Life expectancy in Europe has increased significantly. This is of course a huge achievement, but combined with low birth rates it threatens the financial sustainability of pension systems. With the ratio between pensioners and the working population reaching critical levels, only the adjustment of the retirement age can prevent excessive increases in pension spending that will undermine the well-being of future generations.

This is also the main reason why the extension of working life has emerged as an issue of major importance. The example of France is typical, where despite the mass mobilizations and strikes of the unions, and the reactions of the opposition parties, France’s Constitutional Council approved the key elements of the pension reform, with the main objective being the gradual increase of the retirement age.

An excessive pension deficit is something that no country can afford in the long term. The problem is exacerbated in countries with high public debt and high pension spending. Although pension reforms entail political costs, in most countries the retirement age has increased recently, or is set to increase in the future. In some European countries, the retirement age is now linked to life expectancy.

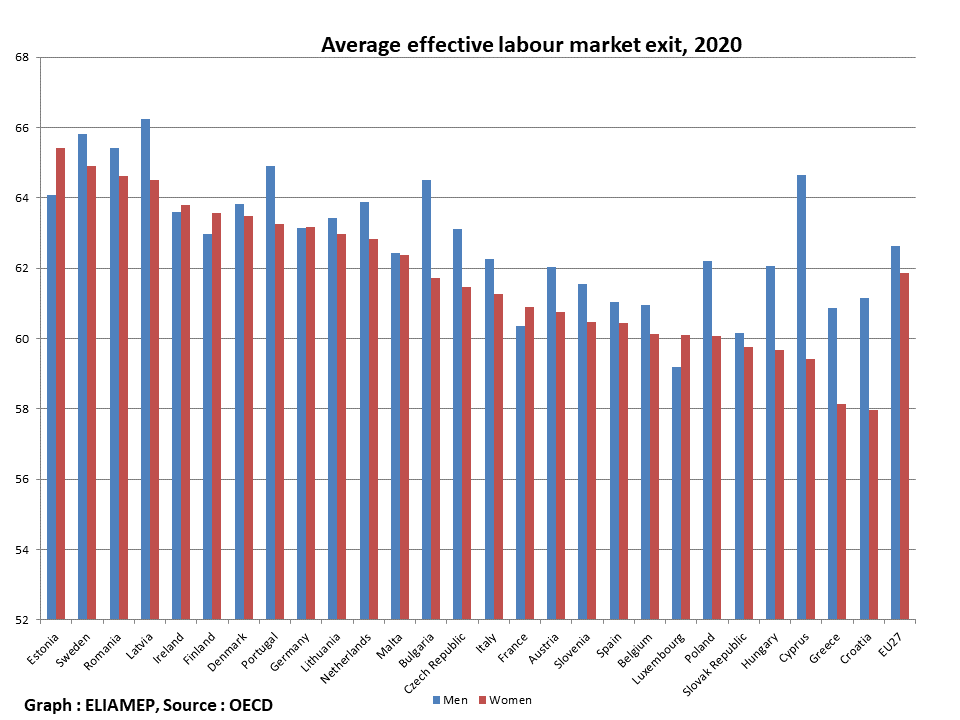

According to the OECD’s annual pensions report, in 2020 the ‘normal retirement age’ (the age of eligibility to all mandatory components of the pension system assuming labour market entry at age 22 and an uninterrupted career) in the EU was 64.3 years on average for men and 63.5 years for women. But the effective age of retirement (average age of exit from the labour force for workers aged 40 and over) was significantly lower: 62.6 years for men and 61.9 years for women on average in the EU. In some countries, the effective retirement age differs significantly from the “normal” (e.g. for men in France: 60.4 and 64.5 years respectively).

In 20 EU Member States for men, and in 23 for women, the average effective age of labour market exit in 2020 was below 64 years. In 6 Member States for men and 12 for women, the effective age of labour market exit was below 61.

Disparities between Member States were significant. The lowest effective age of retirement for men is recorded in Luxembourg (59.2 years in 2020), France (60.2 years), and Slovakia (60.2 years), while for women in Croatia (58 years), in Greece (58.1 years) and Cyprus (59.4 years). By contrast, in Sweden the average effective retirement age was 65.8 years for men and 64.9 for women, the second highest in the EU (after Latvia and Estonia respectively).

Greece, with one of the lowest effective age of labour market exit in the EU (60.9 years for men and 58.1 years for women, against the general age limit of retirement of 67 years for almost a decade), is a typical example of deviation from the general rule and the myriad of exceptions for special categories.

Governments across Europe are looking for ways to provide pensions that meet the needs of retirees without exacerbating intergenerational inequalities. Public opinion is often suspicious of attempts to restore the sustainability of the pension system, viewing with antipathy both an increase in the retirement age and a reduction in future pensions. But, in conditions of demographic aging and low growth rates, there is no other way to avoid over-indebtedness and excessive burden on future generations.