Both the size of private debt and its management are critical factors for the recovery of the European economy from the Covid-19 pandemic crisis. Private debt in an economy consists mainly of corporate and household debt.

As we pointed out in our previous post, the level of corporate debt is crucial both for economic recovery and financial stability, as it will partly determine the resilience of businesses after the end of the pandemic and will also affect the volume of Non-Performing Loans. What has been the state of household debt over the pandemic, and what impact could its size have on the recovery effort?

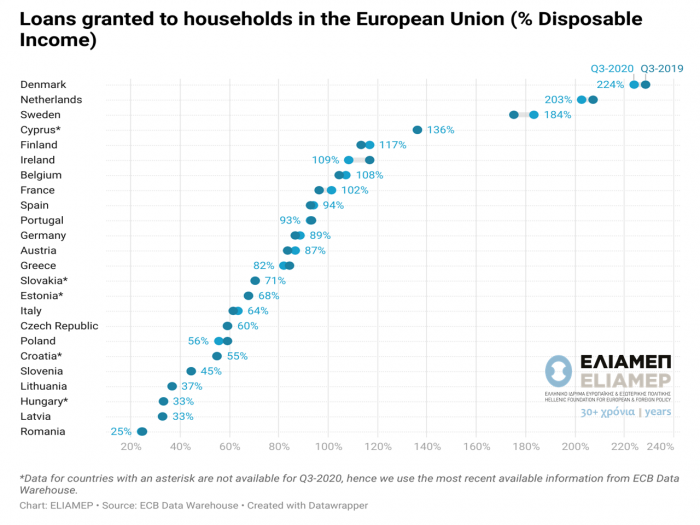

In order to assess the burden of household debt, we obtained data on household loans from the ECB Data Warehouse. The data is shown in the graph above where countries are ranked according to the percentage of debt on disposable household income in the third quarter of 2020. Also, for all countries with available data, household debt for the respective quarter in 2019 is presented, in order to highlight the change during the pandemic period. In countries where there is no data for the third quarter of 2020, we quote the latest available data.

From the data, we observe that the volume of household debt during the pandemic increases very little in most countries or remains at the same level. In particular, the average change in household debt in EU countries is 0.26%.

Exceptions to this pattern are France, Sweden, and Austria, where household debt increases between 4% and 5%. In contrast, in Ireland and Poland, household debt fell sharply by 7%. Household debt volume stability in the current conditions is not surprising, as it reflects the general stagnation in household economic activity. At the same time, household spending has fallen to historic lows while savings have risen. While these developments lead to a reduction in uninsured debt, the majority of household debt relates to fixed-rate mortgages, which do not respond significantly to changes in consumption and savings.

The issue of household debt is significant for financial stability, as it is related to the issue of Non-Performing Loans, but also has macroeconomic implications. The literature shows that indebted households are forced to make excessive savings in order to repay their debts, which slows down consumption and therefore growth. Thus, the development of private debt will be crucial for the dynamic recovery from the crisis caused by the pandemic.