Russia and the EU have been entangled in the harsh effects of asymmetrical interdependence and the security threats it generates. Russia’s economy is linked directly to the form and volume of trade directed from the EU towards the Russian economy, while the EU economy is linked to the flow of Russian gas and oil directed towards European businesses and households. Growing concerns on EU’s dependency on energy imports led the European Commission to release its Energy Security Strategy (2014), aiming to secure stability and abundancy of energy supply while simultaneously examining the effects of discrepancies from Russian gas imports to the European energy systems. In contrast, Russia’s primary concern is to secure the necessary energy revenues that could enable Moscow to project and exercise its hard power to areas with strategic interest by striving to gain greater leverage within the European energy markets. Russia’s security objectives in relation to its energy export capacity are expressed primarily through materialisation of two major natural gas pipeline systems, namely the Nord Stream 2 and the TurkStream pipelines.

This paper by Michalis Mathioulakis, Research Associate of ELIAMEP; Energy Strategy Analyst and Academic Director of the Greek Energy Forum, examines the strive between the two international actors in redetermining their future relations and the role of Russian gas pipelines and the EU’s regulatory framework in shaping the two actors’ common future.

You may access the paper here.

Introduction

At the beginning of the 21st century, Russia finds itself in an asymmetrical interdependence with the EU. The two actors re connected by strong trading relations as well as investment capital flows that move to-and-from both the parties involved. Although their position in the international system does not seem to bring them in a direct path of collision, the two trade partners seem to be prone to the harsh effects of asymmetrical interdependence and the security threats that it implies. Interdependence is not established solely by the high volume of transactions between two parties but requires the existence of significant costly effects linked to the limitations that derive from these transactions.[1] The actors involved are obligated to accept constraints in their ability to act freely in the international system in order to maintain the benefits that also derive from these extensive interactions. Russia’s economy and its growth potential are linked directly to the decisions EU officials make on the form and volume of trade they will direct towards the Russian economy.[2] By the same token, EU growth is inevitably linked to the Kremlin’s decisions over the flow of gas and oil it will direct towards European businesses and households.

The need for enhanced energy security in the EU

For the European Union, the significance of its energy security spawns from the broad spectrum of influence energy holds in all aspects of economic activity. Far from just transportation and heating, energy determines the ways human societies are structured, the intensity of production, urbanisation, communications, global trade, quality of the environment and relations between countries. Energy security is primarily linked to concerns regarding the dependable acquisition of energy supply, the regional concentration of energy resources, and the effects of their strategic management. The context of energy security has been broadening throughout the years alongside the reasons that carry the capacity to generate disruptions in the energy supply chain. Political unrest like the Russia-Ukraine natural gas disputes in 2006-2009, instability in the Middle East affecting the global oil supply, natural disasters like the earthquake and tsunami in Japan in 2011, and power system failures like the 2003 blackout in the northeast US, raise overall concerns over the vulnerability of economic systems, human activity and wellbeing due to energy-related disruptions. This led to an expansion of the energy security context to include the resilience of energy infrastructure, the structure and interconnectivity of energy networks and the composition of the energy mix; the ways energy sources are combined to support economic and social activity.

“Energy security is primarily linked to concerns regarding the dependable acquisition of energy supply, the regional concentration of energy resources, and the effects of their strategic management.”

The importance of a coherent energy security strategy for the EU derives from the Union’s growing dependency on energy imports. Despite regressing rates of energy demand, the steep decline in primary energy production in the EU led to an increase of its ‘energy dependency rate’, the percentage of net energy imports to gross available energy, to more than 55% in 2017.[3] Production of primary energy in the EU declined by 12,1 % in the last decade totalling 758 million tonnes of oil equivalent (Mtoe) primarily due to depleted production of natural gas fields and the rendering of coal fields as uneconomical for further exploitation. Primary energy produced within the European borders diversifies through a variety of energy sources, with renewable energy leading with a 29,9 % share, nuclear energy 27,8 %, coal 16,4 %, natural gas 13,6 % and crude oil with a 8,8 % share of the EU total production.[4] Furthermore, the EU’s robust resolve to battle the effects of global warming inevitably raises concerns over its energy security regarding the rate that higher renewable energy production can replace lower nuclear and coal production.

