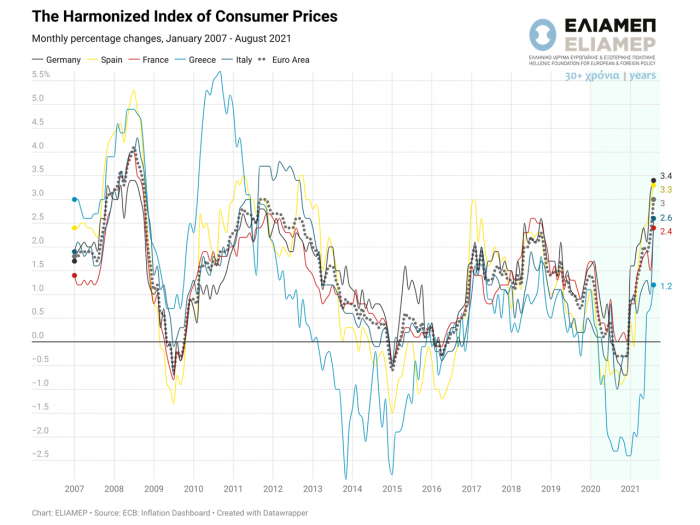

The COVID-19 pandemic has dramatically affected economic activity since the beginning of 2020. The turbulence could not have left the price level in the euro countries unaffected. As the graph shows, in 2020 the economies of the euro area fell into deflation for the first time in four years. However, with the gradual lifting of restrictive measures and extensive monetary support from the ECB, the rate of inflation has now increased substantially, surpassing the Bank’s revised target, at 2% (in the medium term).

In particular, according to the latest available data from the ECB’s Inflation dashboard, inflation in the eurozone member states hovers at 3%, the highest level in a decade. Looking at the largest economies in the eurozone, in August, Germany recorded an inflation rate of 3.4%, followed by Spain (3.3%), Italy (2.6%), and France (2.4%). Inflation in Greece remains low at 1.2%. In addition to the expanded support for economies through its quantitative easing packages and the inflationary pressures these carry, high inflation is undoubtedly also due to the opening up of economies and the increase in consumption, as well as to the difficulties of adjusting internal and external supply to increased demand. Although some of these factors are considered to be transient and a de-escalation of inflation is expected in the medium term, the debate on the gradual lifting of the ECB’s support measures has already begun.