Protecting employment was not just a 2020 issue – while 2021 will be racing for vaccinations, and the immediate and complete relaxation of the containment measures will remain unlikely, the need to protect incomes and jobs will be as relevant as ever. As such, this policy brief analyses the rationale for, and the integration qualities of, the SURE instrument, which is being implemented following a European Commission proposal in April 2020 and a Council decision on 19 May 2020. By establishing the importance of short-time work schemes in protecting employment during the crucial first months of the pandemic, the brief explains the solidarity function of the SURE instrument, which ensures that all Member States have the resources available to make use of similar schemes to protect jobs, workers and incomes. Additionally, the decision to fund the SURE instrument with social bonds, which have been met with consistently overwhelming investor demand, forms an initial treasury form of what can be regarded as a European safe asset; something which will be strengthened in size and scope by the incoming European bonds funding the Recovery Instrument, Next Generation EU. Moving beyond 2021 and looking into a future model of employment protection in the future of the European labour market, the brief outlines the legal and political feasibility of transforming SURE into a permanent employment scheme, and, as such, an instrument of integration and socioeconomic resilience in the European Union.

You may find the Policy paper by Christina Kattami, Policy officer, European Commission, in pdf here.

The use of, and rationale for, short-time work schemes

Protecting employment from the unprecedented halt in economic activity induced by the COVID-19 pandemic will not be an issue in 2020 alone—while the focus in 2021 will be on racing for vaccinations, and the immediate relaxation of the current containment measures remains unlikely, the need to protect incomes and jobs will remain as relevant as ever in the year to come.

“Short-time work schemes have been instrumental in protecting employment in Europe amidst the coronavirus-induced crisis.”

In the crucial first months of the pandemic, many EU Member States turned to short-time work schemes in an effort to protect incomes and jobs. These schemes proved effective in protecting employment. Short-time work (STW) schemes and similar measures are public programmes that allow firms which are experiencing economic difficulties to temporarily reduce the hours worked by their staff, while providing their employees with income support from the State for the hours not worked. In essence, such schemes help preserve employment by encouraging firms to adjust labour input along the intensive margin (by reducing working hours) rather than the extensive margin (by laying off staff).

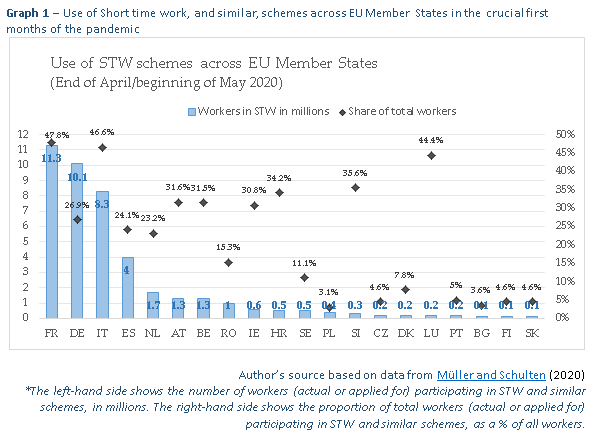

As the graph below shows, 20 Member States had employed STW or similar schemes by the end of April/beginning of May 2020; of the 20, only 12 had had similar systems in place before the pandemic. The highest share of workers in STW schemes was registered in France (with 47.8% of the workforce, which represents 11.3 million workers); Italy (46.6% of the workforce, 8.3 million workers); Germany (26.9% of the workforce, 10.1 million workers); and Spain (24.1% of the workforce, 4 million workers).

“In the EU as a whole, more than one in five workers had applied for a short-time work scheme at the end of April 2020.”

In the EU as a whole, more than one in five workers—a total of 42 million workers—had applied for STW or similar schemes by the end of April 2020.

Has this broad-based use been effective in protecting employment? The literature presents a consensus: it has (see, for example, the collection of public policy responses to the socio-economic crisis in the OECD’s Employment Outlook 2020 p. 36).