“Production of primary energy in the EU declined by 12,1 % in the last decade totalling 758 million tonnes of oil equivalent (Mtoe)”

Together with concerns over the stability of the European power-production system during this transitional period, the trend towards depleted nuclear (and coal) production raises the need for natural gas imports. This, in turn, raises the EU’s dependence and vulnerability from third countries, primarily from Russia. According to the latest published official data from Eurostat, Russia accounts for 38,9 % of the EU’s imports of coal, 33,7 % of its crude oil imports and 38,7% of total EU imports of natural gas.[5] Severe dependency from Russian energy sources leads to excess vulnerability of EU’s energy systems while simultaneously exposing the Member States to political pressure from the Kremlin. The 2006-09 Russia-Ukraine conflict and the disruption of gas flow towards the EU has been the catalyst to showcase such vulnerabilities.

Concerns over energy disruptions

Volatility over gas prices and uncertainty over gas supply has been manifested also during the 2014 annexation of Crimea as well as the 2019 legal disputes between Russian Gazprom and Ukrainian Naftogaz that ended with the signing of a new accord between the two companies only a few days before the expiration of the previous one on December 31, 2019, thus keeping the flow of natural gas to Europe intact.[6] Growing concerns on EU’s dependency on energy imports led the European Commission to release already in early 2014 its Energy Security Strategy, aiming to secure stability and abundancy of energy supply while simultaneously examining the effects of discrepancies from Russian gas imports to the European energy system.[7] The objectives and stress-test results included in the Commission’s Energy Security Strategy led to the formulation of a coherent framework strategy in 2015 for a resilient Energy Union with a forward-looking climate change policy.[8]

“Growing concerns on EU’s dependency on energy imports led the European Commission to release already in early 2014 its Energy Security Strategy.”

Overall, in the field of energy, the EU faces a number of issues that can be summed up primarily in three areas of interest, namely energy security, climate change and market integration. The first set of issues (energy security) refers to increasing dependency on energy imports, limited diversification of energy sources, competition by growing global energy demand, and security risks affecting producing and transit countries. The second set of issues refers to the growing and diverse threats of climate change, the slow progress in energy efficiency and the challenges of integrating an increasing share of renewables in the European energy mix. The third set of issues refers to the integration and interconnection of energy markets in order to tackle high and volatile energy prices, increase transparency and competition and empower the final consumers.

“The EU has implemented an ambitious plan in order to improve all aspects of its energy policy from reducing its emissions of greenhouse gases to the reduction of its dependency on imported energy.”

The EU has implemented an ambitious plan in order to improve all aspects of its energy policy from reducing its emissions of greenhouse gases to the reduction of its dependency on imported energy. EU Energy Security Policy includes several elements that align with its Common Foreign and Security Policy. On the critical issue of relations with Russia, policies to reduce dependence to Russian natural gas offer a tool to also reduce Russia’s efficiency in financing its defence budget and therefore its ability to act outside the realm of international law on a regional level.

Russia’s security and energy objectives in Europe

Russia perceives NATO’s expansion in Europe as a primary security threat. Furthermore, it faces security issues on the south of its Central Asian borders together with the implications that they bring to its Middle East policy. In effect, its primary concern is to secure the necessary energy revenues that could enable Moscow to project and exercise, if necessary, its hard power to those areas, thus rendering Russia eager to demonstrate a more assertive posture by striving to gain greater leverage within the European energy markets.[9] Developments in the Eastern Mediterranean raise both opportunities and challenges for Moscow. Kremlin’s overall energy efforts have been focusing on maintaining its energy sales revenues from the European markets while avoiding Ukraine. Furthermore, the Eastern Mediterranean offers Moscow the opportunity to attempt to control and influence future flows of natural gas from Iran through Syria or Turkey, towards the European markets. Recent discoveries of natural gas resources in Egypt, Israel, and Cyprus, pose a potential threat for the Kremlin.

