Hydrogen is positioned as a strong candidate for fulfilling the carbon-neutrality objective set out in the European Green Deal, provided that it is able to compete on a level-playing field with other technologies favoring sector coupling. Pushing the envisioned hydrogen economy past its tipping point necessitates a conducive EU regulation, repurposing of existing large-scale EU networks, along with additional investments, as well as strategic partnerships with the EU’s third-country suppliers. This paper aims to outline the role of hydrogen as a component of the decarbonization of the European natural gas sector, in the context of an integrated energy system.

You may find the Policy Paper, by Mariana Liakopoulou, Research Fellow in Energy Security, NATO Association of Canada (NAOC), in pdf here.

Introduction

According to the European Commission’s (EC) proposal for the first European Climate Law (2020a), “cost-effectiveness and technological neutrality in achieving greenhouse gas emissions reductions and removals and increasing resilience” should be taken into account on the road towards the prospective carbon-neutral EU economy of 2050, as set out in the European Green Deal. Hydrogen is positioned as a strong candidate for fulfilling the above objective, provided it is able to compete on a level-playing field with other technologies linking electricity and gas markets and infrastructure.

Hydrogen is a transportable and storable energy vector that can be produced from different energy sources via an array of pathways.

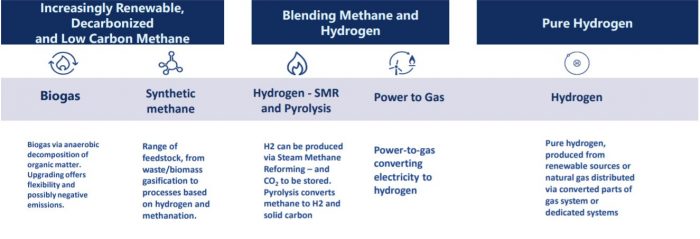

Renewable electricity (RE)-sourced hydrogen[1] is made in electrolyzers that split water into oxygen and hydrogen using renewable electricity (upstream pathway). Additionally, hydrogen can be synthesized with carbon dioxide into methane. Power-to-gas (P2G) projects combine electrolysis with methanation. RE-sourced hydrogen can also result from the steam reforming of biomethane and biogas, in which methane reacts with high-temperature steam in the presence of a catalyst.

According to J.P. Morgan (Cembalest 2020), around 95 percent of commercially available hydrogen is currently derived from fossil fuels, whereas the International Energy Agency (IEA) says that electrolysis accounts for about 2 percent of global hydrogen production (IEA 2019).

Natural gas (NG)-sourced hydrogen is produced from natural gas via the highly endothermic steam methane reforming (SMR) reaction and the closely related, exothermic and slightly cheaper autothermal reforming (ATR) reaction (downstream pathway). The use of carbon capture and storage (CCS) can clean up these methods by means of the safe, underground storage of CO2 emissions. CCS has so far been deployed at scale at the Motiva refinery in Port Arthur, Texas, for enhanced oil recovery (EOR) purposes.

A less developed technology for NG-sourced hydrogen is pyrolysis, which decomposes natural gas into gaseous hydrogen and solid carbon –the latter being easier to store and transport–, thus not adding to atmospheric emissions. Methane pyrolysis requires less energy than electrolysis or SMR, and this could be supplied by renewables.

Today, refining, chemicals and fertilizers represent the strongest use cases for hydrogen. Industrial end-users, long-distance transport, grid blending and buildings as well as power generation and storage could provide reliable sources of baseload demand to support RE- and NG-sourced hydrogen technologies in the medium term.

Pushing the envisioned hydrogen economy past its tipping point necessitates an EU regulatory framework that is conducive to it, the repurposing of existing large-scale EU networks, along with additional investments, and strategic partnerships with the EU’s third-country suppliers. This paper aims to outline the role of hydrogen as a component in the decarbonization of the European natural gas sector in the context of an integrated energy system.

On a policy level, it argues that conventional gas market integration, along with the associated regulatory framework, can facilitate the adaptation of conventional gas market concepts to future hydrogen clusters.

On an energy security level, it argues that hydrogen trade is poised to reshape Europe’s geopolitical energy map, triggering the emergence of new suppliers. However, it could, to a certain extent, also depoliticize energy supply, since the formation of a decentralized system in which hydrogen is domestically generated will likely make the EU more flexible in relation to stress incidents, as well as limiting the Bloc’s constant need to cultivate alternative external gas relations for supply security reasons, as it has to do within the current commoditized market model.

Figure 1: Breakdown of green gas technologies

Source: Ingwersen, J., 2019. ENTSOG Roadmap for Gas Grids: Making Grids Ready for Transition. Brussels: 32nd Madrid Forum.