“The empirical evidence suggests that countries that rely heavily on STW schemes have experienced milder employment declines. It also shows that STW schemes have the potential to protect more than the jobs they set out to save.”

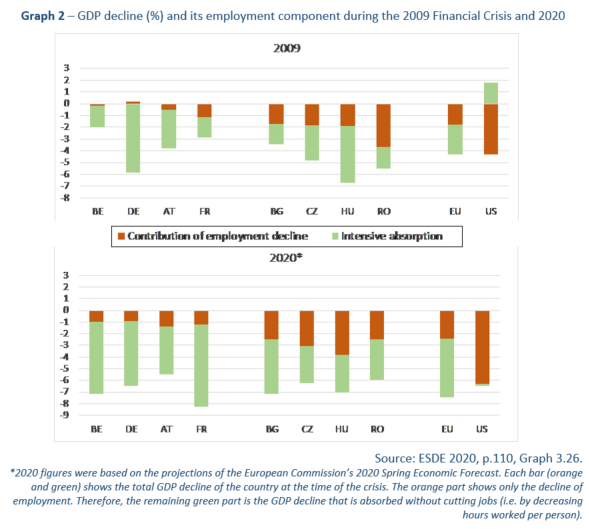

The European Commission’s annual Employment and Social Developments in Europe report compares the 2009 crisis to the current one and finds that employment declines are milder in countries that rely heavily on STW schemes to reduce employees’ working hours (intensive absorption). Take Germany, for instance; in 2009, its GDP decline was significant at -5.6%. Nonetheless, the country managed to emerge from that crisis with no employment decline at all. On the other hand, the US, which does not rely on STW schemes, experienced pronounced job cuts in both crises without intensive absorption.

The country-specific analysis contained in this same report confirms this finding empirically: in times of declining production, a major part of the adverse effect on unemployment can be absorbed through short-time work schemes. In addition, over and beyond this, the analysis points to an important multiplier effect: if we subsidise one job with STW, we will actually end up saving more than this one job (see ESDE 2020, Chapter 3, p.112).

Similarly, analysts agree that the immediate budgetary cost of the STW schemes is less than the cost that would be incurred in the form of unemployment benefits that would have to be paid out if the STW schemes were not in place; however, that does not imply that STW schemes are not costly themselves.

“STW are cheaper than having to support unemployment benefits, but still present an important budgetary cost to the state.”

Therefore, we know that:

- STW schemes are efficient at cushioning employment declines following an adverse economic shock;

- STW schemes can actually have a multiplier effect and save more jobs than they were designed to save;

- STW schemes are cheaper than unemployment benefits…

- …but remain costly, and impose budgetary burdens on a number of Member States. This is particularly true if the STW schemes need to be extended to self-employed workers, who have been hit particularly hard by the pandemic crisis.

The SURE instrument addresses this fourth point: it provides the resources required to ensure that all Member States use STW schemes to their full potential and protect all workers against the risk of unemployment and income loss.

The SURE instrument in numbers

“The SURE regulation was put forward by the European Commission as early as April, and was approved by the Council in the record time of 1.5 months.”

The European Commission put forward a proposal for temporary Support to mitigate Unemployment Risks in an Emergency (SURE) back in April. The Regulation was adopted by the Council in record time (1.5 months), and the procedure began formally in the summer.

The SURE instrument provides resources through loans made on favourable terms for supporting STW or similar measures, allowing Member States to protect employment. These measures include support for businesses which is explicitly aimed at subsidising labour costs; support for the self-employed and other workers not covered by traditional STW schemes; special COVID-19 benefits (e.g. sick-leave, quarantine, parental leave); and health-related measures (supporting the resumption of activities, special benefits for medical staff, etc.).