“Kremlin’s overall energy efforts have been focusing on maintaining its energy sales revenues from the European markets while avoiding Ukraine.”

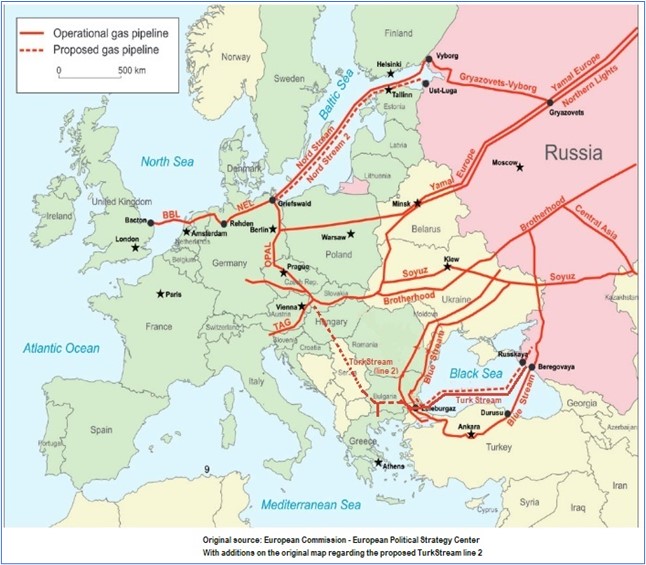

Russia’s security objectives in relation to its energy export capacity are expressed primarily through the materialisation of two major natural gas pipeline systems, namely the Nord Stream 2 and the TurkStream pipelines. The Nord Stream 2 is designed to carry 55 bcm/y of natural gas from the Russian port of Ust-Luga in the Leningrad region, across the Baltic Sea to Germany in the Greifswald area close to the exit point of Nord Stream 1. There, it connects with the existing OPAL pipeline running across the eastern part of Germany to the Czech Republic. The TurkStream pipeline starts from Russkaya compressor station near Anapa in Russia’s Krasnodar region, crossing the Black Sea to the receiving terminal at Kıyıköy in Turkey. It consists of two lines with a capacity of 15 bcm/y each. The first line is already in operation, delivering 15 bcm/y of gas to Turkey for its internal needs. The second line is designed to run from Turkey to Bulgaria, across Serbia to Hungary and Slovakia.

“Russia’s security objectives in relation to its energy export capacity are expressed primarily through the materialisation of two major natural gas pipeline systems.”

Operating and proposed Russian gas pipelines in Europe

Source: European Political Strategy Center (with additions on the original map regarding the proposed TurkStream line 2)

Observing the above map with the combined routes of Nord Stream 2 and the TurkStream,[10] reveals that the countries they enclose are identical to the limits of the former Eastern Bloc that was under Russian influence before the fall of USSR. Overall, Russian security objectives include creating a buffer zone against the pressure Kremlin feels it faces from NATO in Europe. The perceived need to recreate a buffer zone at Russia’s borders against the West has pervaded Russia’s leadership since the early 1990s.[11] It needs to be mentioned that Vladimir Putin characterized the fragmentation of the Soviet Union, “the greatest geopolitical catastrophe of the 20th century”.[12]

The above analysis leads to the realization that regarding the regional subsystems of SE Europe and the Eastern Mediterranean, Russia’s energy interests relate primarily to the development of the TurkStream pipeline. Consequently, Kremlin’s efforts on the issue focus on the construction of the aforementioned second line passing through Bulgaria and Serbia to the rest of Europe. Besides securing its influence over the European markets, the pipeline enhances Russia’s position in Bulgaria and Serbia. The pipeline’s 15 bcm/y capacity offers an abundance of cheap Russian gas flowing through the Balkans, thus rendering any competitive (Greek-EU-US) gas project in the area economically non-viable. It needs to be noted that the combined natural gas demand in Bulgaria, Serbia, North Macedonia, Albania, Bosnia and Herzegovina, and Montenegro is less than 6 bcm/y.[13]