EU Gas Market Fundamentals

EU gas market liberalization, which kickstarted in the late nineties and peaked in the early 2010s, led to regulated entities[2] advancing the creation of a competitive internal market. Securing effective and non-discriminatory third-party access (TPA) to, and the reliable operation of, an increasingly interconnected infrastructure system was part of their mission. Investment in bidirectional cross-border infrastructure which provides entry points for alternative gas volumes has strengthened supply security against the backdrop of rising import dependency and declining indigenous production.

Meanwhile, the dominance of vertically-integrated incumbents in the wholesale market was enfeebled by ownership unbundling, while consumer switching was made easier on the demand front. Finally, the growth of hub-indexation and financial derivatives have boosted liquidity and helped mitigate risk through flexible contractual arrangements and competitive prices, while also promoting the commoditization of both gas and liquefied natural gas (LNG).

In short, supply security and competitiveness have been the two main aspects that have governed EU gas market design to date. Climate targets set for 2050 now require that decarbonization be considered a third aspect. The integration of the gas and electricity sectors in terms of both their market and their infrastructure —“sector coupling” — will be a critical enabler in this effort, especially upon the emergence of large-scale hydrogen production and use.

The successful decarbonization of the European energy system is subject to flexibility of energy supply, including over seasonal timescales. In this respect, hydrogen could smooth the way for RES integration by overcoming seasonal fluctuations, especially in parts of Europe troubled by transmission bottlenecks.

However, adapting the existing gas regulatory framework for the decarbonization of the European gas sector with increased penetration on the part of green gases, including hydrogen, may prove a tricky task in the absence of a mature industry within which capital could be quickly and massively allocated and absorbed, and within which market failure could still be experienced, owing to economies of scale or natural monopolies in networks. After all, both vertical integration and oil indexation became causes for concern within a uniform European gas industry whose existence largely predated the drafting of pertinent gas sector regulation.

Hydrogen and Sector Coupling

The transition from the Gas Target Model (GTM)[3] to an equivalent model covering pure hydrogen networks will be further clarified upon release of the Gas Decarbonization Package in 2021. In its response document to the EC’s Hydrogen Strategy, the European Federation of Energy Traders (EFET) argues that the Third Gas Directive does in fact cover green gases in scope (EFET 2020). Nevertheless, the wording of Article 1.2[4] of the Directive clearly restricts its applicability to hydrogen blending into existing natural gas networks that cannot exceed 20 percent.

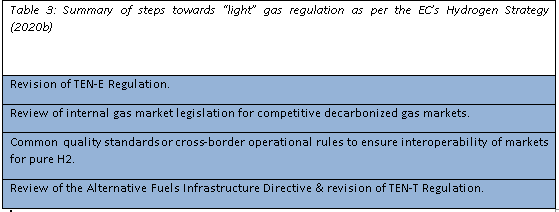

The EC’s Hydrogen Strategy (2020b), released along with the Energy System Integration Strategy, does some rudimentary groundwork for the anticipated “light” gas regulation. The document sets a building target of 40GW of electrolyzers for 2030 and cumulative renewable hydrogen investments of EUR180-470bn by 2050. It also foresees the development of a global hydrogen market in which the fuel will be traded as a liquid commodity denominated in euros. The need to move towards “a liquid market with commodity-based hydrogen trading”, highlighted in the Strategy, echoes the broadly stated argument that trading within the internal gas market may provide the technical basis for hydrogen trading through, for instance, the virtualization of operations and the introduction of similar market integrity and transparency rules.

Although the level of importance placed on low-carbon hydrogen, and its associated investments, has sparked certain criticism, the Strategy recognizes that solutions at a lower technology readiness level, like CCS and pyrolysis, have to be incentivized until upscaling to electrolyzers in the case of gigawatts is achieved. Tenders for “Carbon Contracts for Difference”, a scheme proposed in the Strategy which typically related to RES generation, can mitigate risks primarily for low-carbon hydrogen investors, in the light of renewable hydrogen’s currently higher costs. The scheme ensures a minimum CO2 price and therefore supports long-term low-carbon investments, providing a hedge against a hike in CO2 costs in the EU Emissions Trading System (ETS).

To increase the uptake of hydrogen within an integrated energy system, the Strategy announces a review of the EU gas market legislation by 2021. Concrete infrastructure planning includes the revision of the Trans-European Networks for Energy and Transport (TEN-E/TEN-T) regulations and drafting of integrated Ten-Year Network Development Plans (TYNDPs), allowing operators to reach a common understanding on potential supply/demand developments and to identify and evaluate investment opportunities in different parts of the system –a process expected to reduce project costs. Setting up common hydrogen quality standards and/or cross-border operational rules in favor of the interoperability of pure hydrogen markets is also envisaged along these lines.