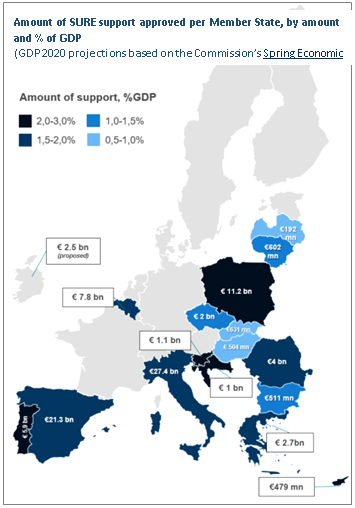

“To date, 18 Member States have made a formal request to use SURE.”

The procedure is as follows: a Member State makes a formal request to the Commission to use the SURE instrument; the Commission makes a relevant proposal, which then has to be approved by the Council. To date, 18 Member States have made formal requests to use the SURE instrument and 17 have been approved. In all, €87.9 billion has been approved of the €100 billion in funding available, based on Commission proposals. The map shows the amounts approved for the 17 Member States and for Ireland, whose request is being considered by the Council, and the percentage of their respective GDP these represent. The €12.1 billion left (€9.6 if we do not include the €2.5 billion proposed for Ireland) are available for Member States that have not yet made a claim.

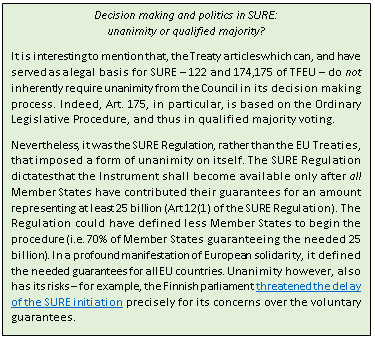

One of the most interesting features of the SURE instrument is that the loans provided to Member States under it are underpinned by a system of voluntary guarantees amounting to €25 billion from the Member States (Article 11 of the SURE Regulation). Each Member State’s contribution to the total guarantee is proportional to its share of the European Union’s total gross national income (GNI), based on the 2020 EU budget. In effect, this means that the Member States have agreed to support each other through the Union, even if they have opted not to use the specific instrument themselves. This makes SURE an instrument of tangible solidarity in the European context.

“SURE is an example of tangible European solidarity, as every Member State has submitted a voluntary guarantee to underpin the instrument’s financing, even if they are not using the instrument themselves.”

Another interesting development in relation to the instrument is its financing. On 20 October, in order to raise the 100 billion needed for the SURE instrument, the European Commission issued its inaugural social bonds, the first time it has issued social bonds in its history. The €100 billion in loans raised through the social bonds are backed by the €25 billion of guarantees which the Member States committed voluntarily to the EU budget in order to leverage the financial power of SURE. The first three issuances of the bonds, worth €39.5 billion, have already been disbursed to the Member States that requested assistance through SURE.

The SURE instrument as a force for socio-economic integration

On closer reading, the SURE instrument may very well be much more than a COVID emergency measure. It has the concrete potential to become a powerful force for European socio-economic integration and resilience, both through its content and the manner of its funding. However, whether the instrument achieves its full potential depends on how permanent it is.

Its content: SURE represents a countercyclical shift towards the creation of a real European job insurance scheme

‘Job insurance’

“…it represents a shift towards the creation of a real European job insurance scheme.”

In very pragmatic terms, the SURE instrument marks a paradigmatic shift towards the creation of a real European job insurance scheme. It ensures that all Member States, not only those who can afford to do so, can protect employment and thus avoid the cost (i.e. the sudden budgetary burden of unemployment benefits) and social consequences of a sharp rise in unemployment.

Take Italy and the Netherlands as examples of countries that had employed STW schemes by the end of April. As outlined in the Commission’s assessment of Stability Programmes back in May, the budgetary impact of using short-time work schemes in Italy was 1.1% of its GDP, while it was proportionally more in the Netherlands, at 1.8% of its GDP. However, the difference between the two is that countries like Italy—highly indebted, with low growth and high government deficit rates—have less fiscal space to protect workers through STW. In contrast, countries like the Netherlands, with lower debts and deficits, can cope with the unexpected budget expenditure. Ergo, it should not come as a surprise that the Netherlands, Germany, Austria and Finland, all of which have STW schemes in place, have not applied for SURE loans.

