Services now account for almost a quarter of export earnings globally. As a recent article by Richard Baldwin argues, international trade in services continues to grow with no signs of slowing down: the future of globalization lies in services.

In 2021, the EU was the world’s largest exporter and importer of services. The EU’s main export markets were the United Kingdom and the United States, which each accounted for approximately one fifth (20.2 % and 20.1 %) of the EU’s exports. The next largest shares were recorded for Switzerland (11.6 %), followed by China (5.2 %).

The EU, meanwhile, is China’s largest trading partner for services. Since 2001, when China joined the World Trade Organisation, EU’s exports of services to China have grown on average more than exports of goods (by 15% and 10% per year respectively). In 2019, EU exports of services to China reached €53.3 billion, although they were still lower compared to exports of goods (€198.5 billion in 2019) (see previous In Focus).

The Covid-19 crisis caused a drop in international trade. Thus, EU’s exports of services to China also fell from €53.3 billion in 2019 to €46.9 billion in 2020. But in 2021, EU services exports to China recovered (€57.1 billion), and were a higher than before the pandemic.

In contrast to trade in goods, οn trade in services, the EU currently has a trade surplus with China. According to a recent study by the European Commission’s Directorate-General for External Policies, EU has particularly specialised in travel and technologyrelated services. The EU still lags behind the US in attracting tourists from China. But the EU exports more technology-related services to China than the US.

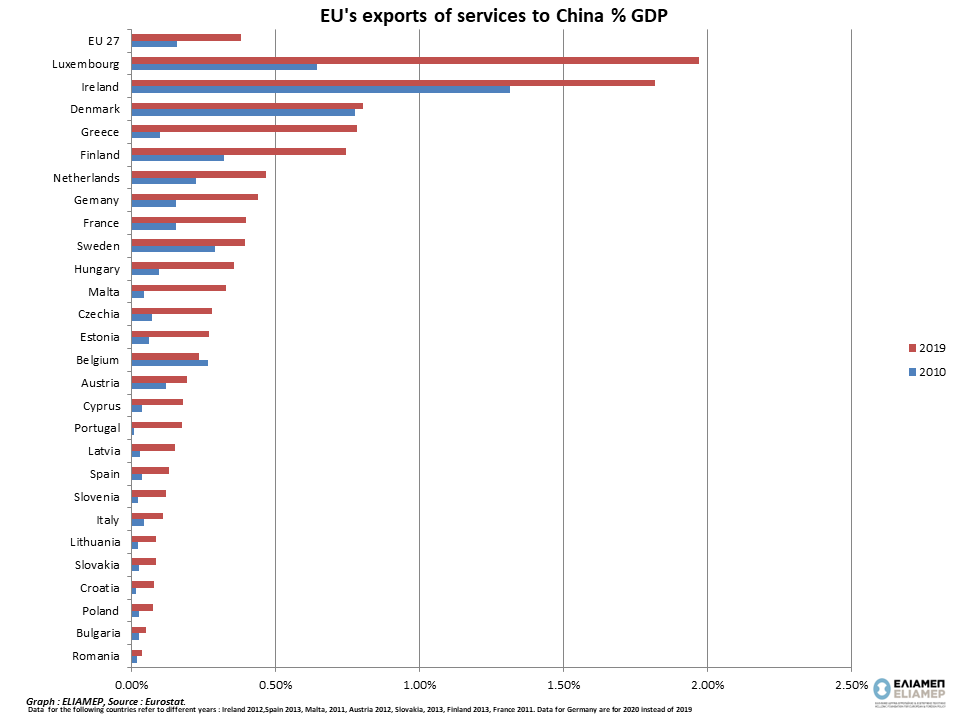

From 2010 to 2019, the importance of EU’s exports of services to China increased significantly (from €17.1 to €53.3 billion, and from 0.16% to 0.38% of EU GDP). EU’s exports of services to China grew over the period 2010-2019 for all Member States, usually faster than GDP. (Only in Belgium did exports of services to China fall slightly as a percentage of GDP, although they increased in value.)

In some Member States, the increase was spectacular. In Portugal, exports of services to China increased twentyfold (from <0.01% of GDP in 2010 to 0.17% of GDP in 2019). In Greece, exports of services to China as percentage of GDP have grown eightfold (from 0.10% to 0.78% of GDP in the period 2010-2019).

In terms of the value of exports of services to China, the largest exporters were Germany (€15.3 billion in 2020), France (€9.6 billion in 2019), and Ireland (€6.5 billion in 2019). In terms of their specific weight in GDP, Greece was in the 4th place in the EU ranking in 2019, after Luxembourg (1.97%), Ireland (1.82%), and Denmark (0.80% of GDP).

Greece (66 %) exhibits a large proportion of international trade in services transactions occurring outside the EU. For Greece, the only country in the EU, China is among the top three trading partners in terms of exports of services. According to data from the Observatory of Economic Complexity (OEC) of Harvard University, the largest exported services from Greece to China in terms of value (1.5 out of 1.6 billion dollars in 2019) concerned sea transport. In contrast, the importance of leisure travel was still low ($40.4 million).