The Strategy does not touch specifically upon the applicability and/or need for an amendment of unbundling rules, but does highlight the need for the development of non-discriminatory TPA rules to reduce the undue burden on market access.

Hydrogen produced close to the point of electricity/natural gas source requires dedicated pipelines or trucks, whereas de-centrally produced hydrogen (i.e. hydrogen produced close to the consumption point) needs limited infrastructure for local storage and distribution (Cihlar et al. 2020). In both cases, the retrofitting of existing natural gas pipeline infrastructure[5] and the re-use of LNG plants[6] to produce hydrogen from regasified methane through CCS, which will then be transported in liquefied form by highly-insulated tankers, could offer significant hydrogen production and carrying capability. The repurposing of the pan-European infrastructure for large-scale cross-border hydrogen transportation is emphasized in the Strategy.

Hydrogen blending into existing infrastructure and end-user equipment across Europe varies from 0.01 to 20 percent, up to which point no technical issues are raised. In all, 35 percent of Member-States (M-S) currently allow or accept hydrogen blending (EU ACER and CEER 2020). In contrast, pure or blended biogas and biomethane can make use of existing transmission pipelines without requiring technical modifications, as they generate the system benefits of natural gas, such as storage, flexibility, high-temperature heat, minus the net carbon emissions.

Although, according to the IEA (2019), hydrogen shipping constitutes the most cost-competitive option for distances over 1,500km due to the inflexibility of pipelines and the associated limited option to shift to different suppliers, the latter become economically advantageous when it comes to imports from or transportation between neighbouring countries or regions. This focuses attention on the role of TSOs (Transmission System Operators) along the hydrogen value chain.

Unbundling prevents TSOs being simultaneous involved in production and supply. The unbundling that comes with DSOs (Distribution System Operators) offers greater flexibility, since DSOs can be incorporated into vertically integrated companies, under certain conditions. Clarification is required as to whether electrons-to-molecules conversion can be classified as a production activity, and whether hydrogen storage should be defined as a trading activity, once hydrogen has been designated for re-electrification. Unless rules change, the Commission could initially grant network operators derogations allowing them to develop small-scale/demonstration projects.

Once this transitional period is over, it is vital that network operators do not exploit their position regarding the ownership and/or operatorship of installations such as P2G conversion plants, unless national energy regulators can verify that there are no market-based investment options over the horizon, in line with a market failure concept. Optimum exploitation of the installations in question is safeguarded if market participants, rather than TSOs exclusively, are able to compete for their building, ownership and operation. Moreover, given the lack of a mature hydrogen market with extensive networks, the over-regulation of early competitive activity –through, for instance, the introduction of TPA provisions– might seem irrelevant[7].

Overall, network operators may initiate the establishment of a hydrogen market to expedite delivery of the Green Deal and the European Recovery Plan (ENTSOG 2020), if this is in the public interest and does not distort the market. The challenge is to strike the right balance between compliance with sectoral rules and maintenance of a market-driven approach through the development of a backbone of low- and zero-carbon gas investments.

The Strategy also discusses the introduction of a low-carbon threshold/standard for the promotion of hydrogen production installations based on their full life-cycle greenhouse gas (GHG) performance, which could be defined relative to the existing ETS benchmark for hydrogen production, as well as a comprehensive terminology and Europe-wide criteria for the certification of renewable and low-carbon hydrogen. This could possibly build on existing ETS monitoring, reporting and verification and on provisions set out in the recast Renewable Energy Directive 2018/2001/EU (RED II) of the Clean Energy for All Europeans Package. RED II focuses on support and targets for renewable gases (biomethane, RE-sourced hydrogen) and Guarantees of Origin (GOs); it does not cover low-carbon hydrogen, however. Support certification schemes, like GOs, are required for policies which remunerate the consumption of green gases. It is therefore important to safeguard their intra-EU interoperability and conversion from one carrier to another.

RED II could potentially also provide the basis for hydrogen tariff regulation. Discounts on network access tariffs could spur large-scale gas sector decarbonization. In contrast, high tariff levels risk provoking a chain reaction of subdued consumption and scarce operator revenues. Market participants –hydrogen investors among them– should have a clear picture of the whole system price signals, including the alignment needs between gas and electricity grid tariffs.