We cannot forget that the SURE resource is still a loan to the 18 countries, not a grant, so protecting employment does not come at no long-term cost. Nevertheless, it has been possible to make the loan on favourable terms (indeed, the interest rates are negative), due to the EU’s high credit rating. In short, SURE ensures support for protecting employment in countries that would either be unable to finance STW or similar schemes themselves, or would have to borrow on much less favourable terms on the financial market.

‘Countercyclical’

European economists and political scientists often fall into the trap of comparing the European internal market with the American federal market to gain insights into the level of market integration in Europe and the outstanding qualities they need to design. In such comparisons, there is one area in which Europe always ‘loses’: the absence of a truly European unemployment insurance. In the US, the transfer union and automatic fiscal stabilisers ensure the de facto presence of a sort of US-wide job insurance.

“Together with this, SURE is a countercyclical mechanism that can stabilise the EU economy in times of adverse shocks.”

There is no concrete European transfer mechanism to achieve this, nor a level of European labour mobility that could bring about a macroeconomic balance in unemployment rates. The SURE instrument does not aim to achieve a transfer union, nor is it, by design, an automatic fiscal stabilization mechanism. It does, however, have counter-cyclical qualities: in the crisis context, it is applied in a targeted way to prevent the crisis having certain effects. As such, and coupled with the significant volume of its resources, SURE can be considered a first step towards an EU fiscal capacity stabilisation instrument.

Its financing: the SURE social bonds establish a Treasury and constitute a step towards a European safe asset

The European Commission can borrow from the international capital markets on behalf of the EU, and has done so. Because the EU is a top-rate borrower and enjoys an AAA credit rating with a stable outlook, it can benefit from low rates that are not available to all of its Member States. Currently, the EU has three loan programmes in place that reflect this mentality and seek to provide financial assistance to Member States and third countries that are experiencing financial difficulties: the European Financial Stability Mechanism; macro-financial assistance to non-EU countries, and balance of payments assistance.

The SURE bonds may be the EU’s fourth loan programme, but it is the first one enacted within a Social Bond framework. This framework will ensure that the investments raised using the social bonds are used exclusively to finance programmes with a positive social impact—protecting employment, for example, as SURE strives to do. The nuances of choosing social loans can be favourable, as such loans can also attract investors with a more philanthropic profile, as the EU starts competing for investors against other AAA-rated sovereign and supranational issuers. In fact, on 27 October 2020, the EU SURE social bond was listed on the Luxembourg Stock Exchange, and will continue to be displayed on the Luxembourg Green Exchange, the world’s leading platform dedicated exclusively to sustainable securities.

“The social bonds are issued at very low, or even negative rates—meaning that Member States can receive more today than what they will have to pay back in the future.”

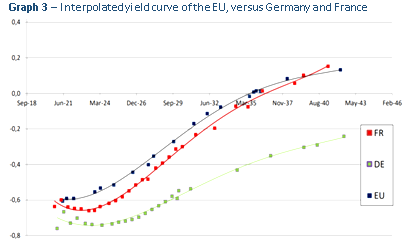

On 20 October, the European Commission issued an initial €17 billion inaugural social bond under the EU SURE instrument. The bonds were oversubscribed more than 13 times, with demand for €233 billion, resulting in favourable pricing terms. The first issuance operation consisted of the issue of two bonds: €10 billion to be redeemed in October 2030 (10-year maturity) and €7 billion in 2040 (20-year maturity). The interest rates on these securities are higher than those available on the market, but are still very low or even negative—in this latter case, the Member States will actually have to pay less than they have received. Indeed, the 10-year bond would have a negative yield of around -0.2%, and the 20-year bond a yield of 0.13%.