Challenges raised by Russia’s energy objectives

Traditionally, sales of Russian natural gas include the commitment through long-term bilateral contracts between Gazprom (the main Russian state-owned gas producer company) and the interested local providers in each country. These contracts usually include periods of 25 to 30 years as well as various clauses on the minimum purchase volumes (“take or pay” clause) or the limited ability of the buyer to resell the purchased gas (destination clause).[14] Sales through the TurkStream pipeline have the ability to easily meet gas demand in the Balkans and cover the capacity of their internal gas networks. Such a development leaves no capacity available for a possible influx of gas originating from other sources. Thus, through the development of the TurkStream pipeline, energy installations in Greece such as the TAP pipeline, the IGB interconnector, the Alexandroupolis FSRU, the Revithousa LNG Terminal and the EastMed pipeline, are facing limited capacity availability towards the Balkan route.

“With the TurkStream, the Kremlin essentially blocks the access for the US, or Eastern Mediterranean natural gas to the Balkans and to the route leading up to Ukraine.”

With the TurkStream, the Kremlin essentially blocks the access for the US, or Eastern Mediterranean natural gas to the Balkans and to the route leading up to Ukraine. The challenge the TurkStream pipeline faces is that passing through Bulgaria, an EU Member State, it needs to comply with the European energy regulation framework. This requires changes in the access offered to third parties that want to sell gas through the pipeline, namely the “Third Party Access” principal included in the EU’s Third Energy Package, as well as adaptations to the gas contracts with domestic providers where the EU regulatory framework includes Over-the-Counter (OTC) bilateral contracts primarily negotiated in an Energy Exchange platform.[15]

From the above analysis it is demonstrated that overall, Russian energy interests have a three-dimensional objective: to maintain the sales of Russian gas to Western Europe through alternative-to-Ukraine routes; to assert and strengthen Russian influence in the Balkans; and to avert and disrupt competitive energy systems. All three dimensions are in a direct collision to EU -and US- strategic interests in the area regarding European energy security and the liberalization of the European energy sector.

Tools of the EU energy regulatory framework with an ‘external’ dimension

The EU Energy Union strategy consists of measures and tools designed to deliver secure, sustainable, competitive, and affordable energy to EU consumers, households, and businesses. However, the Energy Union framework includes regulatory instruments that, while initially built to address internal issues within the EU borders, possess elements of ‘externality’ with a direct effect on EU energy relations with third parties. This includes two principal regulatory instruments, the provision for ‘Third Party Access’ to energy networks and for ‘Ownership Unbundling’ of energy infrastructure. These elements are being utilised to deliver the Energy Union’s goals for energy security within the EU and serve a double goal; to enhance EU resilience and autonomy while advancing its efforts to protect the environment.

“…the Energy Union framework includes regulatory instruments that, while initially built to address internal issues within the EU borders, possess elements of ‘externality’ with a direct effect on EU energy relations with third parties.”

The regulatory framework built to address issues related to the energy sector in the European Union, faces a distinct challenge related to the very nature of energy. While the core objective of the Energy Union aligns with the fundamental scope of the European Union itself regarding the establishment of a common market functioning under competition, the nature of energy makes it difficult to establish free market and competition conditions when it comes to transportation, distribution and storage of energy, in particular electricity and natural (and other forms of) gas. Besides the apparent practical, technical, and economic issues, the development of parallel and competing electricity and gas networks would go against a fundamental objective of the Energy Union, linked to the efficient use of resources. Simply put, building multiple, parallel electricity and gas networks (cables and pipelines) in the European cities and countryside to create free competition, not only degrades living standards and is uneconomical, but also wastes valuable resources.

This distinctive element means that while production, supply and consumption of energy can function under free-market competition rules, energy networks remain under a primarily monopolistic framework. In order to counteract and minimise the negative effects of monopoly, the EU is utilising its regulatory arsenal to ensure that the ownership and function of energy networks does not reduce the overall effectiveness of the free market and competition framework. The aforementioned regulatory instruments, providing ‘Third Party Access’ to energy networks and ‘Ownership Unbundling’ of energy infrastructure are specifically designed to address this issue effectively.