Project Viability and Economics

Low and zero-carbon hydrogen is currently more expensive than hydrogen yielded from fossil fuels and other high-carbon alternatives, because of the technological immaturity of pertinent facilities and the incomplete internalization of the societal cost of carbon emissions (Roberts and Janssen 2020). However, technological innovations and economies of scale in manufacturing –via, for instance, the upscaling of electrolyzers– could reverse this trend. Present gas and electricity prices push the levelized cost of SMR with CCS below that of electrolysis.

The affordability of RE-sourced hydrogen depends on variables such as electricity prices and the availability of low-carbon electricity and CAPEX for electrolysis units, and operating costs. Europe bargains on producing RE-sourced hydrogen from surplus renewable electricity, but the full load hours when this surplus electricity occurs are generally limited. Due to their particular energy intensiveness and the significant losses they entail, electrolysis investments could prove difficult to justify, except when grid bottlenecks take place. On the other hand, CCS cannot be demonstrated at scale where there are no proper storage facilities, or where public awareness of the technology is limited.

According to the Fuel Cells and Hydrogen Joint Undertaking (FCH JU), CCS will most probably become the most cost-competitive technology (along with biomass) at an electricity price above of EUR44/MWh; cheaper electricity renders electrolysis more competitive (FCH JU 2019).

Carbon pricing, as a proven tool for greenhouse gas abatement aspirations, is at the core of every hydrogen roadmap. If worldwide carbon prices rise from their present lows, green hydrogen may end up with a business case of its own, as the cost gap narrows and a level-playing field is created. For Europe in particular, the ETS-related price of carbon emissions will either make or break green gas technologies, including hydrogen.

The small-scale nature of transmission and storage projects for green gases calls into question their right to simplified permits and funding from the EU’s Connecting Europe Facility (CEF) upon their inclusion into TYNDPs and, later, in Project of Common Interest (PCI) lists, in line with the TEN-E regulation[8]. For example, green gases could benefit from investments easing flows from distribution to the more flexible transmission level.

Consequently, green gas technologies, including hydrogen, involve projects with a questionable cross-border impact and, as such, are inconsistent with the subsidiarity principle of EU legislation (Schittekatte et al. 2020). Subject to their scale and geographical expansion, installations like P2G can be deemed cross-border-relevant. Nevertheless, as explained, a market-based approach is preferable during the initial development stages of such projects. This approach downplays the role of TSOs, upon which TYNDPs are based[9].

As a result, TEN-E might not be perfectly suited to the regulation of small-scale infrastructure. Instead, a broader optimization of the EU toolkit may be essential in order to promote innovation in relation to projects with few to zero cross-border implications.

Energy security and geopolitics

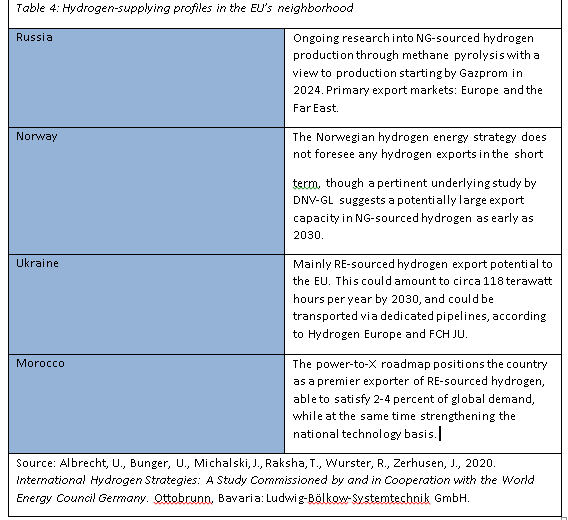

The EC’s Hydrogen Strategy (2020b) foresees the installation of another 40GW of electrolyzers in EU’s Eastern and Southern neighborhood by 2030. Factors such as production locations (i.e. abundant resources and cheap production costs), transport technologies (i.e. availability of ships for liquid hydrogen or ammonia and pipelines for gaseous hydrogen) and the distance from –and infrastructure at– reception points will determine which countries will assume exporting roles and sustain dynamics comparable to those of the oil and gas markets, including the likelihood of geopolitical confrontation.

The higher the penetration of hydrogen into Europe’s energy system, the more important it will be to formulate supply security strategies to guarantee reliable supplies to end-users via a diversified portfolio of intra-EU producers and/or third-country exporters that will access onshore/offshore cross-border pipelines and LNG facilities. For liquidity to become a central element of the primary hydrogen clusters, the availability of adequate and secure volumes from various domestic and third-country suppliers is of marked significance.

