The two main components of labour costs are wages and salaries (which were discussed in the previous In-focus) and non-wage costs i.e. employer’s social security contributions and taxes minus subsidies. In recent decades, the European Commission has underlined the importance of identifying policy reforms to decrease non-wage costs. High taxes on labour and high social contributions provide disincentives for job creation, decrease competitiveness and reinforce the growth of undeclared work.

According to Eurostat data, in the second quarter of 2022 the non-wage cost per hour worked rose by 3.8% in the Euro-area compared with the same quarter of the previous year. In most Eurozone countries there was an increase in non-wage cost during this period. On the contrary, in the case of Greece the nominal no-wage costs per hour worked decreased significantly (-6.4%). The decrease in non-wage cost can be attributed to the measures introduced by the government during the last two years (i.e. the reduction of employer’s social security contribution). These measures play an important role in increasing economic competiveness and investment.

As we move from the whole economy to the business economy, we observe that the nominal non-wage cost per hour worked in Greece increases slightly (2.6%). In other countries it increased less (1.0% in Italy), while in Spain and Germany it even decreased (by 0.1% and 1.7%). It rose substantially in other countries like Slovakia 28.7% and elsewhere.

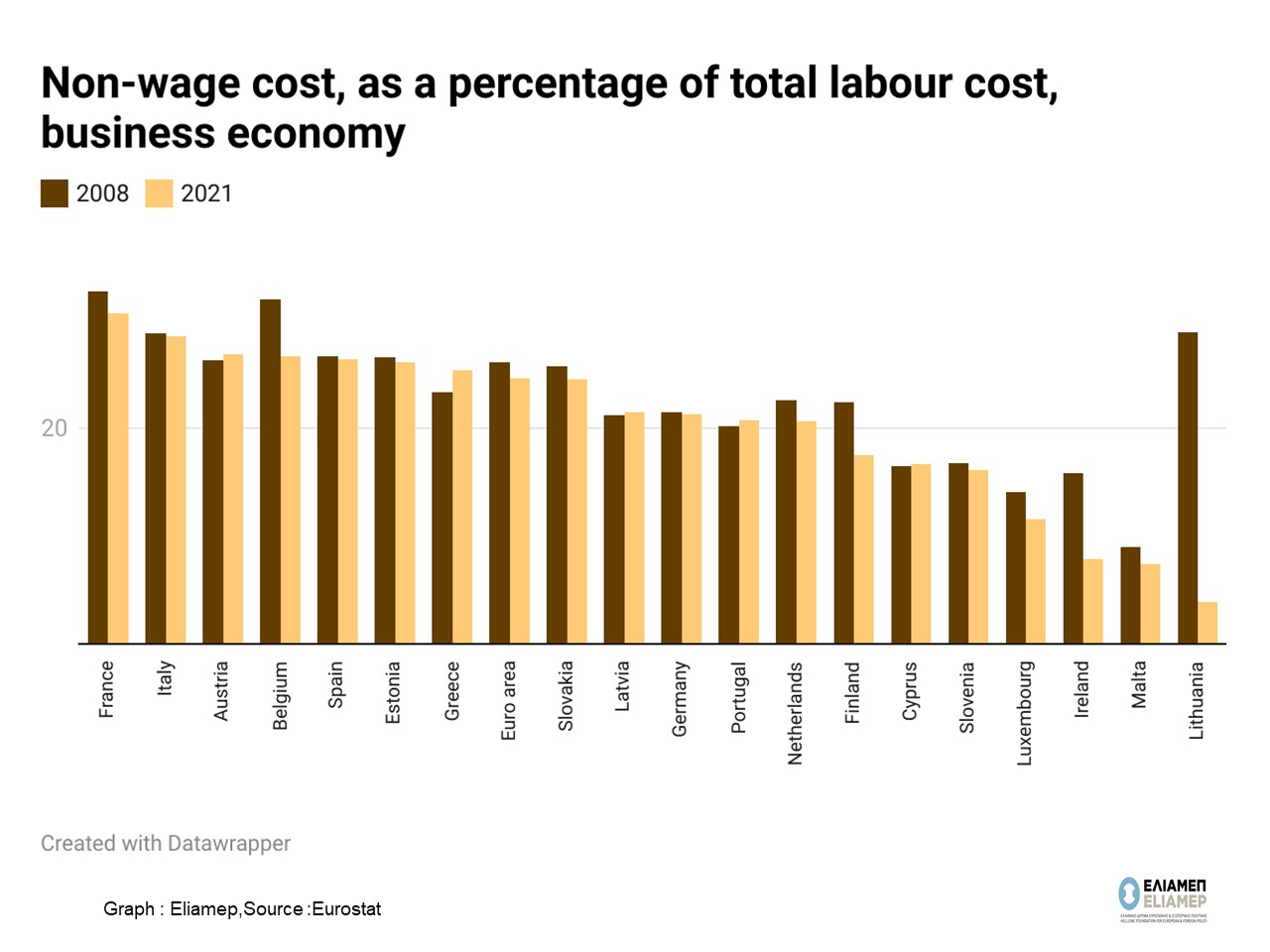

The share of non-wage cost (%of total) for the business economy is another interesting indicator. The available data from Eurostat (for 2021) reveal that the non-wage cost in the business economy as a percentage of total labour costs was 25.5% in Greece, which is above the average non-wage cost in the Euro zone (24.6%). Moreover, it remained higher compared to the pre-crisis levels (23.3% in 2008). At the same time, in other countries in the European “periphery” non – wage cost as a percentage of total cost of labour in the business economy was lower (Portugal: 20.7%, Ireland: 7.9%).

Although the target of reducing non-wage costs remains a priority for the government, the consequences of these reforms are not clear during this period of weak economic growth. According to a report published by Eurofound (2017) for European countries after 2000, reforms aiming at reducing non wage costs were not always successful from an employment perspective.As the research underlines, the probability of a strong positive impact on employment creation is higher for reforms within a comprehensive package and when policies target a specific group of workers (e.g. long-term unemployed). On the contrary, at a time of severe public spending restrictions, the reduction of employer taxes may require new taxes (for example on consumption), with negative second order effects on income distribution and employment. Finally, a positive macroeconomic context enhances the probability that employer cost reduction measures achieve their goal of stimulating employment.

Undoubtedly, improving competitiveness and increasing employment remain important government goals. But at a time of global uncertainty and recession, reforms aiming to reduce non-wage costs in a country with limited fiscal space, should be designed carefully, taking into consideration lessons learned from international experience.