Provisions for ‘Third Party Access’ stipulate that ‘Transmission System Operators’ (TSOs), and ‘Distribution System Operators’ (DSOs) controlling electricity and gas networks, as well as ‘Storage System Operators’ (SSOs) controlling storage facilities, are required to provide energy companies with non-discriminatory access to their infrastructure. Under this provision TSOs, DSOs and SSOs are obliged to offer the same service to different users under identical contractual conditions.[16] Respectively, provisions for ‘Unbundling’ refer to the separation of energy supply and energy generation activities from the operation of transmission and distribution networks. The provision refers primarily to ownership unbundling where supply or production companies are not allowed to hold a majority share or interfere in the work of a Transmission System Operator. The purpose of this regulatory tool is to avoid distortion in the function of competition created in a case where a company that produces or sells energy would also operate a network thus having an incentive to obstruct its competitors’ access to the infrastructure.[17]

The ‘externality’ element in these two regulatory tools lies on the effects they have on the construction or acquisition of energy infrastructure in the EU by companies from third countries. If for example Gazprom, the Russian state-owned gas production company, wants to construct and operate a gas pipeline in the EU, it needs to comply with ‘Third Party Access’ rules, so it needs to offer access to its pipeline to gas from other producers, i.e. Norway, the North Sea, Azerbaijan, Eastern Mediterranean, US LNG etc. Similarly, regarding ‘Ownership Unbundling’, if for example State Grid, the state-owned electricity utility monopoly of China, owns coal, nuclear, or gas-fired power plant in the EU, it cannot also directly acquire the electricity network of the country.

The role of gas-related legal disputes for European energy security

As analysed above, the decline in primary energy production in the EU leads to excessive concerns over the Union’s ability to maintain effective policies regarding energy security without raising its dependence on energy imports. To this end, EU plans towards transition to a more sustainable energy mix seem to collide -or at least not align- with the existing and planned infrastructure in natural gas networks. Germany’s decision to phase-out its nuclear power generation following the 2011 Fukushima accident led to the need for accelerated power production from other sources. This, in turn, has helped boost the county’s RES power production but simultaneously has increased Germany’s need for gas-powered electricity production and therefore its dependency and vulnerability vis-à-vis Russian gas imports.

“…a decision in September 2019 by the Court of Justice of the European Union (CJEU) in ‘Case T-883/16 Poland v. Commission’ has ruled that Gazprom could not use the extended capacity of the OPAL pipeline as an extension to the, also Gazprom-owned, Nord Stream 1 natural gas pipeline.”

As nuclear and coal power production has been a major pillar for energy security in several EU Member States, a phase-out process like the one applied in Germany has not been met in an equally positive manner by several Member States. More importantly, the lengthy dispute resolution process between the Swedish utility Vattenfall against the German government (‘Vattenfall AB et al. v Germany’) over the latter’s decision to completely pull out of nuclear power, creates additional caution in France and Belgium regarding the possibility of phasing out their own -extensive- nuclear power production. Similarly to the situation with nuclear and coal power production, the decline in primary natural gas production within the EU borders, primarily due to decreasing production in the North Sea and Holland’s gas fields, lead to increasing levels of dependency on gas imports. Long-term binding contracts with fixed selling price and volumes, combined with limited routes of gas flows into Europe, have created the conditions for legal disputes in the gas sector. In the case of natural gas prices and network routes, the imperative effects of energy security determine the intensity and gravitas of the legal disputes.

Some of the most significant cases of legal disputes in the gas sector in Europe resolving in arbitration are connected to Gazprom. These refer either in disputes regarding the price of gas or the legal framework of gas pipelines running from Russia to transit or end-user countries. The provisions of the EU’s energy regulation framework have been applied in -both successful and unsuccessful- efforts to deter or reduce the influence of Gazprom.