The trade in green gases, including hydrogen, is poised to reshape Europe’s geopolitical energy map, triggering the emergence of new energy suppliers. Traditional oil and gas transit states, like Belarus and Ukraine, could turn into biomethane and hydrogen exporters to the EU, if they avail themselves of their production potential[10]. Ukraine’s nuclear sector uses hydrogen technology, albeit in small volumes, to cool generators (Kyiv Post 2020). Thanks to its already developed gas network, Ukraine could help the EU in its quest for hydrogen partnerships in its immediate vicinity. In fact, Ukraine was recently identified by Energy Commissioner Kadri Simson as one of Europe’s potential partners with respect to the hydrogen trade (Abnett and Eckert 2020).

The EU’s energy reliance on Russia remains debatable. State incumbent Gazprom is active in pyrolysis. The cost-competitiveness of Russian RE-sourced hydrogen is more uncertain, due to low solar radiation and wind speeds. According to Gazprom Export, modern pipelines, similar to the type used in Nord Stream, could accommodate up to 70 percent hydrogen blended into natural gas (Mitrova et al., 2019). Nonetheless, all this implies time-consuming shifts in Russian producers’ export business models and Russia’s domestic market itself, which could provide the impetus for deliberations on the level of the EU-Russia Gas Advisory Council and/or other formats.

A cross-border renewable hydrogen trade could foster diplomatic relations between the EU and North Africa, Spain and other Mediterranean M-S that could turn into hydrogen transit hubs, and Australia, which offers a reliable shipping route. For example, Germany has signed a cooperation agreement with Morocco concerning methanol production from hydrogen (Federal Ministry for Economic Cooperation and Development, n.d.).

While it will lead to geopolitical shifts, the decarbonization of the European gas sector through hydrogen could to a certain extent depoliticize energy supply, since the emergence of a decentralized system in which hydrogen will be domestically generated will make the EU more flexible in relation to stress incidents, as well as limiting the constant need to cultivate external gas relations for supply security reasons, as is the case within the current commoditized market model.

After World War Two, control over energy resources and their allocation was widely believed to endow countries with power within the international system. For importers, energy security is all about adequate and reliable supplies at reasonable prices, whereas for exporters, it has to do with their reputation as reliable suppliers, as well as with guaranteed revenues from end-markets (Yergin 2006). In this context, key threats such as politically or economically motivated regional conflict have been identified as underlying disruption incidents which affect importers and exporters alike. Decarbonization could alter the current energy security motif into one of geopolitical competition over the production of energy resources, rather than over mere access to them; this is exemplified by the unfolding battle between the EU and China over global supremacy in electrolyzer manufacturing (Amelang 2020).

Finally, the completion of the internal gas market, which is still hindered by geographically uneven trade liquidity and unevenly applied infrastructure regulation across M-S and membership hopefuls, should precede the establishment of a hydrogen economy. Finalizing the remaining network codes, strengthening access to gas infrastructure through investments in the poorly interconnected South-eastern and Central and Eastern Europe, and fostering retail gas competition through the phasing out of price regulation are all steps which need to precede the adaptation of the current gas regulatory framework and market design to the decarbonization of the gas sector. Preconditions for a smooth transposition of the gas decarbonization acquis include: a) the integration of infrastructure investments and policies to enable uniform sector coupling, b) the avoidance of national market fragmentations (Liakopoulou 2020).

Conclusions

Sector coupling (i.e. the interlinkage between the gas and electricity sectors in terms of their markets and infrastructure) is an essential step towards the envisioned EU carbon-neutral economy of 2050, as set out in the European Green Deal. Prior to the transition to an electron-driven future, gas-fired generation can provide both a cost-effective way to reduce CO2 emissions and a necessary back-up to RES in the medium term, especially during peak demand periods; after 2030, its associated infrastructure can be used to accommodate green gases, including hydrogen.

Supply security and competitiveness have been the two main aspects that have governed EU gas market design to date. Climate targets set for 2050 now require that decarbonization be considered a third aspect. The successful decarbonization of the European energy system is subject to flexibility of energy supply, including over seasonal timescales. In this respect, hydrogen could smooth the way for RES integration by overcoming seasonal fluctuations, especially in parts of Europe troubled by transmission bottlenecks –provided that a facilitatory “light” gas regulatory framework is also in place. The EC’s Hydrogen Strategy, released along with the Energy System Integration Strategy, does some rudimentary groundwork for the foreseen regulation, addressing several conventional gas market concepts that could be adapted to hydrogen trade and to infrastructure investments.

From an economics standpoint, the creation of a business case for hydrogen technologies may require a broader optimization of the EU toolkit in order to promote innovation in relation to projects with few to zero cross-border implications.

