The course of real estate prices tends to keep pace with that of the broader macroeconomic indicators. In fact, often, as in the global financial crisis of 2007-08, developments in the real estate markets significantly affect the trajectory of economic growth. Does this also apply in the context of the Covid-19 crisis?

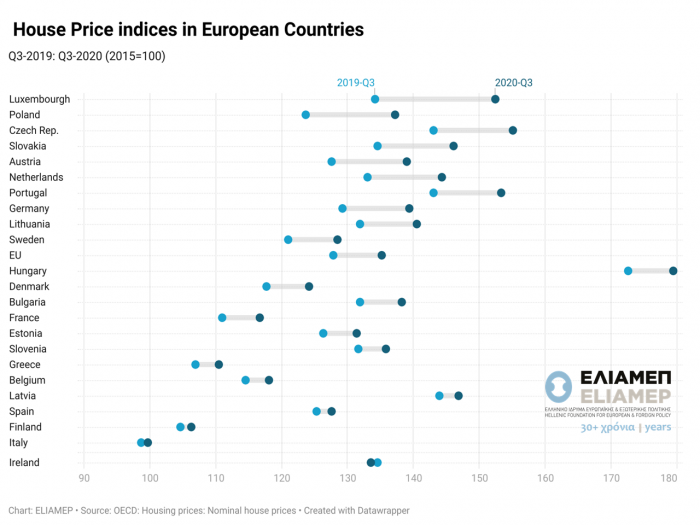

In order to address this question we have collected data on property prices in the European Union. The data comes from the OECD and covers the period beginning in the third quarter of 2019 and ending in the third quarter of 2020. At the beginning of the period, European economies had not yet felt the impending crisis, while at the end of the period economies were experiencing the second pandemic wave, showed limited economic activity, a slowdown in growth rates, and had imposed a number of restrictive measures, which as we have shown in previous posts, exercise significant pressure on the economy.

How are these developments reflected in the real estate markets? At first glance, the pandemic does not seem to affect property prices. During the period under review, the sample of 24 European countries shows an average increase in property prices of 5.6%. The most significant increases are observed in Luxembourg (13.6%), Poland (10.9%), Austria (8.9%) and the Czech Republic (8.3%). In contrast, countries such as Italy (1%) and Spain (1.7%) show anemic increases. The only country that

recorded a decrease during the same period is Ireland (-0.7%), while Greece recorded an increase (3.3%), which is, though, lower than the average increase.

Of course, to some degree, the differences in the rates of change in property prices reflect the differences in growth patterns over the same period and in the restrictive measures adopted. However, these factors do not fully explain the resilience of real estate prices during the pandemic. It remains to be seen whether these trends will continue at the same pace, foreshadowing a price explosion in European real estate markets following the pandemic, or will follow other fundamental variables with some lag.