In one of the most recent occasions, a decision in September 2019 by the Court of Justice of the European Union (CJEU) in ‘Case T-883/16 Poland v. Commission’ (the ‘OPAL case’) has ruled that Gazprom could not use the extended capacity of the OPAL pipeline (a Gazprom-owned onshore pipeline running across the Eastern part of Germany to the Czech Republic) as an extension to the, also Gazprom-owned, Nord Stream 1 natural gas pipeline.[18] Germany’s policies in phasing-out of coal and nuclear power production, combined with the extended needs of its industrial sector, inevitably lead to an increased need for natural gas. The German Regulator (BNetzA) requested the Commission in 2016 to grant an exemption of the OPAL gas pipeline from Third Party Access provisions. In October 2016, the Commission granted the exemption. This led Poland to appeal, arguing that the Commission decision infringes the principles of energy security and energy solidarity. The CJEU in 2019, annulled the Commission decision approving the modification of the exemption regime for the operation of the OPAL gas pipeline, concluding that the Commission’s 2016 decision was adopted in breach of the principle of energy solidarity.[19]

Friction between Nord Stream 2 and the European Commission

In a similar situation to the OPAL case, Gazprom has been facing legal challenges regarding its Nord Stream 2 pipeline. The pipeline is designed to carry 55 bcm/y of natural gas from the Russian port of Ust-Luga in the Leningrad region, across the Baltic Sea to Germany in the Greifswald area close to the exit point of Nord Stream 1. Following the CJEU’s Judgment in the ‘OPAL case’, Gazprom should have been expected to face difficulties for Nord Stream 2 to comply with the examination of the security of supply criterion stipulated in Article 11 of the 2009 Gas Directive, or the competition and market-liberalisation provisions in Article 36 of the same Directive. The importance of the Nord Stream 2 pipeline for Russia, combined with the serious threats it is perceived to hold over the energy security of several EU Member States, brought Gazprom and the EU to the brink of arbitration in 2019. Following up on the Gas Directive amendment early in 2019 that provided for the rules governing the EU’s internal gas market to also apply to pipelines to and from third countries, Gazprom initiated a series of steps against the European Commission itself.

The Nord Stream 2 pipeline consortium filed a notice in September 2019, asking a tribunal of private arbiters to determine whether the European Union is in breach of its obligations under Articles 10 and 13 of the Energy Charter Treaty.[20] While the amendments in the Gas Directive related to third-party access, tariff regulation, ownership unbundling and transparency aren’t directed against any particular project, the Gazprom company argues that they were designed to stop Nord Stream 2. The Directive extends exemptions for pipelines that are completed before May 23, 2019, which is the date it entered into force. According to Gazprom, the discriminatory treatment of Nord Stream 2 derives from the fact that it is the only gas import pipeline that cannot benefit from these exemptions since the final investment decision was made before this date, even though significant capital was committed. It needs to be noted, however, that despite the company’s efforts, by the second quarter of 2020 the pipeline has not yet been completed.

“…in a surprise decision in May 2020, the Bundesnetzagentur rejected the application of Nord Stream 2 AG for derogation from regulation for the section of the Nord Stream 2 pipeline located in German territory.”

The case seemed to be “solved” after the German parliament voted in November 2019 to approve the implementation into national law of the amendments to the EU gas directive with the inclusion in its accompanying report of a special declaration that offers varied interpretations for the ‘completed’ state of a pipeline, thus making it possible for the German Regulator to deem Nord Stream 2 as being ‘completed’.[21] However, in a surprise decision in May 2020, the Bundesnetzagentur rejected the application of Nord Stream 2 AG for derogation from regulation for the section of the Nord Stream 2 pipeline located in German territory.[22] The refusal by Bundesnetzagentur to grand the necessary exemptions to Nord Stream 2 revives the possibility of Gazprom proceeding with arbitration against the European Commission under the Energy Charter Treaty. However, such a decision does not necessarily bring the end of Nord Stream 2, since Gazprom still has the option to simply comply with EU’s regulatory framework by setting up an independent transmission operator or system operator or transfer the operation rights of the German section of the pipeline to either one of the existing German transmission system operators.

The future of Russian gas pipelines in Europe

As analysed above, energy holds an overwhelming weight in the development of the European economy and therefore is a sector evoking fundamental political and security concerns. Such concerns are raised also by the United States. For Washington, stability in Europe remains crucial to US interests in its efforts to strengthen deterrence and defend NATO’s eastern flank against security threats that, among others, include Russian aggression and the use of energy to coerce political pressure in Europe.