Lastly, on the energy security front, the higher the penetration of hydrogen into Europe’s energy system, the more important it will be to formulate supply security strategies to guarantee reliable supplies to end-users via a diversified portfolio of intra-EU producers and/or third-country exporters. The trade in green gases, including hydrogen, is poised to reshape Europe’s geopolitical energy map, triggering the emergence of new energy suppliers that, like Ukraine, traditionally play transit roles. Decarbonization could alter the current energy security motif into one of geopolitical competition over the production of energy resources, rather than over mere access to them; this is exemplified by the unfolding battle between the EU and China over global supremacy in electrolyzer manufacturing. Needless to say, the completion of the internal gas market, which is still hindered by geographically uneven trade liquidity and unevenly applied infrastructure regulation across M-S and membership hopefuls, should precede the establishment of a hydrogen economy.

References:

- Abnett, K. and Eckert, V., 2020. EU Wants Rules on Hydrogen Trade with Partners – Bloc’s Energy Chief. [online] Available at: https://www.reuters.com/article/germany-eu-energy-ministers/update-1-eu-wants-rules-on-hydrogen-trade-with-partners-blocs-energy-chief-idUKL8N2GW3V6 [Accessed on November 09, 2020].

- Albrecht, U., Bunger, U., Michalski, J., Raksha, T., Wurster, R., Zerhusen, J., 2020. International Hydrogen Strategies: A Study Commissioned by and in Cooperation with the World Energy Council Germany. Ottobrunn, Bavaria: Ludwig-Bölkow-Systemtechnik GmbH.

- Amelang, S., 2020. Who Will be the Hydrogen Superpower? The EU or China. [online] Available at: https://energypost.eu/who-will-be-the-hydrogen-superpower-the-eu-or-china/ [Accessed on November 09, 2020].

- Artelys, 2019. Investigation on the Interlinkage Between Gas and Electricity Scenarios and Infrastructure Projects Assessment. Paris: Artelys.

- Cembalest, M., 2020. Tenth Annual Eye on the Market Energy Paper. J. P. Morgan. [online] Available at: https://am.jpmorgan.com/content/dam/jpm-am-aem/global/en/insights/eye-on-the-market/tenth-annual-energy-paper-full.pdf [Accessed on November 09, 2020].

- Cihlar, J., Lejarreta, A. V., Wang, A., Melgar, F., Jens, J., Rio, P., 2020. Hydrogen Generation in Europe: Overview of Key costs and Benefits. Guidehouse and Tractebel Impact.

- Directive 2009/73/EC of the European Parliament and of the Council of 13 July 2009 concerning common rules for the internal market in natural gas and repealing Directive 2003/55/EC.

- EC, 2020a. Proposal for a REGULATION OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL establishing the framework for achieving climate neutrality and amending Regulation (EU) 2018/1999 (European Climate Law) COM/2020/80 final.

- EC, 2020b. COMMUNICATION FROM THE COMMISSION TO THE EUROPEAN PARLIAMENT, THE COUNCIL, THE EUROPEAN ECONOMIC AND SOCIAL COMMITTEE AND THE COMMITTEE OF THE REGIONS A hydrogen strategy for a climate-neutral Europe. COM/2020/301 final.

- EC, 2020c. COMMUNICATION FROM THE COMMISSION TO THE EUROPEAN PARLIAMENT, THE COUNCIL, THE EUROPEAN ECONOMIC AND SOCIAL COMMITTEE AND THE COMMITTEE OF THE REGIONS Powering a climate-neutral economy: An EU Strategy for Energy System Integration. COM (2020) 299 final.

- EFET, 2020. EFET comments on the Roadmap for an EU Hydrogen Strategy. Amsterdam: EFET.

- ENTSOG, 2020. ENTSOG 2050 Roadmap: Action Plan. Brussels: ENTSOG.

- EU ACER, 2015. European Gas Target Model: Review and Update. Ljubljana : EU ACER.

- EU ACER and CEER, 2019. The Bridge Beyond 2020: Conclusions Paper. Brussels and Ljubljana: EU ACER and CEER.

- EU ACER and CEER, 2020. Webinar: The Annual Report on the Results of Monitoring the Internal Electricity and Gas Markets.Available at: https://www.youtube.com/watch?v=qD-0oBUmEV8 [Accessed on November 09, 2020].

- Federal Ministry for Economic Cooperation and Development, n. d. Green Hydrogen and Power-to-X Products. [online] Available at: http://www.bmz.de/en/issues/wasserstoff/index.html [Accessed on November 09, 2020].