The next two issuances of EU SURE bonds, on November 10 and 25, were received with the same pattern of demand. The third issuance, a single tranche bond issue with a 15-year maturity, was priced at a negative yield of -0.102%; this means that for every €102 the Member States receive, they pay back €100.

The overwhelming demand for these social bonds demonstrates investors’ confidence in the EU, but also the increased demand for safe assets as a whole—that is, debt instruments that are expected to preserve their value despite adverse systemic events.

A growing body of literature has emphasized not only the importance of safe assets, but also their perceived shortage (see Caballero et al, 2017). In this context, it has been widely argued that a common safe asset would enhance financial integration and diversify and reduce risk. And by breaking free from the ‘bank-sovereign doom loop’, such an asset could enhance the resilience of the Economic and Monetary Union. It is worth mentioning that the European Commission has sought to propose a type of European bond, most notably with its proposal for Sovereign bond-backed securities (SBBS)—a proposal that ended up deadlocked in the Council.

“A safe asset needs to provide a security and liquidity. The back-to-back loan function of the SURE bond can represent those safe asset qualities already.”

Contrary to common perception, a common safe asset does not automatically or necessarily mutualise existing debts, and this is exactly the line of thought the SURE bonds, and the Next Generation EU bonds use. Rather, it is a simple and straightforward institutional design—the SURE ‘treasury’, bound at 100 billion, borrows from the private sector and distributes the money from the sale of bonds to Member States according to their GDP and their needs, following Council approval. By design, this is not a transfer—or a fiscal—union, just a design based on the advantages afforded by the EU’s back-to-back loans. It does result, however, in a stronger EU treasury (albeit one that is limited in scope) that by using a bond framework to raise its funds, delivers de facto the missing safe asset. A safe asset needs to be able to provide both ‘security’ and ‘liquidity’. The European Commission has proven that it is ‘secure’; now, as a priority, it needs a strategy to enhance the liquid and transparent market in EU bonds, as the Social Bond Framework aims to do.

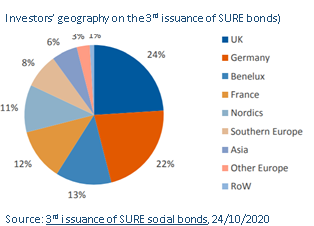

With an EU treasury and a form of Eurobond, the euro’s international role can also be strengthened. The latter has traditionally been hindered by the currency’s low reserve function—in the absence of a common Eurobond, investors have opted to hold currencies (predominantly the dollar) other than the euro as their safe asset. It is worth noting that in the most recent issuance of SURE bonds, around a third of the investors (led primarily by the UK) were not Member States.

“Albeit limited in scope and time, the SURE bonds have created a form of European treasury—that will be reinforced by the 750 billion issued in bonds for the Recovery Instrument (NGEU).”

€100 billion is a very small sum for a European Treasury covering a Single Market with more than €13 trillion in GDP. However, another €750 billion will be added to it by means of the Recovery Instrument, Next Generation EU, which will use the same financing mechanism, albeit with normal—not social—bond issuance. Given an increase in predictability, and size, EU bond issues could become the foundation of more integrated and liquid internal capital markets.

This means that the EU will issue more than €900 billion in bonds between now and the end of 2026 (with the bulk of the issue concentrated in the period 2021–2024). According to Commissioner Hahn: ‘This is the highest amount ever borrowed in the history of the EU’, and it’s also worth mentioning that no other supranational organisation currently borrows as much as the Union in this way.

Its permanence: how to ensure that SURE fulfils its potential

“SURE is linked in its entirety to the Covid crisis—meaning that if another crisis comes along in the future, the EU will not be able to employ it.”