Both the Nord Stream 2 and the second line of the TurkStream pipeline have been subject to sanctions by the United States through the inclusion of the 2019 sanctions legislation ‘Protecting Europe’s Energy Security Act’ in the 2020 National Defence Authorization Act.[23] Furthermore, in July 2020 the US State Department revised its guidance concerning the applicability of pipeline sanctions contained in section 232 of the ‘Countering America’s Adversaries Through Sanctions Act’ to include the Nord Stream II pipeline and the second line of TurkStream as falling within the scope of the sanctions that can be imposed under the Act. Washington sees the two projects as part of Kremlin’s energy policy aiming to create national and regional dependence on Russian energy supplies and leverage this dependence to exert an inappropriate level of political, economic, and military influence in Europe.

“Both the Nord Stream 2 and the second line of the TurkStream pipeline have been subject to sanctions by the United States.”

US sanctions could generate serious difficulties for the completion and future function of the planned Russian pipelines but at the same time they create friction among EU Member States. Germany raised intense opposition over the US sanctions law for the Nord Stream 2, arguing that it interfered in its internal affairs while Poland and the Baltic states agree with the US plans. Furthermore, the European Commission perceives the US sanctions as a threat against European companies, thus adding friction to EU-US relations.

EU’s stance for the protection of its energy sector

The European Union has been prioritizing the protection of its energy sector from external threats through the establishment of a robust regulatory framework rather than a set of politically driven ad hoc decisions. On the issue of energy security and dependence from Russian gas imports, the European Union is therefore relying on the efficient application of its energy regulatory framework both within EU borders and in its relations with third countries. This alleviates the political stance the Commission needs to take in its relations with Russia regarding gas imports and moves the center of ‘defence’ from gas-related Russian influence towards the tools provided by the European energy regulatory framework.

“…if Russia wants to maintain its level of natural gas sales in the European Union, it needs to fully comply with the EU’s energy regulatory framework.”

Simply put, under the current situation, if Russia wants to maintain its level of natural gas sales in the European Union, it needs to fully comply with the EU’s energy regulatory framework or else it will be facing constant legal challenges and disputes that can prevent the expansion of its gas network or end up in costly legally-binding settlements. Such a realization, although obvious, has not been the case in the past. The EU’s energy regulatory framework regarding relations with third counties had not been clearly defined until recently (2019), thus leaving space for political rather than legal ‘solutions’ that have often been determined by national interests of Member States rather than the common European interest.

“The EU’s path towards a cleaner, more sustainable energy future, leads to a sensitive and critical transition period during which natural gas holds a key role for the stability of its energy systems.”

The EU’s path towards a cleaner, more sustainable energy future, leads to a sensitive and critical transition period during which natural gas holds a key role for the stability of its energy systems. The European Union needs Russian gas during this period but is no longer willing to accept the harsh limitations of an asymmetrical interdependence with Russia. For the EU, diversifying its energy sources and its natural gas imports, does not necessarily mean moving away from Russian gas, nor worsening its relations with Russia. On the contrary, providing that the Kremlin chooses to fully comply with the EU’s energy regulatory framework, an opportunity is presented to significantly improve Russia’s image, by lifting the shadow that Russian energy-related political pressure in Europe has been casting on EU-Russia relations.

The EU’s strategic interest regarding Russia should lean towards promoting the concept of a stable Russian economy functioning with respect to free market and competition rules in its relations with the EU. Providing that they abide to EU Law, Russian pipelines could, together with natural gas, also carry an air of healthy cooperation and a gradual improvement of EU-Russia relations. On the contrary, if Russia choses to oppose compliance of its gas pipelines with EU energy law, it would showcase a determination to keep utilizing energy as a tool to exert political power and pressure over Europe, thus strengthening the voices in the EU -and the US- calling for a harsher stance against the Kremlin. It therefore seems that the future of Russian gas pipelines in Europe will be a mirror and an early indication of the overall future of EU-Russian relations.

[1] Robert O. Keohane and Joseph S. Nye, Power and Interdependence, (New York: Longman, 2001), 7-8.