- Fuel Cells and Hydrogen Joint Undertaking, 2019. Hydrogen Roadmap Europe: A Sustainable Pathway for the European Energy Transition. Belgium: FCH JU.

- Glachant, J. M., 2011. A Vision for the EU Gas Target Model: The MECO-S Model. EUI Working Papers RSCAS 2011/38/. Florence: European University Institute, Robert Schuman Centre for Advanced Studies, Florence School of Regulation.

- IEA, 2019. The Future of Hydrogen: Seizing Today’s Opportunities. Paris: IEA.

- IEA, 2020. European Union 2020: Energy Policy Review. Paris: IEA.

- Ingwersen, J., 2019. ENTSOG Roadmap for Gas Grids: Making Grids Ready for Transition. Brussels: 32nd Madrid Forum. [online] Available at: https://ec.europa.eu/info/sites/info/files/01.c.01_presentations_-_entsog_-_entsogs_roadmap_for_gas_sector_decarbonisation_-_ingwersen.pdf [Accessed on November 09, 2020]/

- Kyiv Post, 2020. A Hydrogen Energy Future in Ukraine? [online] Available at: http://brandstudio.kyivpost.com/feogi/hydrogen-energy-future/ [Accessed on November 09, 2020].

- Liakopoulou, M., 2020. Gas Market Integration and Decarbonization in Southeastern and Central and Eastern Europe. International Association for Energy Economics Webinar Series. [online] Available at: https://www.iaee.org/en/webinars/webinar_liakopoulou.aspx [Accessed on November 09, 2020].

- Mitrova, T, Melnikov, Y., Chugunov, D. and Glagoleva, A., 2019. Водородная экономика – путь к низкоуглеродному развитию (Hydrogen economy – a path towards low-carbon development). Moscow: SKOLKOVO.

- Renewable Energy Directive (RED II). Directive (EU) 2018/2001 (recast) on the promotion of the use of energy from renewable sources (Text with EEA relevance.)

- Roberts, D. and Janssen, M., 2020. The Role of LNG in the Energy Sector Transition: Regulatory Recommendations. [presentation] Brussels, October 2020. Frontier Economics.

- Schittekatte, T., Pototschnig, A., Meeus, L., Jamasb, T., Llorca, M., 2020. Making the TEN-E Regulation Compatible with the Green Deal: Eligibility, Selection, and Cost Allocation for PCIs. Florence: Florence School of Regulation, Copenhagen School of Energy Infrastructure.

- van Melle, T., Peters, D., Cherkasky, J., 2018. Gas for Climate: How Gas Can Help to Achieve the Paris Agreement Target in an Affordable Way. Brussels: Ecofys.

- Yergin, D., 2006. “Ensuring Energy Security.” Foreign Affairs, 85 (2), pages 69-82.