One factor is crucial if SURE is to fulfil its fiscal stabilization, job insurance and safe asset functions: its permanence. As it stands, SURE is a temporary emergency instrument, since it is linked in both its time and scope entirely to the COVID-19 emergency. According to its Regulation, it ceases to be available on 31 December 2022 (Art 12.3), while in addition the European Commission has to assess every six months whether the exceptional circumstances causing severe economic disturbances in Member States still exist, and report their conclusions back to the Council (Preamble (15)). Consequently, if another crisis were to occur in the future, SURE would not be part of the toolkit with which the EU could provide immediate support to countries in need.

However, this in no way precludes the establishment of a future permanent unemployment reinsurance scheme. Indeed, a more permanent European Unemployment Reinsurance Scheme was proposed at the start of the Von der Leyen Commission (see the Agenda put forward by the President-designate before taking office). When the COVID-19 crisis began, the European Commission simply accelerated the preparation of its legislative proposal for SURE, explicitly mentioned its intention of building upon SURE in its communication in relation to Europe’s Recovery Plan. Already, other mechanisms such as the European Social Fund plus and the new REACT-EU initiative can be used to support job maintenance through inter alia short-time work schemes, support for the self-employed, and job creation.

Legal feasibility

The legal basis of the temporary SURE instrument is the ‘crisis’ Article 122. The first part of the Article expresses the call for a collective solidarity response and enables the construction of the guarantee system of voluntary contributions from Member States to the Union. Its second part allows the Union to provide financial assistance to a Member State which is in difficulty, or seriously threatened by difficulties, as a result of natural disasters or exceptional occurrences beyond its control. This mechanism has been used once before, during the financial crisis, as a means for establishing the European Financial Stabilisation Mechanism which the Union used to provide loans to Ireland and Portugal and bridge-finance for Greece.

“Legally, a permanent SURE can be feasible, and was already on the Agenda put forward by President-designate Von der Leyen, before she took office in December 2019.”

To make SURE a permanent instrument, we have to move beyond the ‘crisis’ Article onto permanent initiatives in economic governance. This legal basis is evident in Articles 174 and 175 of the TFEU, which enable further EU actions as long as they are aimed at enhancing economic, social and territorial cohesion within the European Union. As such, the new permanent SURE instrument must prove in its design that this is its objective. If it is once again linked to short time work and similar schemes, which are crucial for protecting employment in times of adverse shocks, it is clearly aimed at fulfilling economic and social cohesion and will thus have a solid legal basis.

This has a legal precedent: there are two examples of current EU instruments based on Article 175: the European Solidarity Fund (EUSF) and the European Globalisation Adjustment Fund (EGF). These funds are activated to provide support to Member States in exceptional circumstances, such as major natural disasters (the EUSF) or large-scale worker redundancies as a result of major structural changes in world trade patterns due to globalisation or an economic crisis (the EGF).

Nevertheless, these precedents concern only the content of the permanent mechanism, whose financing, especially in maintaining the social bond framework, would rest on a procedure all its own. If the permanent SURE instrument wishes to raise a significant amount of funds, which should be the case, there are two viable paths for its continuation: The first would involve a decision to raise the own resources ceiling—that is, the maximum amount of own resources the Union can request the Member States to make available to the Union in a given year. This would be necessary, as the current ceiling would likely be too low to include an additional amount for SURE (in the current MFF 2014–2020, it is 1.20% of the EU’s GNI). Indeed, given the current ceiling, two other lending programmes, the Balance of Payments assistance facility and the European Financial Stability Mechanism, already account for the maximum amount of own resources that the EU may raise in one year.

However, increasing the own resources ceiling is a challenging legal procedure, as it would require the unanimous agreement of the Council, as well as the approval of all national parliaments.

“Politically, the feasibility of a permanent SURE could be high, if its smooth temporary agreement is a good basis for projection.”

The second option is more intergovernmental in nature, and represents how the temporary SURE came into being in the first place; setting up the system of national voluntary guarantees to underpin the financing of the permanent instrument. This would still require the approval of national parliaments, albeit in a much more targeted fashion than the difficult political negotiations an Own Resource decision would entail. Additionally, the specificities of having either all Member States or only a majority of them contributing to the system of guarantees could be defined on a case-by-case basis in the Regulation of the permanent instrument.

