China’s importance as an importer of goods produced in the EU is increasing. Between 2008 and 2021, EU exports to China more than tripled in value, while as a percentage of (EU) GDP they increased by 2.4 times.

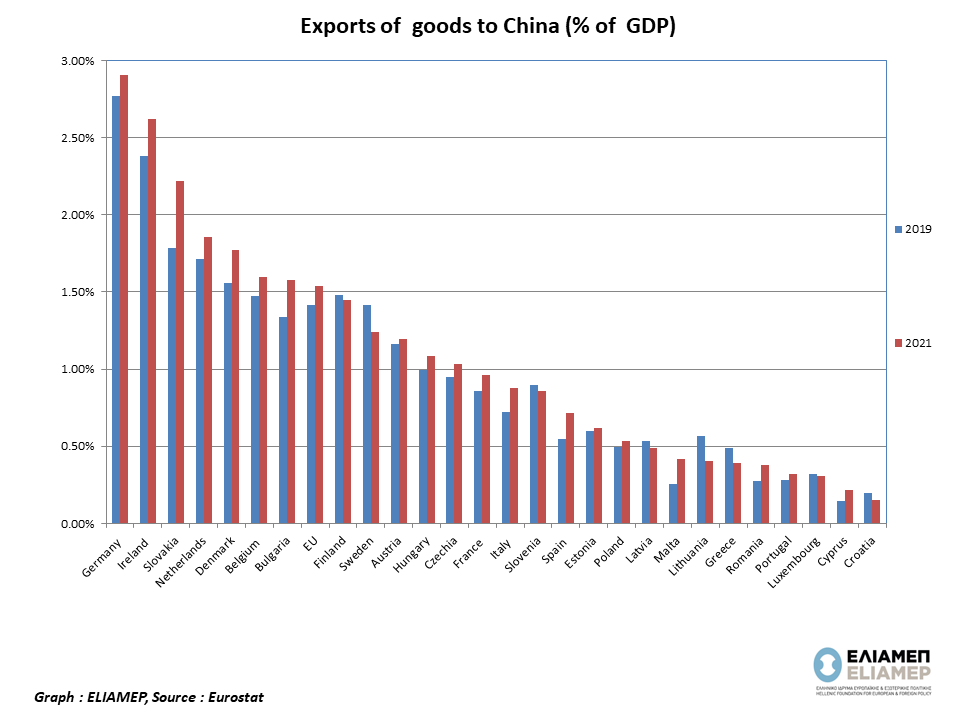

In 2021, China was the third largest partner (after the US and the UK) for EU exports of goods (10.2 %) The COVID-19 crisis caused both exports and imports between the EU and China to fall in 2020. Exports reached a minimum in March 2020. By December 2021 they had recovered. Comparing 2021 with 2019, despite the pandemic, the Russia-Ukraine war, as well as the US-China trade war, EU exports to China were up, both in value (from 198.5 to 223.6 billion Euros) and as a share of EU GDP (from 1.42% to 1.54%).In 2021, EU exports of manufactured goods (86 %) had a higher share than primary goods (12 %). The most exported manufactured goods were machinery & vehicles (52 %), followed by other manufactured goods (20 %) and chemicals (15 %).

The three largest exporters to China in the EU were Germany (€ 104 7 billion), France (€ 24 billion) and the Netherlands (€ 15,9 billion). In Germany, the value of exports to China corresponds to 2.9% of GDP (it was 1.3% in 2008). Ireland (2.6% of GDP) and Slovakia (2.2%) also have significant dependence on Chinese imports of European products.

Compared to 2019, the value of exports to China in 2021 has increased for all but four Member States: Greece, Sweden, Lithuania and Croatia. As a percentage of GDP, the decline was larger in Sweden (-0.18 percentage points) and Lithuania (-0.16 percentage points), due to the well-known dispute and economic sanctions imposed by China after Lithuania’s decision to allow Taiwan to open a de facto embassy in Vilnius.

In Greece the decline of 177 million Euros was the largest in the EU, and it happened while total exports from the EU to China were increasing (by 25.1 billion Euros). The share of Greek exports of products to China decreased from 0.49% of GDP in 2019 to 0.39% in 2021 and Greece now ranks 22nd among 27 members (in terms of exports of goods to china as % GDP).

It is worth noting that despite the recent recession, in previous years Greek exports of goods to China had increased significantly. Specifically, from 135 million Euros in 2008 (0.06% of GDP) they went to 892 million Euros in 2019 (0.49% of GDP). According to OEC data, the main products that Greece exported to China in 2019 were Refined Petroleum ($450 million), Precious Metal Ore ($52 million), Marble, Travertine and Alabaster ($28 million). However, China is not among the largest partners for Greek exports of goods. According to ELSTAT, the main destination countries for Greek products for 2021 are Italy, Germany, Cyprus, Turkey, Bulgaria, and France.

Although recent international developments do not appear to have adversely affected bilateral trade relations between most EU Member States and China, difficulties remain. A slowdown in the growth rates of the Chinese economy could reduce imports from the EU, and lead to increased protectionism in strategic sectors. At the same time, issues linked with human rights and the green transition, will increasingly impact EU-China economic relations.

Despite the fact that Greek exports to China have risen steadily in the last few years, their value remains relatively low. Moreover, the recent decline in Greek exports of products to China (while exports to China from the EU as a whole are increasing), raise questions for Greek businesses. Apart from coincidental factors, the appetite for products “Made in Greece” remains limited in China.