In this period of high inflation, central banks are expressing concerns about a possible repeat of the wage-price spiral of the oil crises in the 1970’s. But today’s experience is different. Back then after the sharp increase in energy costs, labor unions (some years, in some countries) succeeded in extracting above-inflation wage increases. This had a knock-on effect: those firms that operated in a less competitive environment passed the cost on to consumers, while those firms that could not raise their prices sufficiently suffered a reduction in their profit margins.

Today, labor unions are much weaker than they were 45 or 50 years ago. So, almost everywhere in Europe wages increases are below inflation, causing real wages to fall (see previous In Focus). If this trend continues, the upward wage-price spiral will prove to be “the dog that didn’t bark.”

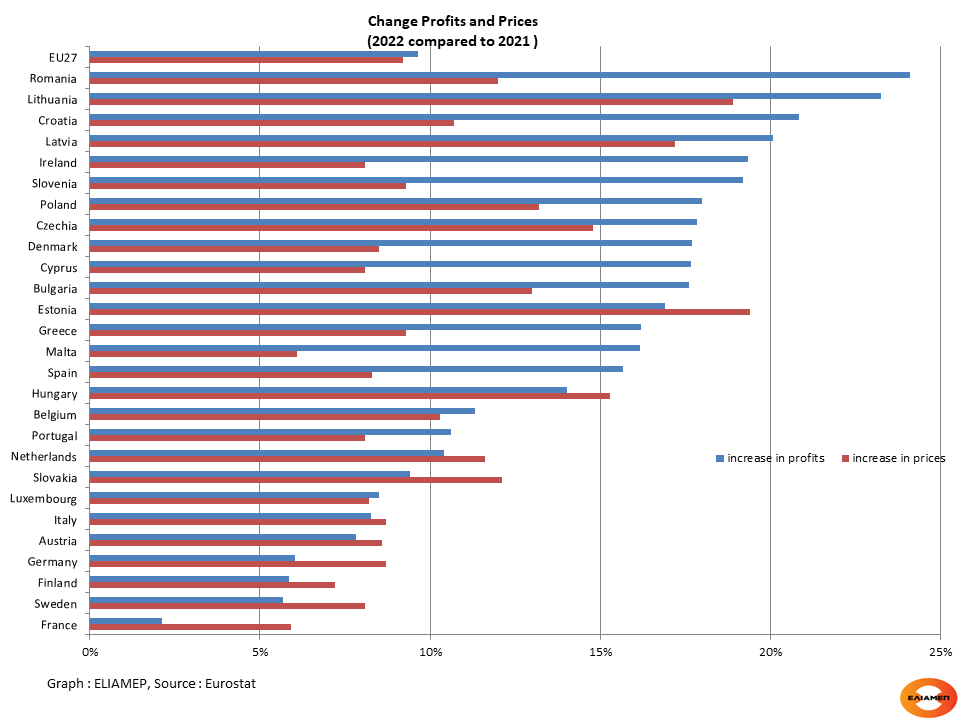

While real wages are falling almost everywhere, in most Member States (and the EU as a whole) profits are rising faster than inflation. As the graph shows, in 2022 the gross operating surplus of businesses increased in the EU by 9.6% compared to 2021, while the harmonized index of consumer prices increased by 9.2%.

In 10 countries, profits rose less than inflation. These include large Western European economies (such as Germany, France, and Italy), small dynamic Western European economies (such as Sweden, Finland, the Netherlands, and Austria), as well as some Eastern European countries of Europe (such as Slovakia, Hungary, and Estonia).

The opposite happened in the remaining 17 Member States. In the countries of the European South, in the other countries of Eastern Europe (such as Poland and the Czech Republic), as well as in Denmark, Belgium, and Ireland, profits increased above inflation. In our country, the total gross operating surplus of businesses increased in 2022 by 16.2% compared to 2021, while the harmonized consumer price index increased by 9.3%.

This development has not gone unnoticed. As Fabio Panetta, a member of the ECB’s Executive Board, pointed out last week, unit profits contributed to more than half of domestic price pressures in the last quarter of 2022. Indeed, in some industries, retail prices are rising rapidly, in spite of the fact that wholesale prices have been decreasing for some time. This suggests that these firms are taking advantage of the uncertainty created by high inflation to improve their profitability.

How is this phenomenon explained? In conditions of high inflation, consumers are more tolerant of price increases, while at the same time it is not easy to determine whether companies are raising prices beyond what was necessary to absorb cost increases. The problem is particularly evident in industries where demand is high while supply is tight (for example due to supply chain problems), since companies can increase profit margins without risking losing market share. The concern is that opportunistic business behavior is jeopardizing the projected decline in inflation in 2023, leading to an upward profit-price spiral. Recent analysis by the European Trade Union Confederation (ETUC) points to the asymmetry: in the new conditions of this inflationary environment, profits are expanding while wages are shrinking.

The risk of a profit-price spiral does not appear to be confined to the EU. Two studies, one by the Economic Policy Institute and another by the Institute for New Economic Thinking, report that on the other side of the Atlantic the contribution of profits to inflation is two to three times higher than that of wages.

This fact has begun to seriously worry central banks, since higher than anticipated increase in profit margins threatens to undermine their effort to contain inflation by raising interest rates. In her speech on March 22, Christine Lagarde called for a “fair burden sharing” of tackling inflation between workers and firms. As the ECB president said: if both parties attempt to unilaterally minimise their losses, we could see a feedback mechanism between higher profit margins, wages and prices.

Shifting emphasis from the risk of a wage-price spiral to the need to avoid a profit-price spiral is evident.