Russia is the 12th largest exporter in the world (data for 2020). For the EU, Russia is the third largest partner for EU imports of goods: 7.5% of EU’s total imports of goods come from Russia (€162.5 billion in 2021). EU imports of services from Russia were €10.1 billion in 2021 (only 1.1% of EU’s total imports of services).

After a temporary decrease due to the coronavirus, EU imports of goods from Russia increased in 2021, surpassing the 2019 level by 12%. The same pattern was observed with imports of services, with the difference that the latter in 2021 remained 21% below the 2019 level.

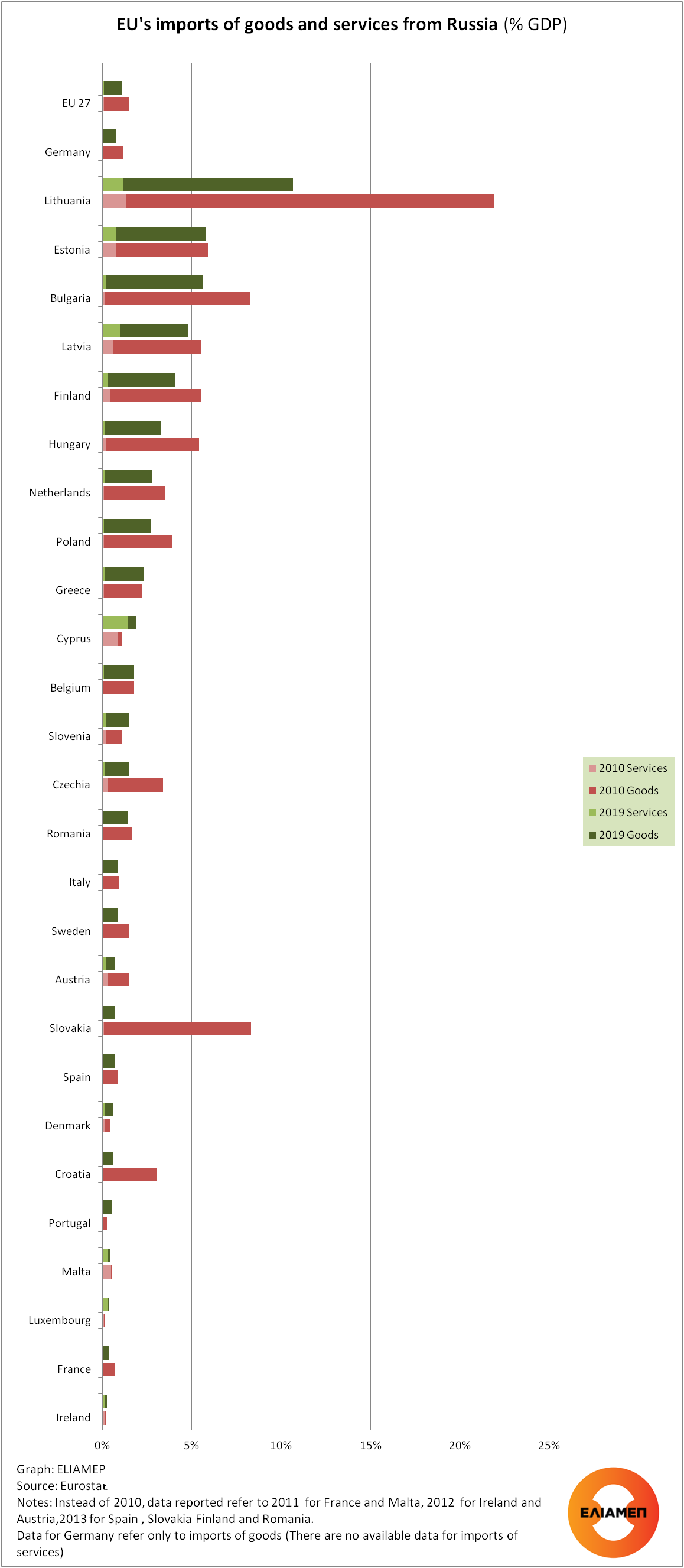

During the last decade, imports of goods from Russia increased in terms of value but decreased as a percentage of GDP: from 155.7 billion euros (1.42% of EU GDP) in 2010 to 162.5 billion euros (1.12% of GDP) in 2021. Between 2010 and 2019, there was a decrease in imports of Russian goods in 13 of the 27 Member States in absolute terms, and in 19 of the 27 Member States as a percentage of GDP. In Greece, Russian imports of goods as a percentage of GDP remained almost constant (from 2.15% of GDP in 2010 to 2.17% in 2019). In terms of value, imports of goods from Russia to Greece decreased (from 4.8 in 2010 to 3.8 billion euros in 2019, at constant 2015 prices).

The three largest importers of goods from Russia to the EU in 2021 were Germany (€28.8 billion), the Netherlands (€26.6 billion), and Poland (€16.7 billion). In 2019, Russian imports of goods as a percentage of GDP were of major importance for the three Baltic countries (Lithuania 9.5% of GDP, Estonia 5.0%, and Latvia 3.8%) but also for Bulgaria (5.4%).

In 2021, primary goods imported from Russia (68 %) had a higher share in EU’s imports than manufactured goods (19 %). The most imported primary goods from Russia were energy (62 %), followed by raw materials (5 %). In 2021, the EU had trade surpluses with Russia in machinery & vehicles (€ 37 billion), chemicals (€ 13 billion) and food & drink (€ 4 billion). On the contrary, the EU had trade deficits with Russia in energy (€ 98 billion), other manufactured goods (€ 1 billion), raw materials (€ 5 billion) and other goods (€ 19 billion). Regarding the trade balance with Russia EU held a deficit (€73.3 billion in 2021). Only 4 member states had a trade surplus with Russia (Czech Republic, Slovenia, Sweden, and Luxembourg). The largest trade deficits with Russia were recorded in the Netherlands, Poland, and Italy.

The top services exported by Russia in 2019 were miscellaneous business, professional, and technical services, air transport, personal transport and sea transport. In contrast to the trade balance of goods, in the balance of bilateral trade in services with Russia EU recorded a surplus (14.2 billion euros in 2021). In terms of total EU imports of services, Russia was EU’s tenth most important partner in 2021. Russia’s exports of services to the EU in the period 2010-2019 decreased slightly as a percentage of EU GDP (from 0.10% to 0. 09%), although they increased in terms of value (from 11.2 to 12.7 billion euros). In 2019, the largest importers of services from Russia were Italy (1 billion euros), France (992 million), and the Netherlands (983 million). (There are no available data for Germany.) With the exception of Cyprus (1.4% of GDP in 2019) and Luxembourg (1.2%) the imports of services from Russia as a percentage of GDP remain below 1% in all EU member states. In Greece, imports of services from Russia increased slightly in terms of value (from 224 million euros in 2010 to 272 million euros in 2019, at constant 2015 prices) and their share in GDP increased also slightly (from 0.10% in 2010 to 0.15% in 2019).

The 2014 sanctions had an impact on EU-Russia trade relations, contributing to the contraction of Russian exports to the EU. The Russian invasion of Ukraine brought new sanctions (9 packages in 2022) and is expected to further reduce the attractiveness of Russian products for the European consumers, even after the end of the war. The contraction of bilateral trade with Russia has implications for the EU as well. In many member states, exports to Russia have decreased in the last decade (see previous In focus). As a spokesperson for Belgium’s government mentioned : “It is becoming increasingly difficult to impose sanctions that hit Russia hard enough, without excessive collateral damage to the EU”.