[2] Andrej Krickovic, “When Interdependence Produces Conflict: EU-Russia Energy Relations as a Security Dilemma”, Contemporary Security Policy, (2015): 36(1): 3-26.

[3] Energy, transport and environment statistics”, Eurostat.

[4] “Energy production and imports”, Eurostat.

https://ec.europa.eu/eurostat/statistics-explained/index.php/Energy_production_and_imports

[5] Eurostat, “Energy, transport and environment statistics”

[6] “Russia, Ukraine Sign Gas Transit Deal Ahead of Deadline” Deutsche Welle.

https://www.dw.com/en/russia-ukraine-sign-gas-transit-deal-ahead-of-deadline/a-51841576

[7] “European Energy Security Strategy”, European Commission, May 28, 2014.

https://eur-lex.europa.eu/legal-content/EN/ALL/?uri=CELEX:52014DC0330

[8] “A Framework Strategy for a Resilient Energy Union with a Forward-Looking Climate Change Policy”, European Commission, February 25, 2015.

https://eur-lex.europa.eu/legal-content/EN/ALL/?uri=CELEX:52015DC0080

[9] Jeffrey Mankoff, Russian Foreign Policy-The return of Great Power politics. (Lanham: Rowman & Littlefield, 2012), 2-6

[10] “Nord Stream 2 – Divide et Impera Again?”, European Political Strategy Center.

https://euagenda.eu/upload/publications/untitled-135832-ea.pdf

[11] “Russia’s Design in The Black Sea: Extending the Buffer Zone”, Center for Strategic and International Studies, June 28, 2017. https://www.csis.org/analysis/russias-design-black-sea-extending-buffer-zone

[12] “Putin: Soviet collapse a genuine tragedy”, NBC news, April 25, 2005.

[13] “Towards a Balkan gas hub: the interplay between pipeline gas, LNG and renewable energy in South East Europe”, Oxford Institute for Energy Studies, February 2017.

https://www.oxfordenergy.org/wpcms/wp-content/uploads/2017/02/Towards-a-Balkan-gas-hub-NG-115.pdf

[14] Vavilov Andrej Petrovič. Gazprom: An Energy Giant and Its Challenges in Europe. (Houndmills: Palgrave Macmillan, 2015), 160-162.

[15] “Questions and Answers on the third legislative package for an internal EU gas and electricity market”, European Commission memo, March 2, 2011.

https://ec.europa.eu/commission/presscorner/detail/en/MEMO_11_125

[16] “Access to infrastructure and exemptions”, European Commission. Accessed February 2, 2020.

[17] “Third energy package”, European Commission. Accessed February 2, 2020.

[18] “The General Court annuls the Commission decision approving the modification of the exemption regime for the operation of the OPAL gas pipeline”, Press release n°107/19, General Court of the European Union, September 10, 2019.

https://curia.europa.eu/jcms/upload/docs/application/pdf/2019-09/cp190107en.pdf

[19] Press release n°107/19, General Court of the European Union, September 10, 2019.

[20] “Nord Stream 2: Pipeline spat with EU evolves into ECT dispute”, International Institute for Sustainable Development, December 17, 2019.

https://www.iisd.org/itn/2019/12/17/nord-stream-2-pipeline-spat-with-eu-evolves-into-ect-dispute/

[21] “German parliament approves implementation of EU gas directive amendments”, S&P Global Platts, November 14, 2019. https://www.spglobal.com/platts/en/market-insights/latest-news/natural-gas/111419-german-parliament-approves-implementation-of-eu-gas-directive-amendments

[22] “No derogation from regulation for Nord Stream 2”, Bundesnetzagentur, May 15, 2020. https://www.bundesnetzagentur.de/SharedDocs/Pressemitteilungen/EN/2020/20200515_NordStream2.html

[23] “The future of Nord Stream 2 and TurkStream: The impact of sanctions legislation”, Atlantic Council, accessed February 2, 2020, https://www.atlanticcouncil.org/event/the-future-of-nord-stream-2-and-turkstream-the-impact-of-sanctions-legislation/