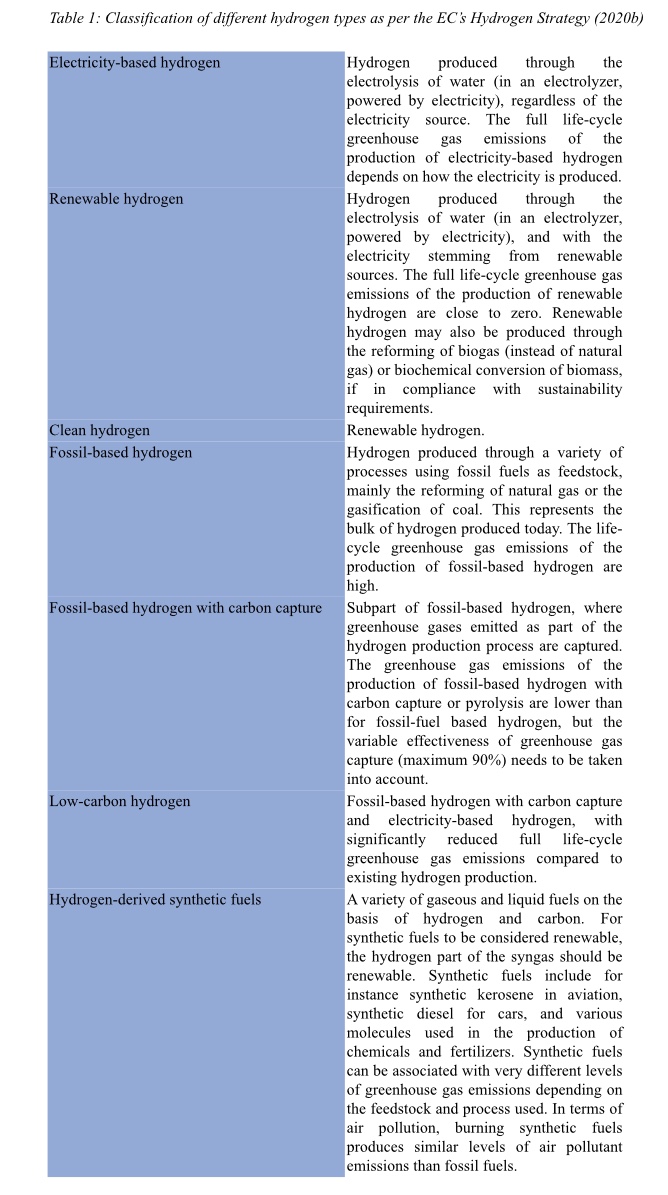

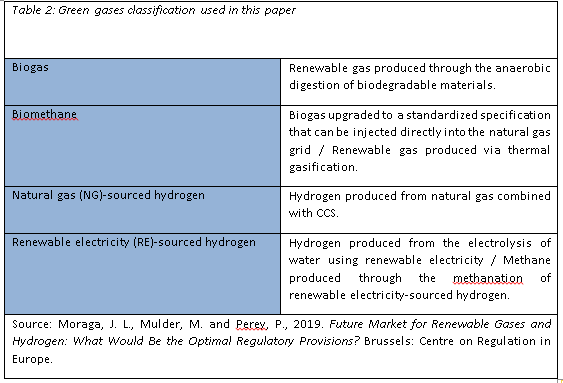

[1] See tables 1 and 2 for classifications of different types of hydrogen and other green gases.

[2] Transmission system operators – TSOs, distribution system operators – DSOs, storage system operators – SSOs, LNG system operators – LSOs.

[3] Discussion on the GTM was kickstarted at the European Gas Regulatory Forum (Madrid Forum) in 2010 with the aim of ensuring the consistent implementation of the Third Energy Package (TEP) by all stakeholders (Glachant 2011). The latest GTM (EU ACER 2015) has been deemed generally successful, although stakeholders have noted that “its metrics focus on market functioning and have not, to date, tracked progress on decarbonization” (EU ACER and CEER 2019).

[4] Directive 2009/73/EC Article 1.2: “The rules established by this Directive for natural gas, including LNG, shall also apply in a non-discriminatory way to biogas and gas from biomass or other types of gas in so far as such gases can technically and safely be injected into, and transported through, the natural gas system.”

[5] 200,000 km of high-pressure TSO-operated and 1.4 million km of medium and low-pressure, DSO-operated networks (Artelys 2019), along with 1,100 TWh of underground gas storage capacity (IEA 2020).

[6] 29 import facilities in 11 Member-States with 210 BCM/a of regasification capacity and 10 MCM of storage capacity (IEA 2020).

[7] On network operator neutrality, the Strategy (EC 2020b) specifically states that: “To facilitate the deployment of hydrogen and develop a market where also new producers have access to customers, hydrogen infrastructure should be accessible to all on a non-discriminatory basis. In order not to distort the level playing field for market-based activities, network operators must remain neutral. Third-party access rules, clear rules on connecting electrolyzers to the grid and streamlining of permitting and administrative hurdles will need to be developed to reduce undue burden to market access. Providing clarity now will avoid sunk investments and the costs of ex-post interventions later.”

[8] The EC’s Energy System Integration Strategy (2020c) states that: “While gas networks may be used to enable blending of hydrogen to a limited extent during a transitional phase, dedicated infrastructures for large-scale storage and transportation of pure hydrogen, going beyond point-to-point pipelines within industrial clusters, may be needed.” It also expects network planning through the TYNDPs to abide by “a more integrated and cross-sectoral approach, notably of the electricity and gas sectors” and to be in “full consistency with climate and energy targets, including alignment with National Energy and Climate Plans (NECPs).” Finally, it identifies the need for a revised TEN-E Regulation that is “fully consistent with climate neutrality and enables the cost-effective integration of the energy system, as well as its integration with the digital and transport systems.”

[9] In its 2050 Roadmap, the European Network for Transmission System Operators for Gas (ENTSOG) proposes that hydrogen projects should be included in integrated TYNDPs, starting from 2022, by means of “a change to the existing TYNDP process, PCI criteria and underlying cost-benefit analysis (CBA) methodology” which is scheduled for 2021 (ENTSOG 2020).

[10] An Ecofys study (van Melle et al. 2018) suggests that Ukraine and Belarus, two countries with existing pipeline connections to the EU, could contribute up to 20BCM/a of biomethane to the intra-EU output.