unable to service their mortgage debt. That brings back one of the most characteristic phenomena of the financial crisis of the previous decade. The design of public policies that provides a safety net to households that are under pressure, but do not offer opportunities to “strategic defaulters”, will be the challenge of the years to come.