In short, with some different options in mind, the legal basis–in terms of both the content and the financing of a permanent SURE focused on short-time work and similar schemes–could be available and feasible. If one were to be ambitious, one might say it could even be achieved during the current Von der Leyen Commission.

Political feasibility

If the agreement on the temporary version of SURE is anything to go by, there should be no problems in terms of the political feasibility of agreeing on its permanent version. SURE was agreed and adopted in record time, with almost no concerns expressed, despite its bold bond function. At the same time, with the Commission expressing its intentions for a future SURE clearly, and with the Parliament explicitly supporting a loans-based stabilisation capacity within the MFF, there are strong grounds for claiming that a permanent SURE would enjoy broad and bipartisan support.

Of course, the easy adoption could have simply been a result of SURE’s temporary nature, coupled with its limited scope and its loan nature. A permanent SURE could thus be compared with the European Investment Stabilisation Function (EISF), which was proposed by the Juncker Commission in 2018. Like SURE, the EISF was designed to allow the Commission to offer back-to-back loans to countries facing asymmetric shocks which they could not manage on their own. The EISF had a far lower lending capacity than the SURE has now, but it was still rejected immediately by many Member States, who considered it a Trojan horse for a common European stabilisation capacity. Given that precedent, things do not look good for the political acceptance of the SURE instrument, which could be seen as containing a similar potential.

In the past of European policymaking, however, the power of precedent, and the strength of incrementalism in agenda-setting, has been strong. The precedent of having SURE bonds already in place, together with a likely softer resistance approach from the Member States after the shock of the COVID-19 pandemic, may prove conducive to political agreement on a permanent SURE instrument.

Conclusion

“There’s more than meets the eye in SURE, and it can go beyond the COVID years.”

Short-time work schemes have proven efficient at saving employment in the unprecedented context of the COVID-19 health and socioeconomic crisis. In a concrete display of solidarity, the SURE instrument ensures that all Member States can benefit from those schemes and protect workers, jobs and incomes in their national contexts.

The decision to fund SURE with social bonds is another of the ‘unthinkable firsts’ we have witnessed in European policymaking over the past year. The issuance of the social bonds met with overwhelming demand, and the bonds have been consistently oversubscribed by investors both inside and outside the EU. Although limited in scope and time, the function of the social bonds does create a simple treasury form that resembles the function of a European safe asset. This, together with its function of saving employment and its countercyclical crisis quality, give SURE the potential to be an instrument of integration, solidarity and resilience in the European economy.

To reach its potential, SURE must be transformed from a Covid-19 crisis response scheme into a permanent instrument. Legally, a permanent SURE is possible. Politically, given the funding success of the SURE instrument, as well as the efficiency of short-time work schemes to save employment, there is a significant policy window for the Commission to propose another ‘unthinkable first’: a permanent unemployment reinsurance mechanism for Europe.

Bibliography

- Caballero R. et al (2017), ‘The safe asset shortage, the rise of mark-ups, and the decline in the labour share’, VoxEU, 13 December 2017. Available here

- Council Regulation (EU) 2020/672 on the establishment of a European instrument for temporary support to mitigate unemployment risks in an emergency (SURE) following the COVID-19 outbreak. Available here

- European Commission (2020), ‘Investor Presentation’, 30 September 2020. Available here

- European Commission (2020), ‘Press Release on the third SURE bond issuance’, 24 November 2020. Available here

- European Commission (2020), Employment and Social Developments in Europe (ESDE) 2020. Available here

- European Commission (2020), SURE Social Bond Framework. Available here

- Müller T. and Schulten T. (2020), ‘Ensuring fair short-time work—a European overview’, ETUI Policy Brief, 7/2020. Available here.

- Politico, (2020), ‘Finland puts brakes on EU unemployment scheme’, 17/04/2020. Available here