During the fourth quarter of 2020, the share of US dollar reserves held by central banks fell to its lowest level in the last decades. According to data from the International Monetary Fund, the share of US dollar assets in central bank reserves dropped by 12 percentage points—from 71 to 59 percent—since the euro was launched in 1999. Meanwhile, the share of the euro has fluctuated around 20 percent, reaching the highest level in 2009 (28%), just before the outbreak of the Euro zone debt crisis.

Some analysts draw quick conclusions suggesting that this reflects the declining role of the US dollar in the global economy, in the face of competition from other currencies. However, this is an oversimplified assessment. To begin with, the US dollar still plays a key role in the international monetary and financial system. According to a report by the Bank for International Settlements, almost half of cross-border bank loans are dollar-denominated — only a third are euro-denominated, with loans in other currencies representing less than 20 percent. In 2019, around half of international trade is invoiced in US dollars, and around 40% of international payments are made in US dollars.

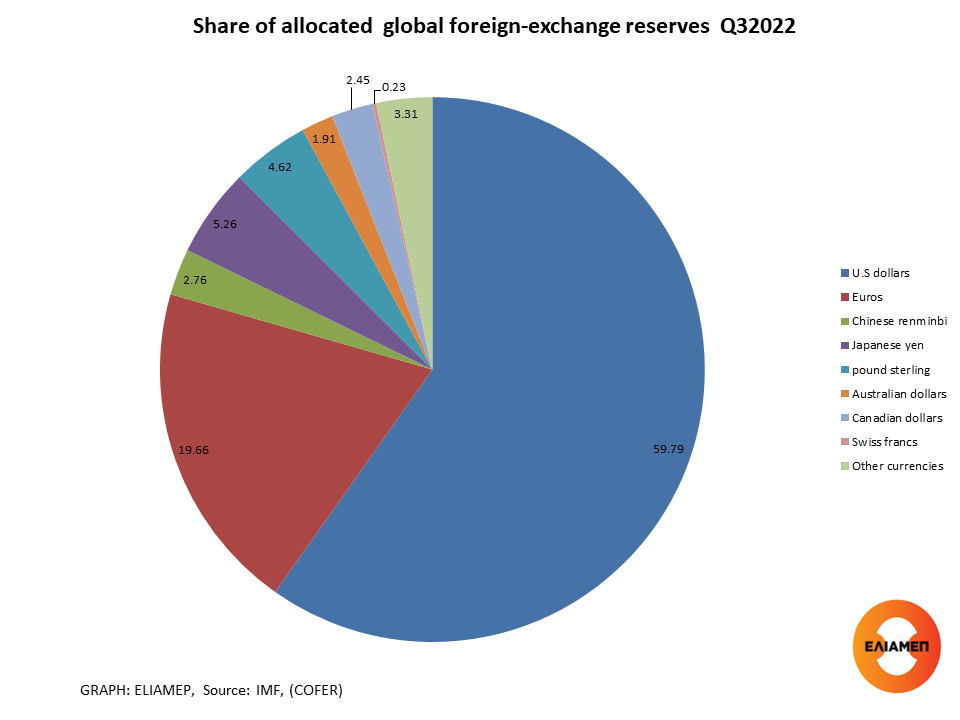

Even at the end of 2020, when dollar reserves reached a historical low (59%), the shares of foreign exchange reserves in euro (21%), yen (6%) and British pound (under 5%) remained much lower compared to the dollar’s. As the IMF suggests the reduced role of the US dollar hasn’t been matched by increases in the shares of the other traditional reserve currencies.

In recent years there has been a steady increase in the share of reserves held in renminbi. This doesn’t come as a surprise as China is now the second biggest economy in the world. It is important to note that, according to the IMF, almost a third of the world’s renminbi reserves in 2021 were held by a single country: Russia. After the outbreak of the US-China trade war, Russia and China have drastically cut their use of the dollar in bilateral trade. In 2015, approximately 90 per cent of their bilateral transactions were conducted in dollars and this had dropped to 51 per cent by 2019. However, since the Chinese government is still carefully managing the renminbi, and China’s capital markets remain less developed compared to those in the West, the renminbi won’t really compete with the dollar.

Moreover, current geopolitical developments seem to establish the dollar as the reserve currency- at least for now- despite predictions that US sanctions on Russia’s foreign exchange reserves would threaten dollar’s dominance. Recent data shows that the share of global foreign exchange reserves held in US dollars is higher in the third quarter of 2022 (59.79%) than in the first quarter of 2022 (58.8%). Russia’s invasion of Ukraine, China’s “ZERO-COVID» policy, and the global economic recession are creating anxiety in the markets. In times of distress, the demand for safe assets increases. US is a net energy exporter which means that compared to other countries, US fortified against the energy crisis. Moreover, FED reacted quickly by raising interest rates in order to fight inflation. These factors contributed to the increase in the global demand for dollars. Unlike the US, the EU is a net energy importer and is heavily dependent on Russia’s exports, while the ECB’s monetary policy to tackle inflation has so far been less aggressive. Possibly the above explains the slight decline in the share of global foreign exchange reserves in euros from 20% in the first quarter of 2022 to 19.7% in the third quarter of 2022. In the same period there was a slight decrease in share of reserves in renminbi (from 2.9 % to 2.8%).

Meanwhile, although the dollar, euro and renminbi monopolize international interest, the share of other currencies in global reserves (eg the Australian dollar and the Canadian dollar) has been increasing in recent decades. The privilege of these currencies is that they combine higher returns with relatively lower volatility. Also, the increased demand for these currencies is due to the fact that they are issued by countries with open capital accounts and track records of sound and stable policies, which makes them attractive even in times of crisis. In the first three quarters of 2022, the share of these currencies in foreign exchange reserves was 2.5% for the Canadian dollar and 1.9% for the Australian dollar.

The developments of the last decades show that central banks around the world seek further diversification of the currency composition of their reserves. This has led to a rise in the share of non-traditional currencies in global foreign exchange reserves. On the other hand, in periods of uncertainty the hegemony of the dollar is strengthened. In 2022 the dollar remains the dominant international reserve currency while the shares of the other currencies in global reserves remain significantly lower.